Happy Sunday!

As we’ve been saying in recent newsletters—the bulls have taken charge, and now that the indexes have reclaimed the 200-day moving average, dip buyers are likely to get activated again at key support levels. And like they say, “good things tend to happen above the 200DMA.” That’s exactly how it played out. The bulls pushed hard this week, and with the index back above that critical level, we saw the second-best week of the year—helped by a surprise U.S.–China trade deal struck in just two days. Honestly, the outcome was way better than most folks expected. On top of that, Trump kept the positive momentum going during his trip to the Middle East. As he moved from one country to the next, the size of the investment deals just kept growing. That helped fuel the the risk-on rally in equities—especially in the AI and semiconductor spaces.

US-CHINA TARIFF DEAL: A 90-DAY RESET

This week, Washington and Beijing pulled off a rare diplomatic win: a 90-day tariff truce hammered out in Geneva. The U.S. will slash tariffs on Chinese goods from 145% to 30%, while China cuts its own from 125% to 10%. Both sides agreed to a formal consultation channel to keep the talks alive.

Chinese regulators lifted their freeze on Boeing deliveries, and U.S. consumer brands like Therabody and Bogg Bag are rushing to ship delayed inventory out of Chinese factories. Boston’s port is seeing a pickup in volume, but container prices are climbing again.

Treasury Sec. Scott Bessent, who led the talks, called the 30% tariff level “a floor, not a ceiling.” And if meaningful progress doesn’t come by mid-August, those tariffs could snap right back but not to 145%.

Trump’s Middle East Trip: New U.S. Approach

President Donald Trump wrapped up a high-profile three-day tour of the Middle East this week, visiting Saudi Arabia, Qatar, and the United Arab Emirates—his first major overseas trip since returning to the White House.

Trump's message to the region leaned heavily on non-interventionism. In a speech in Riyadh, he criticized past U.S. foreign policy, especially neoconservative-led interventions in Iraq and Afghanistan. “The gleaming marbles of Riyadh and Abu Dhabi were not created by the so-called nation-builders,” he said, underscoring that progress in the Gulf came from local leadership, not U.S. military ventures.

The president also made headlines by announcing plans to lift U.S. sanctions on Syria, at the request of Saudi Crown Prince Mohammed bin Salman and Turkish President Recep Tayyip Erdogan. Trump met with interim Syrian President Ahmad al-Sharaa, calling him a “young, attractive guy,” and pitched the sanctions relief as a step toward economic recovery.

On Iran, Trump struck a more restrained tone than in previous years. He said he still wants a deal but warned Tehran that the “offer won’t last forever.” He did not threaten military action, a notable shift from his past rhetoric.

Beyond the diplomacy, business was front and center. The White House claims Trump secured about $2 trillion in new investments from the region, including $600 billion from Saudi Arabia, $243 billion from Qatar, and $200 billion from the UAE. Deals include arms purchases, oil and gas expansion, and major AI infrastructure projects.

In Abu Dhabi, Etihad Airways committed $14.5 billion for Boeing aircraft, while U.S. firms like ExxonMobil and RTX struck new energy and mineral deals. AI took center stage in the UAE, with Qualcomm and Amazon among companies backing plans for data centers, semiconductor production, and a new AI campus run by G42—a rising Emirati tech firm with U.S. ties.

Want More? Join Me on Discord

If you’re finding value in this newsletter or my updates on X, the Discord is where I go deeper. I share real-time trade setups, earnings breakdowns, morning notes, and market-moving news—plus exclusive insights I don’t post elsewhere. It’s a great space to stay ahead with a strong, active community.

Use code WALL20 for 20% off on any plan.

America’s healthcare titan is in free-fall

UnitedHealth Group—the onetime juggernaut of the Dow—has erased roughly $288 billion in market value, its stock cratering almost 60 % from last year’s peak and plumbing a five-year low. Once the index’s heaviest weight, it has tumbled out of the Dow’s top tier and posted its steepest weekly collapse since 1998. Technical gauges echo the carnage: the daily RSI has sunk to depths unseen in 27 years, underscoring just how severe the capitulation has been.

How the unraveling gathered speed

Date | Flashpoint | Immediate Market Reaction |

|---|---|---|

Apr 17 | First earnings miss since 2008; guidance cut | Stock slid ~20 % |

May 13 | CEO Andrew Witty resigns; 2025 forecast withdrawn | Shares fell ~18 % |

May 15 | Wall St. Journal report of a DOJ criminal probe into Medicare Advantage practices | Intraday plunge pushed the monthly drawdown toward record 60% |

UnitedHealth’s business model leans heavily on Medicare Advantage risk-score payments and Optum’s sprawling provider network. The new V28 risk-adjustment rules and talk of trimming federal health-care spending strike at that core. Analysts now forecast a double-digit earnings decline this year and don’t see profits recovering to 2024 levels until 2027—yet more than four-fifths of the Street still rates the stock a Buy, with price targets far above the current quote.

