Sponsored by edgeful

Happy Sunday, Crew!

Hope you’re having a good weekend and getting some rest before the new week kicks off. With the government shutdown, markets didn’t get much fresh data to chew on, though that hasn’t stopped the usual wave of commentary and speculation.

The focus now shifts to earnings season. We’ll start seeing company results this week, with Delta reporting on Thursday. I’ll send out a preview before Wednesday so you’re ready going in.

For now, let’s jump into some stories from the past week.

Sponsored

We've all had those moments, spotting what looks like a solid setup, but wondering if it's backed by history or just wishful thinking.

If you want to add some straightforward stats to your process without drowning in complexity, edgeful could be a solid option. I've checked it out myself lately, and it's given me quick insights into how markets have played out in similar spots.

What edgeful offers is a clean way to dig into things like price action patterns, trend behaviors, and even performance on specific weekdays. It's not about magic forecasts; it's more about pulling historical data to show probabilities, so you can line them up with current conditions.

For example, on stocks, it might break down how often a certain breakout level has held or reversed based on past sessions. In futures or forex, you could check volume trends or gap behaviors to gauge if a move has legs. It's practical stuff that helps confirm if a trade fits the odds or if it's smarter to wait.

The tool covers stocks, futures, forex, and crypto, making it versatile if you trade across different areas.

Heads up for my readers: Edgeful doesn't usually offer free trials, but they've hooked us up with a 7-day one. If it sounds useful, check it out via the link below—no strings attached, and sometimes passing is the best call.

EA’s Record $55 Billion Deal

Electronic Arts is officially set to go private in the largest leveraged buyout ever. The $210 per share offer values the video game giant at $55 billion, a 25% premium to where shares traded before rumors broke. That’s also the highest price ever put on the company since it went public 35 years ago.comes from a consortium that includes Saudi Arabia’s Public Investment Fund, Silver Lake, and Jared Kushner’s Affinity Partners. PIF already owns close to 10 percent of EA and will roll its stake into the buyout.

For context, EA stock spent most of the last seven years hovering near $140. Only this year did it break higher, helped by its steady pivot to live-service games like Apex Legends and subscription revenue from EA Play. In fiscal 2025, those live-service offerings made up about 75% of total revenue. That predictable cash flow is exactly what private equity buyers like to see.

The price works out to ~49x fiscal 2025 EPS, almost identical to Microsoft’s multiple when it acquired Activision Blizzard in 2023. The size of the deal alone is historic, pushing U.S. mergers and acquisitions above the $1 trillion mark this year, up nearly 30 percent from last year.

Musk vs. Netflix

Elon Musk has spent the past few days reposting and calling on followers to “cancel Netflix for the health of your kids.” The push came after conservative accounts revived backlash against Dead End: Paranormal Park, an animated show with a transgender character that Netflix canceled back in 2023. Musk amplified posts accusing the company of “actively pushing transgender propaganda” and being “hellbent on ideological indoctrination.”

The show’s creator, Hamish Steele, responded on Bluesky that it was going to be a “very odd day,” while Netflix stayed quiet. Shares fell about 4 percent this week, though analysts note the company’s 300 million–plus subscribers and $490 billion market cap make it unlikely that an online boycott will leave much of a mark. Most expect Musk to move on, but for now the exchange has put Netflix in the culture-war spotlight.

Want More? Join Me on Discord

If you’re finding value in this newsletter or my updates on X, the Discord is where I go deeper. I share real-time trade setups, earnings breakdowns, morning notes, and market-moving news—plus exclusive insights I don’t post elsewhere. It’s a great space to stay ahead with a strong, active community.

Use code WALL20 for 20% off on any plan.

