Happy Sunday!

After a very busy news week—from Wall Street to domestic politics and rising geopolitical tensions—let’s wrap up what happened.

Geo-Political Tensions escalated further as Israel expanded its strikes and Iran fired back. Earlier analysis from Bloomberg’s Dina Esfandiary outlined three possible scenarios: the first and most likely being limited retaliation; the second involving targeted strikes against the U.S. without casualties; and the third, a broader regional war if Iran closes the Strait of Hormuz. That move alone could send oil 🛢️ to $130 per barrel.

The Polymarket odds of U.S. military action against Iran jumped from 10% to over 60% at one point on Saturday before settling back to around 38% by evening. Talks between the U.S. and Iran were reportedly canceled, and risks of further escalation remain elevated.

U.S.–China Trade Deal Done?

After two days of high-stakes negotiations in London, the U.S. and China have reached what President Trump called a “done deal,” pending final approval from both sides. While light on structural breakthroughs, the agreement aims to unwind some of the recent damage from escalating trade tensions.

Under the proposed terms, China will ease restrictions on exports of rare earth elements—materials critical to U.S. defense and tech manufacturing. In return, the U.S. will relax certain export controls on advanced chips and drop plans to limit student visas for Chinese nationals. Tariffs, however, remain unchanged, though a 90-day freeze on new levies is still in effect until August.

The rare earth issue was central to the talks, with China controlling around 70% of global supply. Analysts say the U.S. may have agreed to concessions on tech exports out of necessity, rather than strategic generosity. Despite the optics of progress, no long-term resolution was reached on core issues like industrial subsidies, IP protection, or data localization.

Apple’s WWDC25: A Shiny Surface, But No AI Spark

At this year’s WWDC, Apple brought the gloss — but held back on the guts.

The headline was a sweeping new “Liquid Glass” design rolling out across iPhones, iPads, Macs, Watches, and Vision Pro. It’s Apple’s most dramatic visual overhaul since iOS 7 — full of translucent menus, adaptive lighting, and dynamic animations. The company also simplified its naming convention, aligning OS versions with the calendar year (iOS 26, macOS 26 Tahoe, and so on).

But behind the pretty interface, there was a noticeable lack of sizzle — especially around AI.

After overhyping Siri last year and underdelivering, Apple played it safe this time. Siri’s long-awaited upgrade — the one that taps into personal data and on-screen context — was delayed again, now targeting a spring 2026 launch with iOS 26.4. SVP Craig Federighi acknowledged the delay, saying the feature just wasn’t ready to meet Apple’s “high quality bar.”

There were a few AI tidbits: live call translation, emoji mashups ("Genmoji"), and on-device models for developers to tap into — but nothing to rival the showstoppers we’ve seen from OpenAI, Google, or Meta.

iPads finally got true windowed multitasking (hello, Mac-lite), Apple Watch added a “Workout Buddy” AI fitness coach, and Vision Pro picked up support for PlayStation’s VR2 controller. Apple Maps added personalized, privacy-friendly travel tracking, and iPhones got smarter call screening and messaging upgrades.

Under the hood, Apple’s leaning into its OpenAI partnership, bringing ChatGPT-style image generation and context-aware suggestions to apps. And with iPhone sales rebounding in China — thanks in part to aggressive discounting — the company’s near-term fundamentals are looking up.