With a criminal fraud investigation hovering, regulators eyeing both antitrust and billing practices, and the board steering back to longtime architect Stephen Hemsley, UnitedHealth is betting continuity will calm the storm. Investors, regulators, and patients will decide whether that bet is bold resilience—or just doubling down on a broken playbook.

As the selloff intensified over the past few days, insiders have started buying into the dip—and that activity picked up on Friday. Director Kristen Gil bought 3,700 shares on Thursday at an average price of $271.17. Meanwhile, director Timothy Flynn—who also chairs Walmart’s audit committee—picked up 1,533 shares at $320.80 per share. The stock saw a bit of a relief bounce in response.

Novo Nordisk’s Sudden Leadership Shift

Novo Nordisk has long been a picture of steadiness—three CEOs in 44 years—but that calm shattered when Lars Fruergaard Jørgensen was unexpectedly asked to step down during what was supposed to be a routine Teams catch-up with Chairman Helge Lund. The move follows a bruising 53 % slide in Novo’s share price over the past year, stubborn supply shortfalls for obesity blockbuster Wegovy, and pipeline disappointments such as underwhelming CagriSema data—all while Eli Lilly’s rival Zepbound grabs market share and headlines.

Why the change? Insiders point to the Novo Nordisk Foundation, the company’s controlling shareholder, which reportedly lost confidence in execution. Delays meeting surging demand, political blowback over U.S. pricing, and congressional scrutiny added to the pressure. With Jørgensen out, Novo is casting a wide net for a successor—internally and externally. Among the names floated: former Novo commercial chief Jakob Riis, Zealand Pharma’s Adam Steensberg, and Novo Holdings boss Kasim Kutay—yet history suggests the board favors homegrown talent.

What’s at stake? Lund says strategy stays intact, but it clearly needs a tune-up. Novo must scale output faster, recapture momentum in obesity care, and navigate an increasingly hostile pricing environment—all while Eli Lilly presses its advantage. In a nod to stability, legendary former CEO Lars Rebien Sørensen is rejoining the board as an observer before taking a full seat.

Moody’s Strips U.S. of Final AAA Rating Over Soaring Debt, Fiscal Strains

For the first time in history, the United States no longer holds a top-tier AAA credit rating from any major rating agency. Moody’s downgraded the U.S. sovereign rating to Aa1 from Aaa, citing long-term fiscal deterioration, a growing debt burden, and rising interest costs that are outpacing revenue growth.

