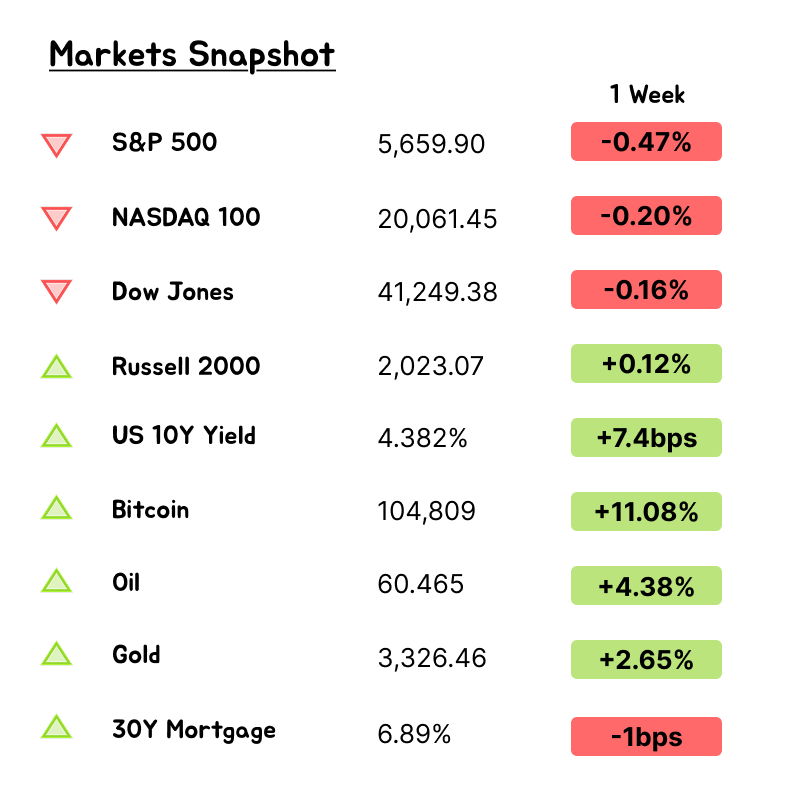

Happy Sunday!

Grab a coffee ☕, because we’re digging into what happened this past week and what’s on deck. It might’ve felt calm, but is this just the calm before the storm? U.S.-China talks kicked off in Geneva this weekend. Trump called early discussions “positive and constructive,” but let’s be real—he always says that. The real question is whether we’ll see actual signs of de-escalation. Markets don’t need a full deal—just enough progress to keep the bulls engaged.

Bulls vs Bears: Where We Are Now

We’ve had a monster move off the lows. The NASDAQ is up 23% in just a month—nearly matching all of 2024’s gains in four weeks. That kind of momentum doesn’t happen without serious risk appetite behind it. Earnings reactions in growth names have been strong, and speculative themes like quantum and nuclear are leading again. That’s bullish behavior.

We’ve also shaken off every bit of bad news—Fed uncertainty, tariffs, global tensions—and the market just kept climbing. Now, we’re knocking on the door of the 200-day moving average. If we clear that level and hold it, we’ll likely see CTAs and other trend-followers step in, pushing prices even higher. That’s the bull case in full form.

But—and it’s a big but—if you’re not already in, now might not be the time to chase. There’s no edge buying directly into a major moving average that hasn’t been sustainably broken in years. Patience pays here. Either wait for a clean reclaim of the 200-day or look for a healthy pullback into the 10/20/50-day moving averages for a lower-risk entry.

The bears? They’ll say this rally is mostly positioning-driven. A snapback from oversold levels, not a true breakout. They’ll point to tariffs, stretched valuations (20x+ on $265 EPS), and supply chain pressures that haven’t fully hit the data yet. The fear is that we’re trading on sentiment, not fundamentals—and when the music stops, it could unwind fast.

Also worth noting: news is mostly noise. If you gave one trader just charts and price, and another every headline and data point, the chart-watcher wins nine times out of ten. Price is the truth. Everything else is narrative.

So what’s next? Bulls have control—for now. But at this level, discipline matters more than ever. The easy part of the rally is likely behind us. From here, you either wait for confirmation... or for a better pitch.

U.S.–UK Trade: A PR Victory More Than a Breakthrough

This week, the U.S. and U.K. unveiled the Economic Prosperity Deal—the first official trade framework of the Trump administration’s new trade push, and potentially the most politically convenient.