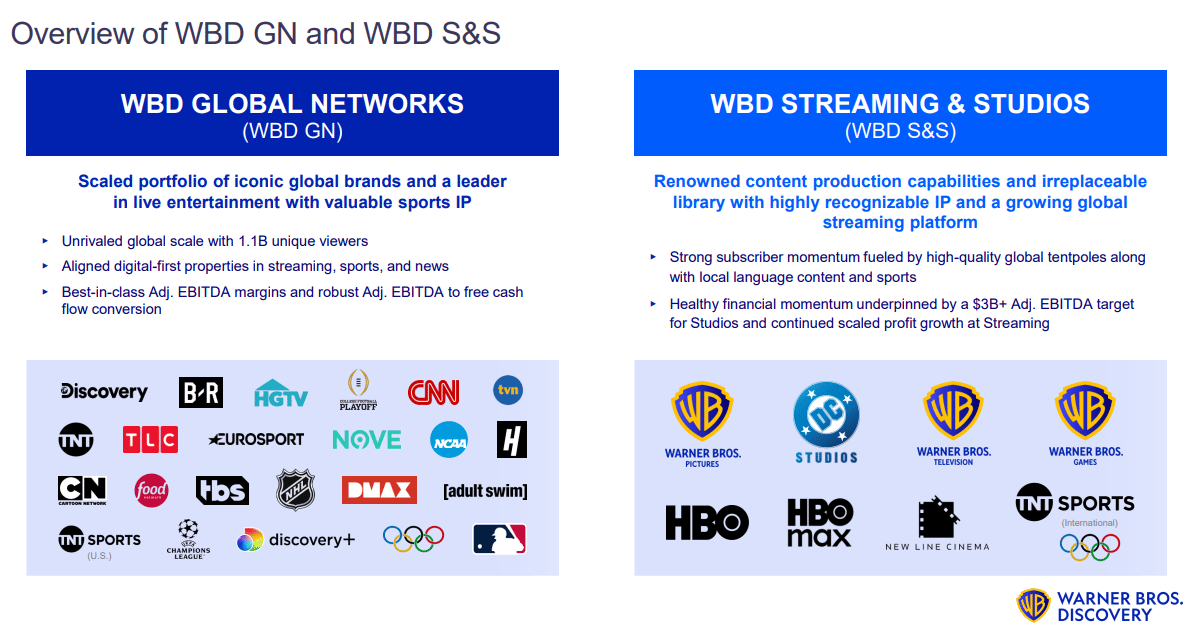

Warner Bros. Discovery to Split in Two

Warner Bros. Discovery is breaking itself in two. The company announced plans to spin off into two publicly traded entities by mid-2026:

Streaming & Studios, which will house HBO, HBO Max, Warner Bros. film and TV studios, and gaming.

Global Networks, home to CNN, TNT, Discovery, and international cable assets—plus U.S. sports rights.

CEO David Zaslav will lead the streaming entity, while CFO Gunnar Wiedenfels will take over the networks business. The move comes after steep stock declines since the 2022 Warner–Discovery merger, ongoing cord-cutting, and growing investor pressure—including a symbolic shareholder vote rejecting Zaslav’s $51.9 million pay package.

The networks division will carry most of the company’s $34 billion debt, though it's expected to generate steady cash flow. Meanwhile, streaming remains profitable but still trails rivals like Netflix and Disney+ in scale.

This mirrors Comcast’s strategy with its NBCUniversal cable spinoff and signals a broader media trend: decouple declining assets to focus on growth—and maybe open doors for future M&A.

Meta’s Bet on Scale AI Is Already Getting Messy

Meta has made its biggest external AI move yet, agreeing to acquire a 49% stake in Scale AI for $14.8 billion. The deal gives Meta access to one of the most important players in data labeling—an essential piece of the AI model training pipeline—and brings Scale’s CEO, Alexandr Wang, on board to lead a new superintelligence lab inside Meta.

This isn’t a full acquisition, but it follows a growing trend where Big Tech firms sidestep regulatory scrutiny by structuring deals as strategic investments paired with high-profile hires. Microsoft, Amazon, and Google have all used variations of this “acqui-hire + license” model in recent months to quietly absorb AI talent and IP.

Scale AI, which provides data labeling services critical to training large AI models, has worked with nearly every major player in the space, including Google, Microsoft, OpenAI, and xAI. But the Meta tie-up is now causing serious friction. According to multiple reports, Google — previously Scale’s largest customer — is pulling out of its $200 million contract. Microsoft and xAI are said to be reviewing their own relationships, and OpenAI has already reduced its reliance on Scale.