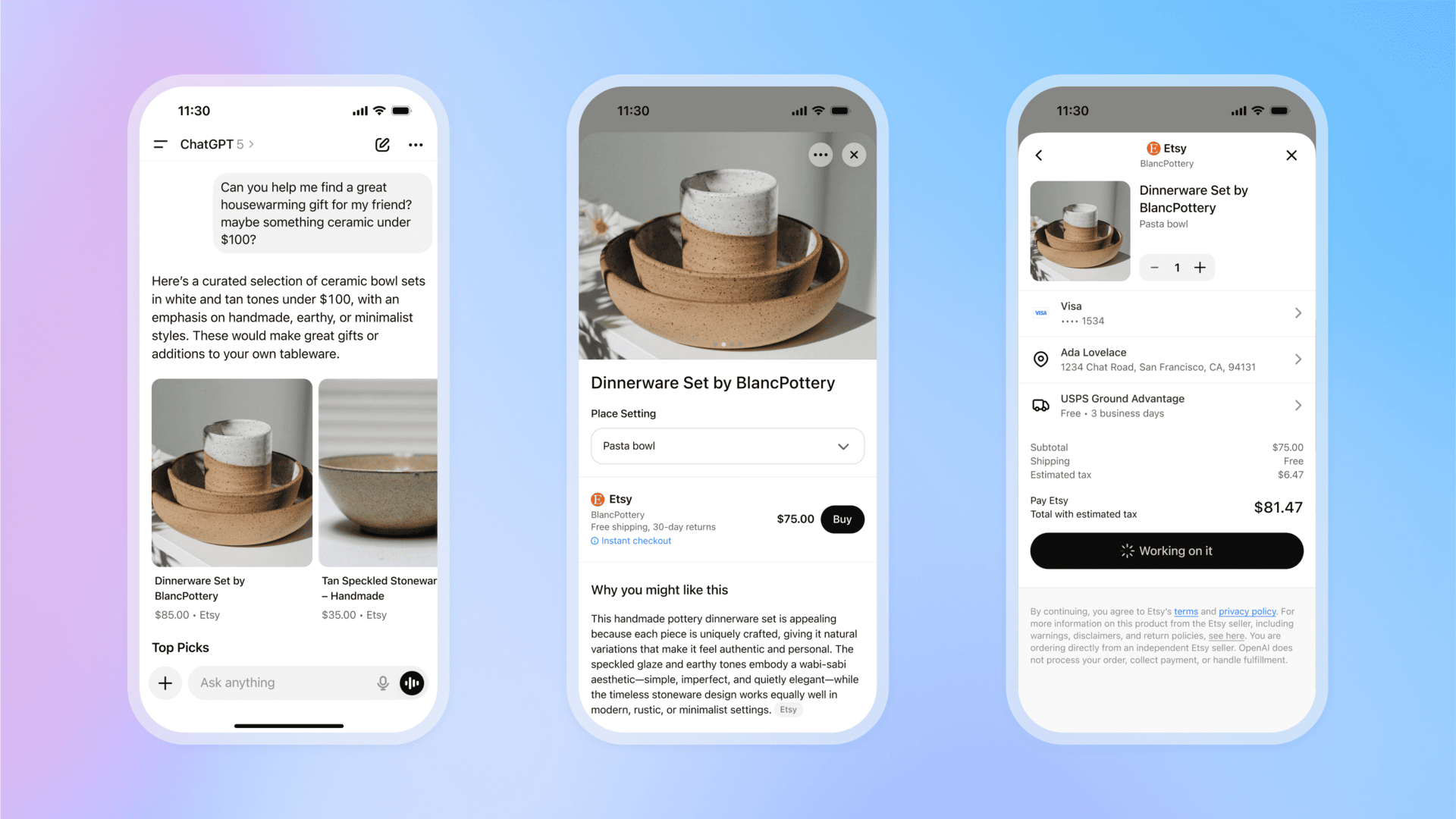

OpenAI tries Shopping

OpenAI rolled out what it calls an “Instant Checkout” inside ChatGPT, letting U.S. users buy from Etsy and from more than a million Shopify merchants soon. The pitch is that you can ask ChatGPT for a product recommendation, then hit a Buy button without leaving the conversation. Payment options include Apple Pay, Google Pay, Stripe, or a credit card, with merchants handling the fulfillment.

The company framed this as its first step “toward agentic commerce,” though for now it looks more like Instagram shopping than Amazon. Once the order is placed, the seller does the rest. OpenAI takes a small fee from merchants, giving it a new way to monetize hundreds of millions of free users beyond its Pro and Plus subscriptions.