At first glance, the deal looks like a diplomatic layup.

The UK economy makes up less than 3% of U.S. trade. That means Washington could offer tariff relief without much political risk at home—just enough to give Prime Minister Keir Starmer a post-Brexit win and let the White House flex its ability to close "reciprocal" deals. Optically, it was a win-win.

Here’s what was actually agreed:

Tariff cuts on British cars: From 27.5% → 10%, but only for the first 100,000 vehicles/year. Anything above that gets slapped with a 25% rate again. Jaguar-Land Rover is the big winner here.

Steel and aluminum duties cut to zero, providing much-needed relief to the UK’s industrial sector.

U.S. gets expanded access for ethanol (1.4B liters) and beef (13,000 mt duty-free quota)—a clear bone tossed to American agriculture.

Rolls-Royce aircraft engines explicitly exempted from tariffs, directly tied to the UK’s $10B Boeing order. That’s a vital save for both countries’ aerospace sectors.

Digital tax untouched—for now. Britain’s 2% levy on U.S. tech companies (Amazon, Meta, Google) remains in place, though both sides agreed to “future talks” on digital rules.

Average U.S. tariffs on UK goods drop to 1.8%, down from 5.1%, though the base 10% duty on all UK goods remains.

So, was the UK the easiest to deal with? Probably.

Compared to the upcoming talks with China, India, Japan, or even the EU, the UK deal was simple, low-friction, and politically friendly. There were no heated standoffs over agriculture standards, pharma IP, or digital dominance. In fact, all those tricky issues were kicked down the road entirely.

Apple vs. Google and the $20 Billion Question

For the first time in over two decades, search volume on Apple’s Safari browser dropped. That stat, revealed by Apple SVP Eddy Cue during his testimony in the DOJ’s antitrust case against Google, might sound small — but it’s a big deal. Why? Because Safari, which defaults to Google Search, is a critical distribution channel that brings in an estimated $20 billion in annual payments to Apple.

Cue didn’t just blame the dip on user fatigue or browser habits. He pointed directly to AI: “People are using ChatGPT. They’re using Perplexity.” And Apple’s not just watching — it’s moving. Cue confirmed Apple is actively considering AI-native search engines like OpenAI, Anthropic, and Perplexity as future options within Safari.

“I certainly would expect that over the coming year, we will add other choices to the search engine choice in the browser,” Cue said. He even added: “You may not need an iPhone 10 years from now.”

Why It Matters for Google

Alphabet’s stock dropped 7.26% on the news — its second-worst non-earnings decline in recent history — wiping out nearly $100 billion in market cap in just one day. Apple dipped only 1.14%, but the bigger story is what this shift could mean for Google’s core business.

Roughly 26% of Google’s net search revenue and 30% of its profits in 2025 are expected to come from that Safari default deal. With that potentially on the line — whether through regulatory action or Apple simply going another direction — Google’s search dominance is no longer untouchable.

GOOGL hasn’t had to deal with this kind of real competitive pressure in 25 years. Now throw the antitrust trial on top of it, and that’s another weight on the stock, making it tougher to justify new money coming in.

Search still makes up over $200 billion of Google’s annual revenue. A rough comparison? Google earns about $7 per user per month in Search ARPU. If Apple decided to monetize search directly (say, $1/month across its 1.5B+ active users), it could generate $18B/year — enough to nearly replace Google’s payments, without needing to rely on Google at all.

And Apple already has OpenAI’s ChatGPT integrated into Siri. Gemini, Google’s own model, is also reportedly on the roadmap. This isn’t just negotiation leverage — it’s a platform shift.

Despite the panic, many on Wall Street still see this as a buying opportunity for $GOOGL. Here’s the current read:

Valuation: Google trades at just 15x FY26 EPS ($10), well below the S&P 500’s average and viewed by Morgan Stanley as a “trough multiple.”

Scale: Google’s ecosystem is massive:

15 products with 500M+ MAUs,

7 platforms with 2B+ users,

and the 45B-product Shopping Graph, updated 2B times/hour.

AI Adoption: Gemini Pro 2.5 is now leading the LLM pack, with over 350M+ users, and AI Overviews has already hit 1.5B monthly users.

The narrative shift? Search isn’t going away — but it is evolving. Instead of static links, users are starting to expect direct, conversational, AI-powered answers. And whoever controls that front door — Apple, Google, or someone else — controls the next $100 billion wave.