The underlying concern is trust. AI developers often share proprietary datasets, early-stage models, and sensitive product roadmaps with data labeling partners. With Meta now holding a major stake in Scale and Wang joining Meta’s leadership, rivals worry their confidential R&D could indirectly land in the hands of a competitor.

Despite reassurances from Scale that it will operate independently and protect client data, trust is clearly under pressure. Some rivals—like Labelbox and Turing—say they’ve already seen a surge in demand from companies looking to switch providers. Several are forecasting hundreds of millions in new revenue from customers migrating away.

For Meta, the deal is part of a broader attempt to regain momentum after underwhelming results from its Llama 4 model. CEO Mark Zuckerberg has also formed a new superintelligence team of about 50 members under his direct oversight. Meta is expected to spend as much as $65 billion on AI infrastructure this year.

Whether Meta’s backing proves to be a strategic advantage for Scale AI— or a turning point that weakens Scale’s neutrality — remains to be seen.

Want More? Join Me on Discord

If you’re finding value in this newsletter or my updates on X, the Discord is where I go deeper. I share real-time trade setups, earnings breakdowns, morning notes, and market-moving news—plus exclusive insights I don’t post elsewhere. It’s a great space to stay ahead with a strong, active community.

Use code WALL20 for 20% off on any plan.

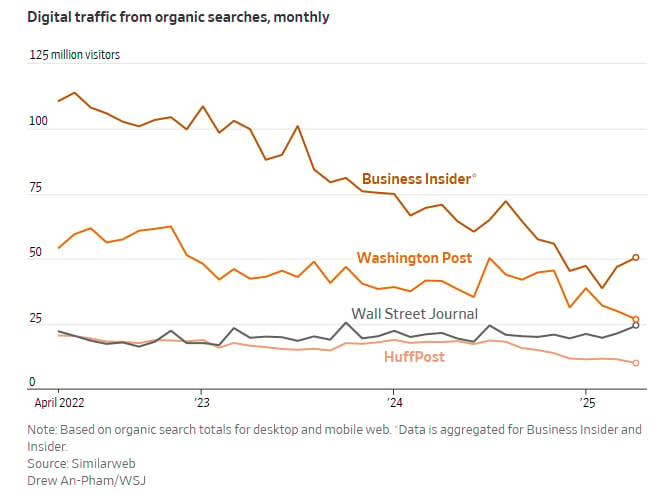

Google's Shift Is Gutting Media Traffic

If it feels like you’re spending less time clicking links on Google and more time just getting the answer you need directly on the search page—you’re not alone. That’s by design.

Google’s becoming what The Atlantic CEO Nicholas Thompson calls an “answer engine.” And while that’s great for users looking for quick info, it’s been brutal for digital publishers.

Big names in media are watching their organic search traffic tank. HuffPost has seen traffic from Google drop more than 50% in just three years. The Washington Post saw a similar decline, and Business Insider lost 55% of its search-driven traffic from April 2022 to April 2025. That collapse played a role in the company’s recent decision to cut 21% of its staff.

The New York Times now gets 36.5% of its traffic from Google search, down from 44%. Even The Wall Street Journal, which has grown its total traffic, said its search share fell from 29% to 24%.

Some outlets aren’t waiting for a turnaround. The Atlantic is planning for a future where it gets zero Google traffic. Others, like The Washington Post, are racing to build direct relationships with readers and rely less on search altogether. And Dotdash Meredith? Google used to drive 60% of its traffic. Now it’s closer to 33%.

As Google shifts from guide to gatekeeper, publishers are scrambling to survive in a world where search clicks might soon be a thing of the past.

AI Rivals Team Up

In a twist few saw coming, OpenAI—best known for ChatGPT and backed heavily by Microsoft—is now turning to Google for more compute power.