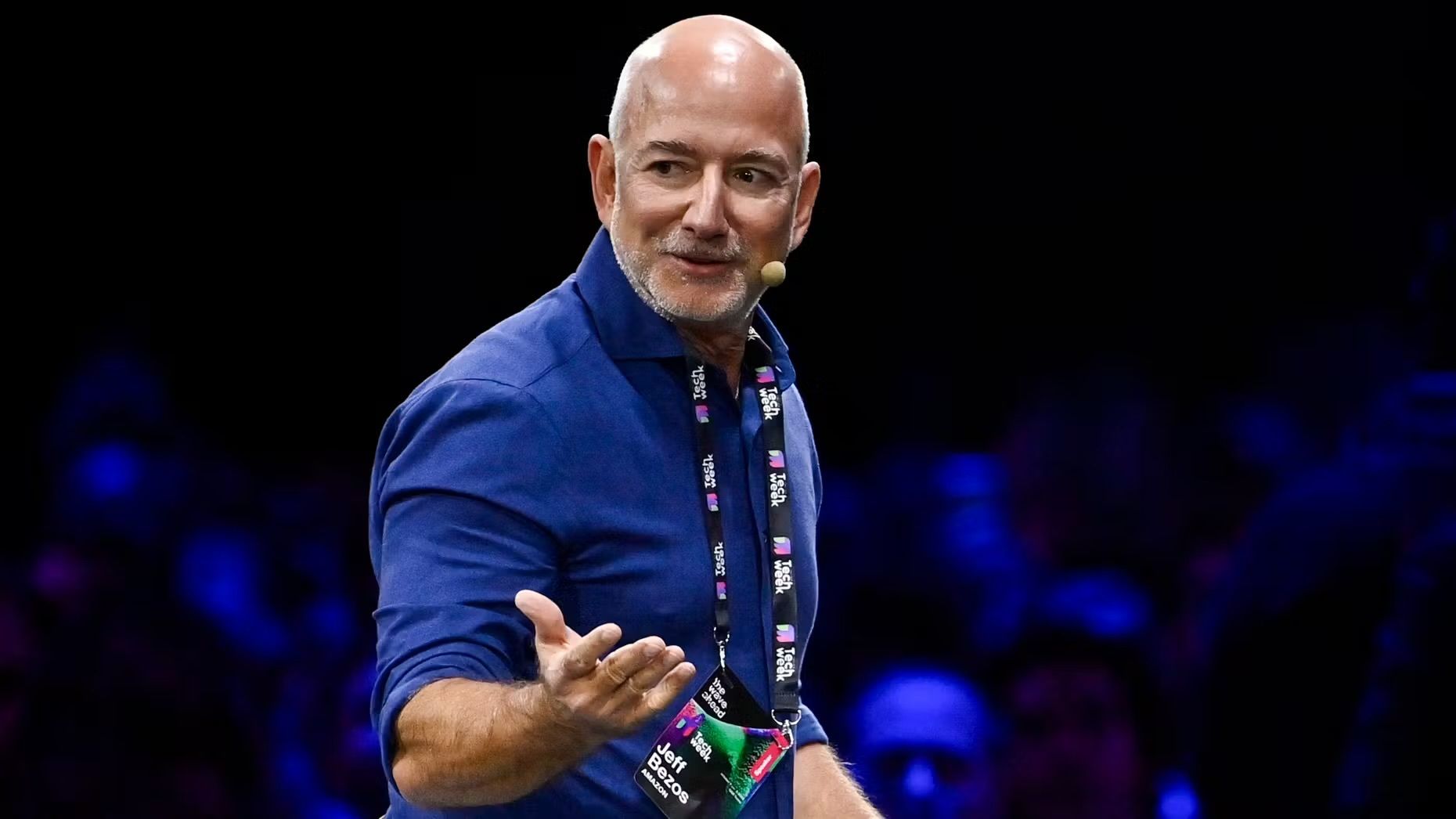

Bezos Calls AI an “Industrial Bubble”

Jeff Bezos said at Italian Tech Week that artificial intelligence is in a bubble, but “the kind that can even be good.” He explained that when excitement peaks, “every experiment gets funded, every company gets funded… the good ideas and the bad ideas. Investors have a hard time… distinguishing between the good ideas and the bad ideas and so that’s also probably happening today.”