Google isn’t standing still. It’s aggressively integrating AI into its main search bar and prepping to showcase major updates at Google I/O (May 20–21).

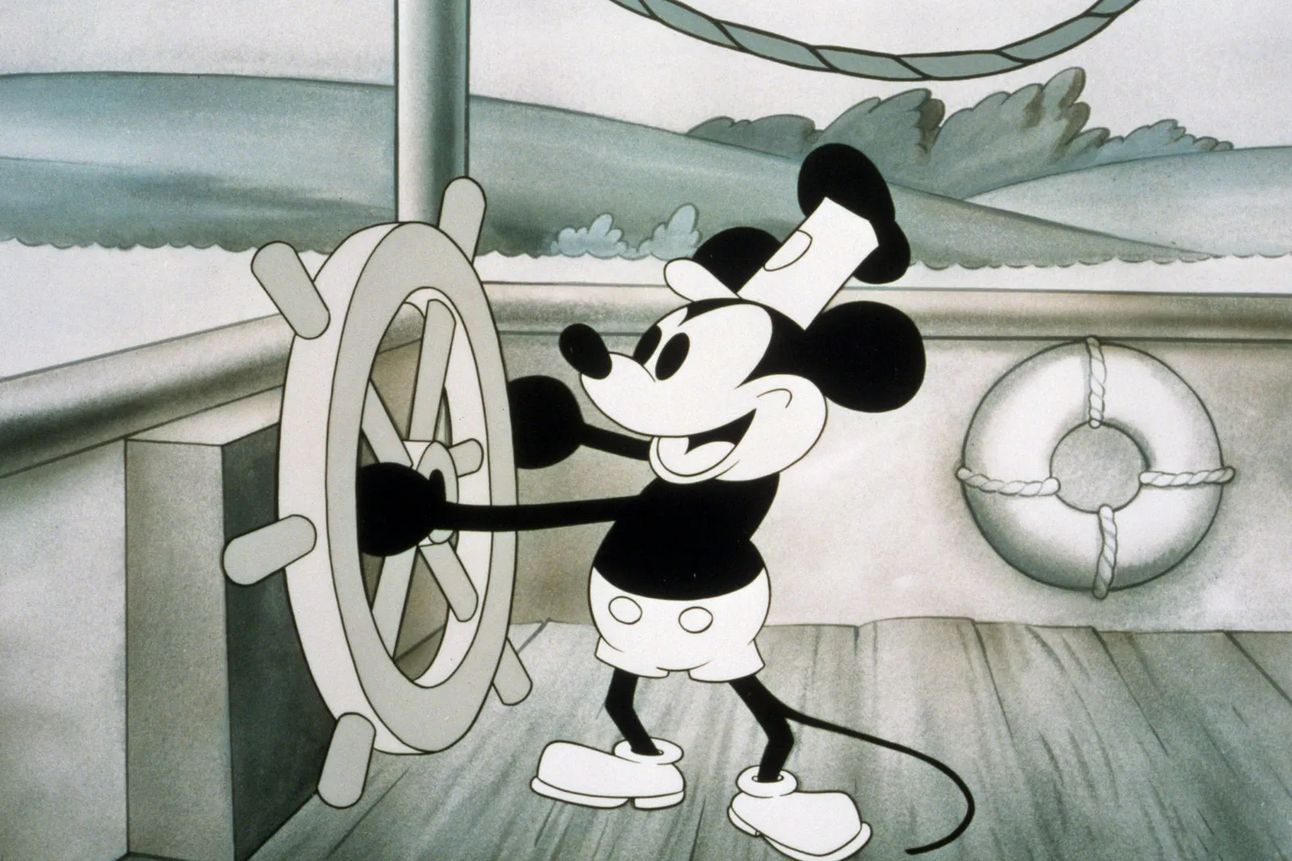

Magic Kingdoms & Middle-East Mice

Disney just cranked the turnstiles—again.

March-quarter numbers blew past the Street: $1.45 EPS vs. $1.20 est. (+20 % YoY) and a guidance hike to $5.75 for FY25. Experiences OI popped +9 %, DTC swung to a tidy $336 M profit, and CFO Hugh Johnston basically flexed on everyone: “Live sports is doing extremely well.” Translation—sports ad money is keeping the lights on while linear TV fades.