According to a Reuters report, the deal was finalized in May and will see OpenAI adding Google Cloud to its growing list of infrastructure partners. While the specific chip setup (TPUs vs. GPUs) hasn’t been disclosed, analysts believe it's more likely OpenAI will use Google’s GPUs, though a move to TPUs would be a bold endorsement of Google's in-house AI tech.

Morgan Stanley sees this as a clear win for Google Cloud, calling it “material upside” as GenAI continues to demand serious compute at scale. As OpenAI’s needs grow, especially during the inference phase (when users interact with models like ChatGPT), the added workload could help Google Cloud close the gap with Amazon and Microsoft in the cloud race.

Interestingly, CoreWeave, a rising GPU cloud infrastructure provider, is also part of this loop—supplying compute to Google, which in turn services OpenAI.

So while Microsoft may remain OpenAI’s main squeeze, exclusivity is clearly off the table.

Stargate Still a Mirage, But Oracle’s Cloud Is Very Real

One of the biggest surprises from Oracle’s latest earnings wasn’t about revenue or margins — it was about what didn’t happen. CEO Safra Catz confirmed that Stargate, the highly-publicized $500 billion joint venture with OpenAI and SoftBank to build AI super-data centers, “is not yet formed.” It’s the clearest sign yet that the project — first teased with big headlines — is off to a slow start, echoing reports that SoftBank hasn’t even started fundraising amid economic jitters tied to new U.S. tariffs.

But: Oracle doesn’t seem to need Stargate to hit the gas on its AI cloud strategy.

Despite the JV being in limbo, Oracle’s core cloud infrastructure business (OCI) is booming. It grew 52% in Q4 and is projected to surge over 70% in fiscal 2026. CEO Safra Catz framed this year as an inflection point, saying Oracle’s cloud growth is accelerating dramatically, with demand so strong they’re still turning customers away due to supply constraints. That demand helped drive remaining performance obligations (RPO) up 41% year-over-year — and Oracle is now guiding to more than 100% RPO growth in FY26, excluding Stargate.

In other words: Stargate might be stuck on the launchpad, but Oracle’s rocket is already in flight.

CTO Larry Ellison, never one to undersell, claimed Oracle will eventually operate more cloud data centers than all rivals combined. That might be a stretch — Oracle still has just a fraction of AWS’s cloud revenue — but there’s no denying the company is catching a powerful AI tailwind. And for now, it's doing just fine without a $500 billion moonshot.

STABLECOINS SHAKE UP RETAIL — AND RATTLE THE BANKS

Big retailers like Walmart and Amazon are reportedly eyeing stablecoins to cut down on transaction costs and payment delays. Right now, they lose billions each year to credit card fees — just on prepaid and debit cards, the Fed says fees hit $32 billion in 2021. That’s where stablecoins come in.

By using stablecoins, which settle almost instantly and are backed 1:1 with U.S. dollars, merchants could bypass card networks like Visa and Mastercard entirely. It’s not just about savings — it’s about speed. Card transactions can take days to clear. With stablecoins, the money hits their accounts in seconds. That means better cash flow and even interest gains from funds that usually just sit in transit.

Retailers have two paths: accept existing coins like USDC, or launch their own. If they go the latter route, they also pocket the interest on the reserves — a whole new revenue stream. But to get there, they’re waiting on Congress to move forward on the Genius Act, a bill that would create a legal framework for stablecoin use.

Investors are already reacting. Visa and Mastercard shares dropped about 5–7% after news broke. Circle, the issuer of USDC, popped — it's currently the most viable U.S.-based stablecoin, and the biggest potential winner if this shift takes off.

There’s still work to do convincing shoppers to preload stablecoins, but if retailers start offering discounts or rewards — like Starbucks did with its app — that could change fast.

If stablecoins take off, those 3% swipe fees and slow merchant payments could soon be a thing of the past. The way we pay is changing, and for Visa and Mastercard, the threat is very real.