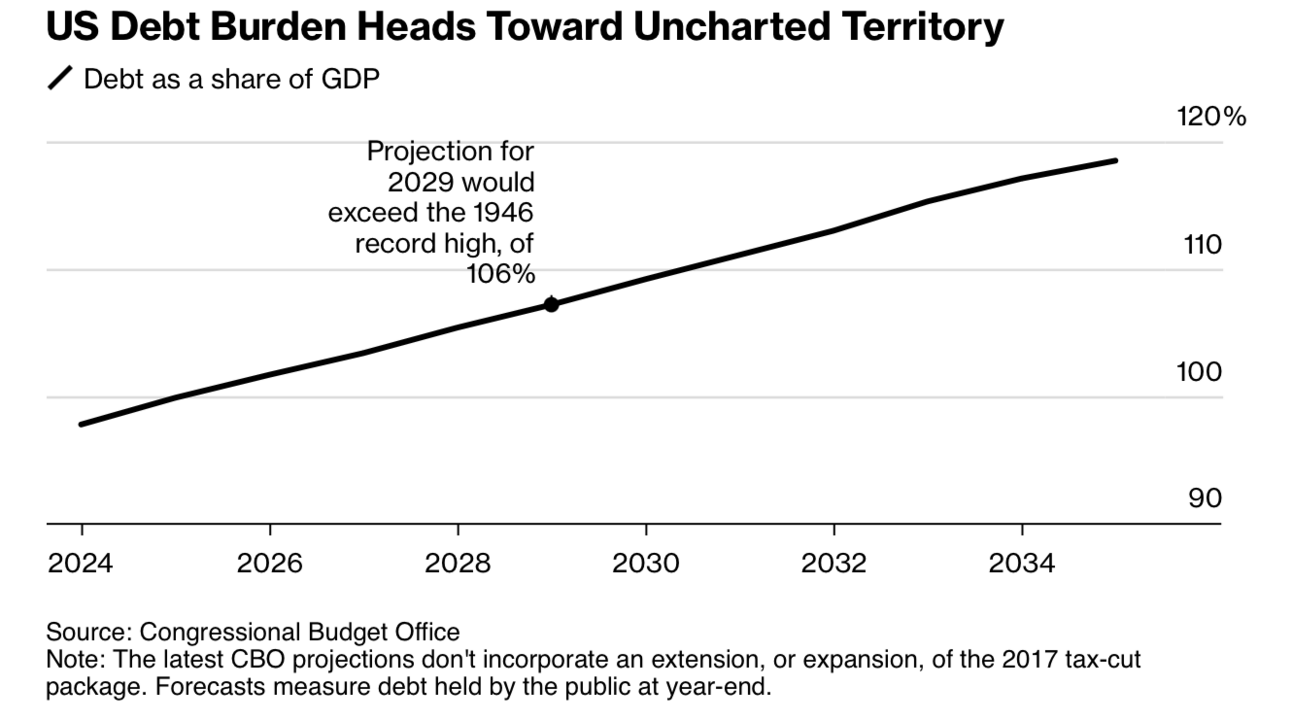

The move follows similar downgrades from S&P in 2011 and Fitch in 2023, making Moody’s the last of the “Big Three” to cut the U.S.’s rating. The downgrade arrives as the federal deficit runs near $2 trillion annually and debt is projected to hit 134% of GDP by 2035, up from 98% in 2024. Interest payments alone could consume 30% of federal revenue within a decade, up from 18% today.

In its statement, Moody’s said: “Successive U.S. administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs.”

The agency noted that the downgrade reflects “persistent” fiscal issues worsened by rising Treasury yields and limited flexibility in the federal budget. Without reforms, Moody’s expects the U.S. to continue running deficits close to 9% of GDP by 2035.

Despite the downgrade, Moody’s shifted the outlook to stable, citing the U.S. economy’s size, the independence of the Federal Reserve, and the global role of the U.S. dollar as key strengths still underpinning the nation's creditworthiness.

The market response was mixed: Treasury yields jumped as investors priced in higher future borrowing costs, while major equity indexes saw modest losses. The S&P 500 ETF fell 1% in after-hours trading, and analysts say the downgrade may trigger cautious rebalancing across portfolios.

At the political level, the White House pushed back, framing the downgrade as politically motivated. Treasury Secretary Scott Bessent called Moody’s a “lagging indicator” and blamed inherited fiscal conditions. “To go back to your question about the downgrade, who cares? Qatar doesn’t. Saudi doesn’t. The UAE doesn’t,” he told NBC.

Still, the downgrade adds pressure as Congress debates a massive tax-and-spending package, with internal GOP splits stalling the bill over deficit concerns. The legislation includes an estimated $4 trillion in tax cuts and $1.5 trillion in spending reductions—a combination unlikely to meaningfully alter the fiscal trajectory flagged by Moody’s.

Whether the downgrade spurs serious deficit reduction or just more political gridlock remains to be seen. But Moody’s message was clear: the U.S. is on an unsustainable fiscal path, and global markets are watching.

COINBASE TARGETED IN CYBERATTACK AHEAD OF S&P 500 ENTRY

Just days before joining the S&P 500, Coinbase says it’s facing a potential $400M hit after a cyberattack compromised data on less than 1% of users. Hackers bribed overseas support agents to access internal tools, then posed as Coinbase to scam customers and demand a $20M Bitcoin ransom.

The company refused to pay, fired involved staff, and is working with law enforcement—offering a $20M bounty for info leading to arrests. No passwords or funds were directly stolen, and Coinbase has pledged full reimbursement to affected users.

The breach highlights rising security challenges in crypto, with 2024 losses across the industry already topping $2.2B, per Chainalysis. Coinbase also confirmed an ongoing SEC probe related to past user metrics—an investigation it calls a “hold-over from the prior administration.”

Week Ahead:

After a pretty busy stretch, we’re looking at a lighter week coming up—at least when it comes to U.S. economic data. It’s actually one of the quietest calendars of the year. Earnings will also be on the lighter side, though retail names will be in the spotlight. We’ll still hear from a good number of Fed speakers, and if history’s any guide, the Trump administration will likely keep things interesting on their end too.

Also, a quick heads-up: next Monday (May 26) is Memorial Day, so expect some traders to be less active this week.

We’ll see how all of this plays out, and I’ll keep you posted with updates throughout the week on my Twitter: @wallstengine.