He called it an “industrial bubble,” comparing it to biotech cycles where many companies failed but the survivors produced life-saving drugs. “AI is real, and it is going to change every industry,” Bezos said. “The benefits to society are going to be gigantic.” Looking ahead, he even predicted that within 10 to 20 years, “the giant, gigawatt-scale data centers for AI training clusters will be built in space” to harness 24/7 solar power.

Sponsored

Keeping track of investments can feel like piecing together a puzzle from different boxes. That's where Finvest comes in.

It's a straightforward app that pulls everything into one spot, so you can see your whole portfolio clearly, spot what's working (or not), and make adjustments without jumping between accounts.

What stands out to me is how it uses simple AI to highlight opportunities – like suggesting stocks or ETFs based on real data, or making it easy to buy U.S. Treasury Bills in just a few taps for steady, government-backed returns.

No more guessing or endless research; it connects to your existing brokers and banks, giving you insights tailored to your setup. It's built with privacy in mind too, your data stays yours, and everything's secured like a bank.

Whether you're just starting out or have a few accounts going, it helps you build confidence step by step. Ready to give it a try?

Treasury Floats a Trump $1 Coin

The Treasury Department is weighing whether to mint a one-dollar coin featuring Donald Trump as part of the U.S. semiquincentennial in 2026. A draft design, overseen by U.S. Treasurer Brandon Beach, shows Trump’s profile on one side and an image of him with a clenched fist in front of the American flag on the other, alongside the words “FIGHT, FIGHT, FIGHT.”

Congress authorized a commemorative $1 coin program back in 2020, when Trump was president, to mark the country’s 250th anniversary. The law requires designs to be “emblematic” of the occasion, but it doesn’t normally allow for living presidents to appear on money. That raises questions about whether this draft would pass legal review.

Treasury officials said no final design has been chosen and promised more details once the current government shutdown ends. Asked if Trump had seen the draft, White House press secretary Karoline Leavitt replied she wasn’t sure, but added, “I’m sure he’ll love it.”

OpenAI Tops SpaceX

OpenAI is now the world’s most valuable private company, hitting a $500 billion valuation in a secondary share sale that let long-time employees cash out. About $6.6 billion worth of stock changed hands, lifting the company well past SpaceX’s $400 billion valuation and its own $300 billion mark from earlier this year.

The deal also served as a reward for employees who stayed during a wave of poaching by rivals offering huge pay packages. It comes the same week OpenAI rolled out a new version of its Sora video app, which lets users generate TikTok-style clips with built-in guardrails. For now, the $500 billion milestone cements OpenAI’s place at the top of the private market.

Week Ahead:

Monday: Spain industrial production and Eurozone retail sales. The US Supreme Court begins its new term with key cases on tariffs. ECB President Christine Lagarde testifies in Parliament, while BOE Governor Andrew Bailey speaks at Scotland’s Global Investment Summit.

Tuesday: China foreign reserves, Japan household spending, and Germany factory orders. Italy reports household consumption data. In the US, August trade data and September NY Fed inflation expectations land. Fed speakers include Stephen Miran, Michelle Bowman, Raphael Bostic, and Neel Kashkari. Amazon’s Prime Big Deal Days kick off.

Wednesday: RBNZ and Thailand policy decisions. Japan labor cash earnings, Germany industrial production, and Sweden CPI. ECB speakers active across Europe. FOMC publishes September meeting minutes. CBO releases its monthly budget review.

Thursday: Philippines rate decision, Germany trade balance, and Mexico CPI. ECB minutes released. In the US: wholesale inventories, jobless claims, and remarks from Fed Chair Powell, Treasury Secretary Bessent, and several Fed governors. Brazil CPI also due.

Friday: Japan PPI, Italy industrial production, and CPI data from Norway and Russia. EU finance ministers meet in Luxembourg. In the US, the University of Michigan consumer sentiment survey is published. Canada posts September jobs data and Mexico industrial production.

Should be an interesting week. I’ll be tracking it all on X (formerly Twitter): @wallstengine.