TESLA'S CYBERCAB ERA KICKS OFF IN AUSTIN

Tesla’s long-hyped robotaxi project is finally hitting real roads. This week, Tesla’s fully autonomous CyberCab was spotted rolling through Austin — no driver in the seat, just a passenger in the back. Elon Musk says public rides are set to begin on June 22, and by June 28, he claims the first Tesla will drive itself straight from the factory to a customer’s home.

Behind the scenes, Washington is helping clear the path. The NHTSA is speeding up how it handles exemption requests for autonomous vehicles, which used to take years. Now, decisions could come in months, giving Tesla and others a faster way to legally ditch steering wheels and pedals. That shift is big news for Tesla, especially as it gears up to launch a full-on ride-hailing service to rival Uber and Lyft — who both saw their stocks dip on the news.

Meanwhile, a video of the CyberCab on its test run went viral, showing the vehicle operating solo, with a second Tesla trailing closely behind — likely as a chase car for safety or filming. Either way, Austin just became ground zero for Tesla’s self-driving future.

Also, in a broader context, President Trump’s recent comments praising Tesla and signing legislation that scraps California’s EV mandates suggest a thaw in relations. Tesla even bumped prices on its Model S and X by $5,000, possibly betting on momentum fueled by these developments.

So while flying cars are still a dream, the driverless taxi era is officially rolling, starting with Texas.

STARTING LIFE WITH STOCKS?

Starting in 2025, every American baby could get a $1,000 head start from the federal government. Trump just unveiled a plan to fund tax-deferred investment accounts—dubbed “Trump accounts”—for kids born between 2025 and 2028. The money would track the stock market and be managed by guardians, with the option to add up to $5,000 a year in private contributions.

He pitched it as a pro-family, pro-growth move, and he’s got support from big names like Goldman Sachs, Dell, and Uber, whose CEOs pledged billions more for their employees’ kids. House Speaker Mike Johnson called it a “transformative” policy.

But here’s the catch: the accounts are part of a massive budget bill that narrowly passed the House and faces real resistance in the Senate. The Congressional Budget Office says it could add $2.4 trillion to the national debt and leave millions without healthcare, thanks to major cuts in Medicaid and food aid.

Still, if it passes, every newborn would start life with a market-tied account. Trump says it’ll help kids “get a big jump on life.” Whether it clears Congress is still up in the air. And to show they’re ready, Robinhood has already unveiled the user interface for the proposed Trump accounts.

Chime’s Big Debut: Fintech’s Back in Business

It’s been a wild few weeks for fintech, and Chime’s IPO just added more fuel to the fire. Following in the footsteps of Circle and Voyager Technologies, the mobile banking app made a splashy entrance on the Nasdaq this week — and investors were here for it.

Chime raised about $864 million ahead of the listing and opened at $42 per share, way above its $27 IPO price. The stock closed at $37, giving the company a market cap just north of $13 billion. Not bad for a fintech firm that doesn’t actually hold a bank charter — Chime offers its services by partnering with banks like Bancorp and Stride Bank.

Of course, that $13 billion is still a far cry from Chime’s peak valuation of $25 billion back in 2021, when VCs were tossing money around like confetti. But timing is everything, and Chime picked a great moment to go public. IPO momentum is back — AI giant CoreWeave is up 271% since its March debut, Circle has nearly quadrupled since last week, and Voyager popped 82% on its first trading day.

Chime’s app, which gained major traction during the pandemic thanks to features like early paycheck access and zero account fees, continues to ride that wave. Revenue jumped 32% year-over-year last quarter, and the company posted $25 million in adjusted profit in Q1 — a good sign for investors eyeing long-term growth.

After years of IPO slowdowns, optimism is back — and Chime’s strong start could signal more listings to come, with Klarna and StubHub waiting in the wings.

