Welcome to this week’s Earnings Preview. I’m covering PDD, OKTA, MDB, NVDA, CRWD, SNOW, and AFRM. Tomorrow I’ll be sending out the Sunday Weekly Recap, free for all subscribers. Until then, here’s the preview.

Let’s get into it 👇

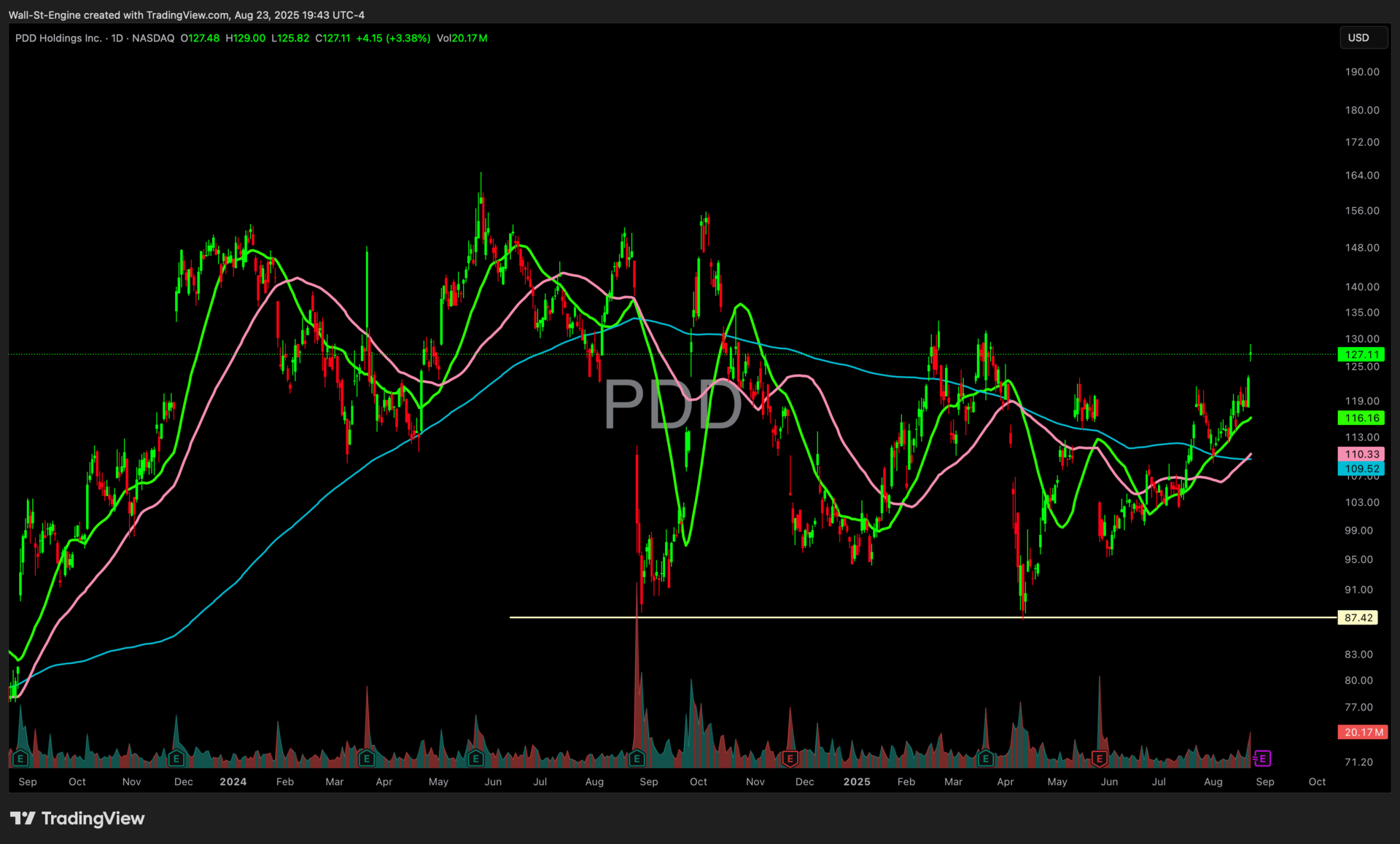

1. Pinduoduo (PDD) | Q2-25 Preview

Earnings due Monday (before the bell) | options imply ± 6.3 % one-day move

Pinduoduo reports Monday before the bell, with options implying about a ±6.3% one-day move. China names have been performing well recently, bullish flow has been all over this name, and the stock has rerated after a big cut to forward EPS following last quarter’s miss. Into this print the forward P/E sits near 13.3x, and the tape will ask whether margins have found a floor.

PDD (Daily)

Street numbers point to modest top-line growth and sharp compression underneath. Consensus revenue is ~103.9B, up 7% year over year, with Marketing Services and Other up ~12% and Transaction Services up ~2%. Gross profit is pegged at ~61.6B, down about 3%, which implies gross margin of 59.3% versus 65.3% last year. Operating income is modeled at ~24.0B, down 31%, for a 23.1% operating margin versus 36.0% a year ago. EPS sits at 15.50, down a third, while free cash flow is expected to rise ~18% to ~51.6B. The mix says growth continues, but it is costing more to win and keep it.

Last quarter the stock fell double digits on a sizable EPS miss and the Street cut next-twelve-month EPS by about 24%, yet shares have since outperformed the S&P by roughly 17 percentage points into this event. That tells you positioning has reset, and expectations for profitability are lower than they were in 2024. A clean margin print can support the multiple. A second hit to margins likely reopens the debate.

What will actually move the stock…….

Subscribe to access the Earnings Preview

To read the full earnings preview covering PDD, OKTA, MDB, NVDA, CRWD, SNOW, and AFRM, you’ll need to be a premium subscriber to The Engine Room.

Upgrade