The sports pivot is working, but it’s a double-edged lightsaber.

Ad revenue inside ESPN land screamed +22 % while non-sports entertainment ads fell 10 %. Great for Disney, awkward for Netflix (still allergic to live rights) and for every marketer who thought prestige dramas were their brand halo. Bulls argue Disney owns the sports pipe and can jack CPMs at will; bears counter that buying those rights gets pricier every cycle, and DTC margins are still wafer-thin versus Reed Hastings’ cash cannon.

Meanwhile, the Mouse found a new sandbox—Abu Dhabi.

A seventh global resort on Yas Island puts one-third of the world’s population within a four-hour hop. Miral fronts the cap-ex, Disney supplies Imagineers and takes a royalty skim. CEO Bob Iger calls it “authentically Disney, distinctly Emirati.” Translation: more high-margin licensing dollars, minimal balance-sheet risk, and a not-so-subtle hedge against U.S. consumer wobbles.

Street reaction?

UBS, Barclays, Morgan Stanley, et al. all nudged PTs to ~$120. At ~$102 the stock’s 17× FY25 EPS—half Netflix’s 34× and finally cheaper than the S&P. If guidance sticks, you’re paying ~15× FY26’s mid-$6 floor. Not a steal, but the first time in ages Disney screens GARP-ish.

Sideways Inflation, Sideline Fed

Jerome Powell just delivered a master class in central-bank rope-a-dope. The Fed held rates at 4.25–4.50 percent and, for the third straight meeting, told markets to quit looking for a quick pivot. Powell said inflation is “kind of moving sideways” and employment remains “fine,” but tariffs have jacked up the risk of both higher prices and higher joblessness—a potential stagflation squeeze that leaves policy in limbo.

He called the current stance “modestly restrictive,” repeated there’s “no hurry” to move, and reminded reporters that tariff shocks haven’t actually hit the data yet. Translation: the Fed won’t cut until it sees whether 145 percent import duties feed through to CPI or clobber hiring first. That means every inflation print between now and September just became binary for risk assets.

Futures traders still pencil in three quarter-point cuts this year, but the June odds slipped below one-in-five the moment Powell walked offstage. Two-year Treasury yields drifted down to 3.78 percent, equities dipped, and the dollar firmed—classic “higher-for-longer” tape action. Powell’s blunt line summed up the vibe: “My gut tells me uncertainty for the path of the economy is extremely elevated.” Until that clears, the Fed’s message is simple—wait, watch, and be ready to move fast either way.

“DoorDash Orders a Double Entrée”

DoorDash just rang up a $5.1 billion tab, scooping UK-based Deliveroo for $3.86 B and hospitality-software firm SevenRooms for $1.2 B. The pair adds 50 million monthly users across Europe, MENA, and Asia and hands DoorDash a reservations-and-CRM stack that pushes it beyond takeout into the full restaurant cycle—think “OpenTable meets logistics.”

Why now? Global delivery is compressing into a few heavyweights as higher rider costs and softer order growth squeeze smaller players. Grubhub and Uber Eats have already bulked up; CEO Tony Xu is bettin

g that a 40-country footprint plus first-party diner data will keep merchants—and advertising budgets—inside the DoorDash ecosystem.

Wall Street’s appetite was mixed: shares slid 7 % after Q1 revenue missed by a hair at $3 B, even as profit surprised at $193 M. Guidance—$600–650 M adj. EBITDA—left analysts questioning where margin leverage shows up, especially with a $2.85 B bridge loan funding Deliveroo despite $4.5 B cash on hand. Investors like the “Amazon of dining” vision; they’re just waiting for the check to match the meal.

“Nuclear on the Fast Track”

White House drafts: Executive orders under review would target a 4× lift in U.S. nuclear capacity by 2050, streamlining NRC approvals, relaxing some radiation limits, and pre-clearing small reactors for military bases and AI data centers.

Trump adviser Scott Bessent pressed the World Bank to treat nuclear build-outs as a core development priority.

Google is funding early work on three 600 MW advanced-reactor sites with Elementl Power, securing options for 24/7 data-center power.

EARNINGS RECAP:

Tech & SaaS

Palantir (PLTR) – $884 M rev (+39 % YoY) and a record $810 M U.S. commercial TCV. Analysts love the growth, hate the 60× ’26 sales multiple.