EARNINGS BITE:

CASY

Casey's crushed FQ4 expectations with a +13% YoY EPS beat ($2.63 vs. $1.96 cons) despite continued fuel margin headwinds. FY26 EBITDA guidance of +10-12% signals sustained strength, aided by the Fikes acquisition and in-store momentum. Nearly every major broker raised PTs—Jefferies to $575, Evercore to $530, and KeyBanc to $550—citing durable execution, robust free cash flow, and a strong M&A pipeline. Stock surged +11.5% as bulls pointed to double-digit EBITDA CAGR, but some like Goldman and BMO noted valuation is now full (~15x EV/EBITDA). Still, consensus: CASY remains best-in-class among c-stores.

SJM

Smucker's Q4 EPS beat ($2.31 vs. $2.24 cons) couldn’t mask the FY26 guide cut—EPS range of $8.50–$9.50 vs. ~$10.25 est.—sending shares plunging -16%. Hostess continues to underwhelm with a $2B impairment and growth downgraded to +3%. Analysts see FY26 as “de-risked” (Jefferies, UBS), but concern over coffee elasticity, tariffs, and ultra-processed food backlash (GLP-1 impact, RFK Jr. push) keeps pressure on the multiple. Valuation now trades at a ~30% discount to food peers, with many calling it cheap but cautioning on visibility. Bulls are eyeing Uncrustables and Bustelo to stabilize the ship.

GME

GameStop posted a surprise Q1 profit ($0.17 vs. $0.04 cons), but the focus quickly shifted to the $2.25B 0% convertible notes offering. Shares tanked -22% as investors questioned the capital raise and pivot to trading cards, despite CEO Cohen touting the move as “logical expansion.” Revenue missed ($732M vs. $754M cons), while physical game sales and store closures continued. Crypto buzz remains—GME disclosed 4,710 BTC bought between May and June—but fundamentals are shaky. The stock’s retail loyalty remains strong, but the dilution + strategic ambiguity make it a high-risk bet.

GTLB

GitLab beat Q1 on EPS and revenue but posted its thinnest topline beat ever (+0.7%), and crucially didn’t raise full-year guidance—spooking investors and dragging shares -13%. Analysts flagged a SaaS mix shift, delayed deals, and modest seat growth, despite Duo adoption and 122% NRR. Some bulls (Piper, Morgan Stanley) see this as noise in a strong story, but others (Goldman, Barclays) worry about slowing net expansion, AI disruption risk, and lack of material AI revenue. Still, GitLab remains profitable with FCF margins >40% and trades at ~5.5x EV/rev—cheap if growth stabilizes.

VSCO

Victoria’s Secret posted a Q1 in-line quarter (EPS $0.09), but lowered FY EPS to $1.80–$2.20 (from $2.00–$2.45), blaming tariffs and weak intimates. PINK, beauty, and digital performed well, but semiannual sales and core traffic remain challenged. Analysts split—Jefferies and Barclays highlight strategic wins in Intl and digital; BofA and JPMorgan see promotion pressure and macro drag. Shares are stuck in a show-me phase, with most expecting flat-to-low-single-digit growth and valuation anchored by discount retailer comps (~4x FY2 EBITDA).

ADBE

Adobe beat Q2 EPS ($5.06 vs. $4.97) and raised FY25 revenue and EPS slightly, but reiterated 11% ARR growth—underwhelming bulls expecting more GenAI upside. Firefly adoption and Express momentum were positives, but net new ARR stayed flat, and AI monetization remains early. Analysts trimmed PTs (TD Cowen $470, Stifel $480), citing competitive pressures and delayed GenAI payoff. Still, Adobe trades at ~17x CY26 FCF and shows healthy margin/FCF trends. Bull case holds on Creative Cloud pricing and AI premium tiers, but stock likely range-bound until ARR shows acceleration.

RH

RH shocked to the upside with a $0.13 EPS beat (vs. -$0.07 est) and FY25 guidance for +10-13% revenue growth, sending shares up +20%. Management reiterated plans for international expansion despite macro noise and tariff headwinds. Adjusted operating margins expected to improve to 14-15%, with strong FCF ($250M–$350M). However, skeptics (UBS, KeyBanc) remain cautious on inventory, discounting, and comp risk in 2H. Stifel sees the reaction as justified given low expectations and progress on new design formats. RH may still be a value story in luxury home—but the path forward has questions.

CHWY

Chewy delivered a solid Q1 with revenue coming in ahead of expectations and active customer growth gaining traction. But while topline trends are moving in the right direction, the market’s reaction reflects concerns around profitability flow-through and a conservative outlook. Analysts remain split—many acknowledge the underlying strength in customer metrics and category momentum, but valuation and execution visibility are keeping some on the sidelines.

Here’s What Else Happened This Week

Snapchat parent is preparing to launch its first consumer AR glasses—called Specs—in 2026. CEO Evan Spiegel says they’ll be lightweight, immersive, and priced well below Apple’s $3,499 Vision Pro.

Microsoft $MSFT unveiled its first handheld gaming console, the ROG Xbox Ally, built with Asus and set to launch this holiday season. It enters a growing field alongside the Steam Deck, Switch 2, and PlayStation Portal.

Netflix picked up a 30-minute pilot from The Daily Beast, marking a broader push into fast-turnaround doc-style content as the streamer looks to compete with YouTube’s rising share of TV time.

Qualcomm is acquiring UK-based Alphawave for $2.4B in cash to strengthen its AI and data center chip offerings. The deal is backed by Alphawave’s board and key shareholders and is expected to close in Q1 2026.

OpenAI’s annualized revenue has reached $10B, up sharply from $3.7B last year, according to CNBC.

Amazon will invest $20B in Pennsylvania to expand AI and cloud infrastructure—its largest-ever investment in the state—bringing new data centers, 1,250 jobs, and major educational initiatives.

China’s exports to the U.S. plunged 34.5% in May—the sharpest drop since early 2020—as imports from the U.S. also fell over 18%, deepening trade tensions.

UK PM Keir Starmer announced a new initiative with 11 major firms to train 11.5 million workers in AI by 2030.

IONQ is acquiring UK-based Oxford Ionics for $1.08B, aiming to scale its quantum computing capacity to 256 qubits by 2026, 10,000+ by 2027, and 2 million by 2030.

IBM says it’s now focused on building a practical quantum computer by 2029, targeting 200 logical qubits. NVIDIA CEO Jensen Huang echoed the industry’s optimism, calling quantum computing “within reach.”

Nebius will open a UK-based AI data center in Q4 2025, powered by 4,000 $NVDA Blackwell Ultra GPUs. The company raised $1.7B in funding to support the expansion.

Uber and UK startup Wayve are planning London’s first robotaxi pilot, targeting launch ahead of the UK’s 2026 commercial self-driving trial program.

Dick’s Sporting Goods and Golf Galaxy are now on UBER Eats, offering same-day delivery from 800+ stores for sporting goods, cleats, and fitness gear.

AST SpaceMobile will join the Russell 1000 Index on June 27 and struck an 80-year spectrum deal for U.S. and Canada. The agreement includes $550M in financing and unlocks mid-band spectrum for its satellite broadband network.

OKLO’s Aurora microreactor licensing took a step forward with NRC acceptance. The firm also secured a deal to provide clean power to an Air Force base in Alaska under a long-term DoD agreement.

Walt Disney CEO Bob Iger plans to stop reporting streaming subscriber numbers in the near future.

Eli Lilly will no longer partner with telehealth firms selling compounded versions of its weight-loss drug Zepbound. $HIMS is excluded, while Ro and LifeMD remain onboard under exclusivity terms.

Novo Nordisk will advance both injectable and oral versions of its amycretin-based weight-loss drug into Phase 3 trials starting Q1 2026.

Microsoft is reportedly working on a deal to add 1 million Copilot users from a single enterprise customer, according to internal briefings.