Datadog (DDOG) – Beat & raise; AI-native clients now 8.5 % of rev, pushing FY-25 guide to $3.23 B. Street calls it a “Rule-of-46” quarter.

Arm (ARM) – First $1 B-plus quarter but pulled FY-26 outlook on tariff fog; royalty rev still running 25–30 % YoY. PT cuts across the board.

Super Micro (SMCI) – Hopper-to-Blackwell slowdown bruised March, but ~$1 B in slipped servers should ship by September. Coverage resumes at Buy.

Unity (U) – Vector ad stack rolled out early, lifting installs 15–20 %; guide still cautious, PTs trickle lower.

The Trade Desk (TTD) – Kokai transition now two-thirds complete; 1Q rev +25 % crushed fear narrative, but macro jitters keep outlook tempered.

Toast (TOST) – Raised FY EBITDA margin guide again (450 bps expansion) with enterprise wins like Topgolf; new-location adds light, Q2 re-accel key.

Axon (AXON) – Revenue +31 %, raises FY guide despite 50 bp tariff drag; Draft One AI writing tool already in 20 % of top deals.

Fintech & Crypto

Upstart (UPST) – Loan volume +89 %, EBITDA beat, but stock wobbled as April origination data lagged high-octane alt-data prints.

Oscar Health (OSCR) – Membership +41 % drove a $275 M profit; MLR a hair hot at 75.4 %. Margin guidance intact.

Coinbase (COIN) – In-line Q1, but April volumes soft; Deribit buy ($2.9 B) plants a flag in crypto options. PT drift lower, bulls stick to “derivatives flywheel” story.

Chips & Gear

AMD – Beat and guided +10 % above consensus despite $700 M China headwind; Instinct GPU rev to grow 60 % QoQ. BofA flips to Buy at 18× ’26 PE.

Nvidia dinner theme – (save for later; no quarterly).

Autos, EV & Mobility

Ferrari (RACE) – 30 % EBIT margin, bookings cover all of 2026; slow China but price hikes offset tariff hit.

Rivian (RIVN) – Gross margin turned +17 %, but deliveries cut to 40–46 K; $1 B VW tranche unlocked.

Carvana (CVNA) – Retail units +46 %, GPU $3.3 K; analysts racing each other to $340 PT.

Lyft (LYFT) – Revenue miss, but rides +18 % and activist Engine Capital exits after $750 M buyback.

Uber (UBER) – Midpoint guide ahead; Mobility pricing softer, frequency stable; AV partnerships (Waymo) scale in Austin.

Consumer & Commerce

Sweetgreen (SG) – Beat Q1 but cut FY-25: comps now flat, tariffs blamed for April drop; analysts see reset as buyable.

DoorDash (DASH) – Rev slight miss, EBITDA +59 %. Buying Deliveroo for $3.9 B—adds 10 markets, stretches integration schedule.

Shopify (SHOP) – 27 % rev growth, but gross-profit guide implies mix pressure; management sees minimal tariff impact so far.

MercadoLibre (MELI) – 37 % rev pop, Argentina GMV +126 % FX-n; TPVs and credit card book both ripping—PTs march toward $3 K.

DraftKings (DKNG) – Weak March-Madness hold dents Q1; FY EBITDA guide only trimmed 6 %, bulls shrug.

Crocs (CROX) – Beat but yanked guidance; 145 % China tariff would sting, yet diversion plans in motion.

Peloton (PTON) – EBITDA beat, guidance up; subs still sliding, Street wants a growth spark.

Media & Ad-Tech

Disney (DIS) – EPS +20 % YoY; sports ads +22 % offset –10 % entertainment. Yas Island park adds asset-light royalty stream; PT cluster at $120.

Warner Bros. Discovery (WBD) – Missed on rev, loss wider, but CNBC says breakup clock is ticking; stock pops on split chatter.

Pinterest (PINS) – MAUs 570 M (+10 %), Performance+ outperforms in 80 % of tests; 2Q guide 1 pt ahead of Street.

Health, Wellness & Energy Drinks

Hims & Hers (HIMS) – Revenue +111 %, first guide miss ever; GLP-1 transition drags Q2 outlook, but FY EBITDA raised.

Celsius (CELH) – Missed top & bottom; U.S. scanner sales −3 % YoY, promotions stepping up; BofA stays Underperform.

TransMedics (TMDX) – Rev +40 %, raises FY guide; organ-logistics attach now 78 %.

Here’s what else made headlines this week

Palantir shares fell after a strong revenue beat failed to justify its premium valuation.

Berkshire Hathaway confirmed Greg Abel will succeed Warren Buffett as CEO in 2026.

SpaceX employees voted to incorporate “Starbase,” a 1.6-sq-mile city at the company’s Texas launch site.

A nine-day S&P rally ended as new tariff threats revived trade-war jitters.

Skechers agreed to a $6.2 billion go-private deal with 3G Capital.

ON Semiconductor dropped on soft outlook despite beating Q1 estimates.

Tyson Foods missed revenue expectations and guided for flat growth.

President Trump proposed a 100 percent tariff on foreign-made films, pressuring media stocks.

Ford pulled 2025 guidance, citing a projected $2.5 billion tariff hit.

Hims & Hers beat on Q1 earnings but offered muted guidance.

Tesla began discounting the revamped Model Y amid signs of soft demand.

United Airlines will trim Newark flights by 10 percent after 1,400 recent disruptions.

Pershing Square invested $900 million to lift its Howard Hughes stake to nearly 47 percent.

Volvo Cars reported an 11 percent sales drop and a 32 percent EV slump for April.

Draft executive orders aim to quadruple U.S. nuclear capacity by 2050 and streamline NRC approvals.

Google committed funding for three 600 MW advanced-nuclear projects with Elementl Power.

DoorDash announced a $5.1 billion double acquisition of Deliveroo and SevenRooms.

Zoox recalled 270 autonomous taxis after a software-linked crash in Las Vegas.

Nvidia flagged a potential “tremendous loss” if China AI restrictions persist, booking a $5.5 billion charge.

U.S. pharma imports surged $20 billion in Q1 as companies raced to beat looming tariffs.

Uber partnered with Pony AI to launch robotaxis across the Middle East.

Apple is reportedly delaying the base iPhone 18 to spring 2027 to focus on a foldable model.

Constellation Energy shares rose on new power deals with AI data-center operators.

Take-Two released a second Grand Theft Auto VI trailer after pushing the game to 2026.

Reddit will introduce identity verification to curb bot-driven impersonation.

Rivian and Lucid posted steep quarterly losses and warned tariffs could inflate costs by billions.

OpenAI scrapped a profit-shift plan, keeping its nonprofit board in control.

CrowdStrike announced 500 layoffs as it shifts spending toward AI automation.

WeightWatchers filed for Chapter 11 restructuring amid shrinking membership and rising debt.

The Federal Reserve held rates at 4.25–4.50 percent and highlighted tariff-related downside risks.

Netflix debuted an AI-driven homepage with vertical video previews and conversational search powered by OpenAI.

PwC announced 1,500 U.S. layoffs—its second downsizing in less than a year

Bill Gates moved up his timeline to donate nearly all of his wealth by 2045

Meta confirmed work on smart glasses with real-time facial recognition, drawing privacy scrutiny from regulators.

OpenAI hired Instacart chief Fidji Simo to run business operations while Sam Altman shifts focus to research.

Mattel said it will raise U.S. toy prices to offset 145 percent tariffs on Chinese imports, even as it diversifies production.

Google agreed to pay $1.4 billion to settle a Texas lawsuit alleging unlawful location tracking.

The podcast industry was valued at $7.3 billion globally in a new Owl & Co. report, double prior estimates.

OVERSUBSCRIBED: eToro’s US IPO drew orders exceeding the 10 million shares on offer; the $46–$50 pricing range will be set May 13, with BlackRock planning a $100 million anchor purchase ahead of next week’s Nasdaq debut under the ticker ETOR.

Week Ahead:

It’s a quieter week on the earnings front, but there’s still plenty to keep an eye on. A lot will hinge on how the U.S.-China trade talks in Geneva wrap up over the weekend — that’s the big one. After the UK trade deal, the focus now shifts to what kind of tariff deal might come next and whether we’ll see any real de-escalation signals.

Also grabbing attention is Trump’s teased “earth-shattering” announcement. He’s hinted it won’t be about trade, and according to Politico, it could be a major Medicare drug pricing move. Word is, he’s looking to bring back the “most favored nation” model, which would tie U.S. drug prices to lower international rates.

We’ll see how all of this plays out, and I’ll keep you posted with updates throughout the week on my Twitter: @wallstengine.