Anduril founder Palmer Luckey confirmed that an IPO is “definitely” in the company’s roadmap, saying they’re building the business with public markets in mind.

Nintendo’s Switch 2 has sold 3.5 million units in just four days, making it the fastest-selling Nintendo console launch globally.

Starbucks is exploring a potential stake sale in its China business. CEO Niccol says interest is high, with plans to expand from 8,000 to 20,000 stores in the region.

YouTube $GOOGL’s U.S. creator ecosystem contributed $55B to GDP in 2024 and supported 490,000+ full-time jobs, per a new Oxford Economics report.

ARK Invest’s Cathie Wood says SpaceX could hit a $2.5T valuation by 2030, fueled by Starlink and Starshield revenues with projected margins above 80%.

President Trump signed executive orders aimed at boosting U.S. dominance in drones, electric air taxis (eVTOLs), and supersonic flight. The orders include FAA modernization and national drone security frameworks.

Stephens is evaluating renewed $PZZA buyout talks. Irth Capital and Apollo are reportedly teaming up for a ~$2B bid. Irth holds a 5% stake and brings sector experience.

Nvidia and Samsung took minority stakes in robotics startup Skild AI as part of its $4.5B Series B. SoftBank led the round with $100M, as the firms look to expand into consumer robotics.

Micron will invest $200B in U.S. memory production and R&D by 2030, with $150B allocated for fab construction and $50B for tech development.

AMD CEO Lisa Su expects the AI chip market to hit $500B by 2028. AMD's MI300 and upcoming MI500 chips are being adopted by xAI, OpenAI, and Oracle.

NVDA CEO Jensen Huang said future forecasts will no longer include China due to U.S. export restrictions, calling any sales to China “upside, not baseline.”

Coinbase launched the Coinbase One Card with AmEx, offering up to 4% back in Bitcoin. It’s also rolling out perpetual futures trading for U.S. users.

Mattel has partnered with OpenAI to build AI-powered toys using ChatGPT tech. First product launches are expected later this year, alongside internal adoption of ChatGPT Enterprise.

Ford CEO Jim Farley said the U.S. EV market has seen no revenue growth in the past three years, despite rising production and incentives.

Chipotle says its AI platform “Ava Cado” cut hiring time by 75%, helping support rapid store expansion. The chain now opens nearly one new location every day.

FanDuel is reportedly in talks with prediction market Kalshi for a potential partnership, expanding reach into markets where sports betting remains restricted.

Anne Wojcicki’s nonprofit struck a $305M deal to acquire bankrupt 23andMe, outbidding Regeneron. The move still faces court approval and legal challenges over user data rights.

Americans are expected to spend $24B on Father’s Day this year—$10B less than Mother’s Day—with average spend per dad at $232, per NRF.

Week Ahead:

The week begins with the G-7 Summit on Sunday in Kananaskis, set against the backdrop of the Canadian Rockies. On Monday, China will publish its retail sales and industrial production data, while inflation figures are due from Nigeria and Italy. Tuesday brings U.S. retail sales, central bank decisions from Japan and Chile—both expected to keep rates steady—and renewed Senate debate on the House tax bill. The UN General Assembly also convenes to begin a summit focused on a potential Palestinian state.

Wednesday features a widely anticipated Fed meeting where rates are expected to remain unchanged, along with rate decisions from Brazil and Indonesia. Sweden’s Riksbank is likely to cut by 25 basis points, while CPI reports come in from the UK and South Africa. On Thursday, the Bank of England is expected to hold rates, but the Swiss National Bank may opt for a quarter-point cut. New Zealand releases its GDP data, and U.S. equity and bond markets will be closed in observance of Juneteenth.

The week wraps up on Friday with CPI data from Japan, and retail sales numbers from both the UK and Canada.

Looks like it’s shaping up to be an eventful week. I’ll be sharing updates as things unfold over on Twitter: @wallstengine.