Welcome to this week’s Earnings Preview. I’ll be covering Palantir, Hims & Hers, MercadoLibre, Caterpillar, Astera Labs, Toast, Snap, Supermicro, AMD, Uber, Shopify, Disney, McDonald’s, Unity, Oscar, and AppLovin.

Coming up next: I’ll be diving into ABNB, ELF, DKNG, DUOL, DASH, LYFT, BROS, LLY, CELH, DDOG, CROX, PTON, XYZ, PINS, CART, SG, & TWLO in the next post—dropping late Monday or early Tuesday. Stay tuned.

Let’s jump in 👇

1. Palantir | Q2-25 Preview

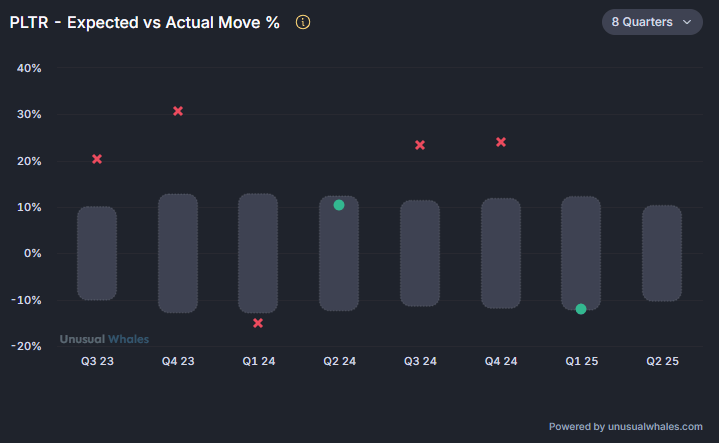

Earnings due Monday (after the bell) | options imply ± 10.3 % one-day move

Palantir reports Monday after the bell, and the bar couldn’t be set much higher as it always has been the case. Consensus sits at about $940 million of Q2 revenue and $0.14 of EPS, which would mark 39 % top-line growth and the 5th straight quarter of acceleration. Loop Capital’s channel work says management is good for at least the usual “beat-and-raise” cadence—roughly four points of upside to the guidance midpoint and another two-plus points tacked onto the full-year outlook—and that dovetails with what we’ve been hearing from the field: most AIP pilots that kicked off in January are already scaling into paid production.

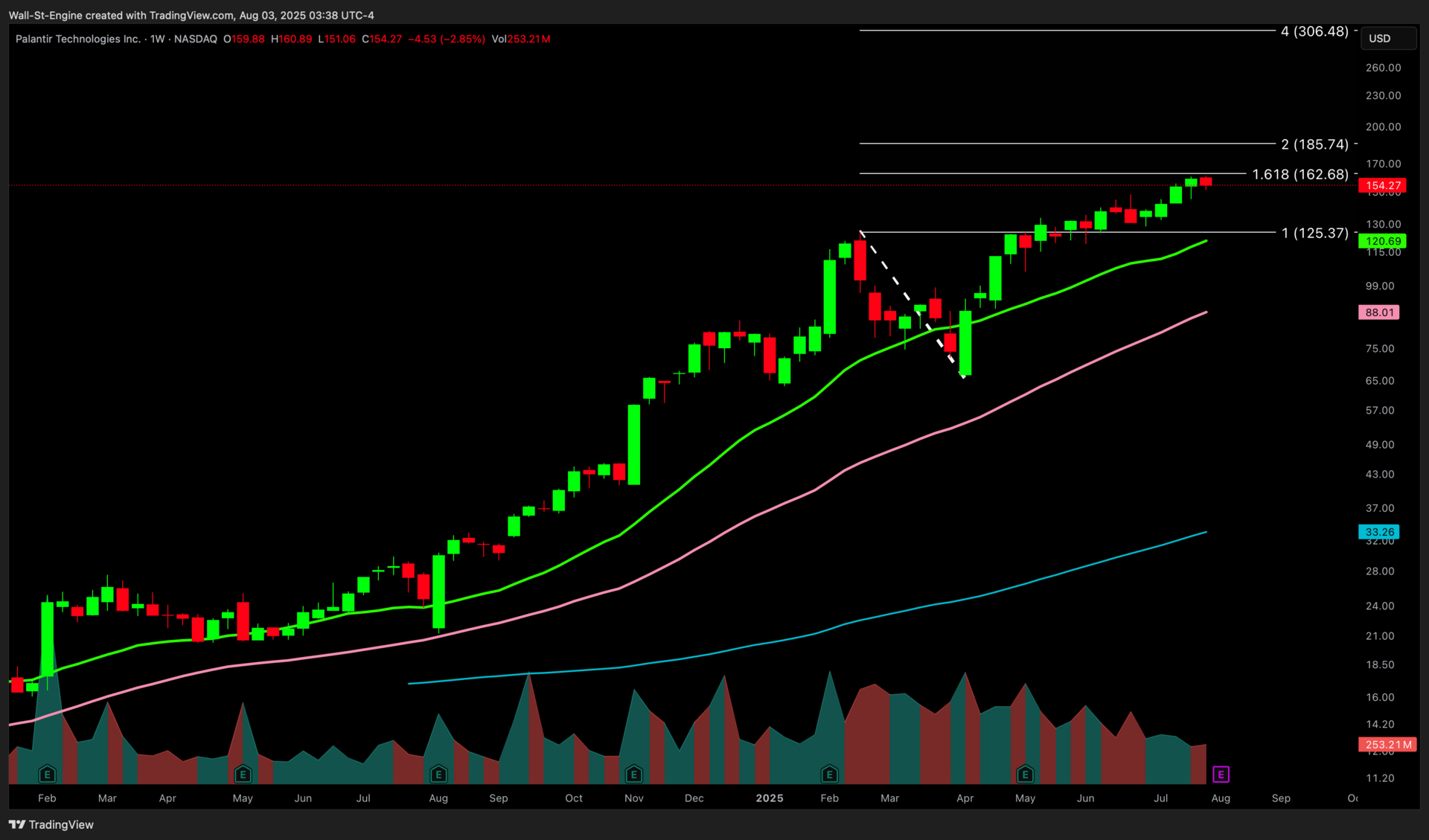

PLTR (Weekly)

The question is whether flawless execution is enough when the stock has doubled since January and now trades at well north of 120× forward sales—a richer multiple than anything else in software, AI or otherwise. Bulls argue Palantir earns that premium on scarcity (one of the few pure-play AI platforms), on a margin profile that already runs a GAAP-level 20 % and a “rule-of-81” efficiency score, and on a commercial pipeline that could turn the U.S. AIP business alone into a $1-billion run-rate within three years as enterprises look for an off-the-shelf way to stitch large-language-model workflows into their data estates. Bears counter that even a clean quarter leaves no room for the slightest wobble in guidance; options are pricing a ±10 % move, but history shows Palantir routinely overshoots that band when sentiment breaks.

Technically the chart is perched in a rising wedge that’s been tightening since April: break higher on Monday night and the price discovery phase resumes; slip even a hair on the outlook and you have 15 % of air before the next volume shelf shows up. Either way, the print should settle the near-term debate. Deliver another revenue beat, keep operating margin pointed up, and show evidence that the commercial backlog is turning into cash as fast as bulls hope, and the “next Oracle” narrative stays intact. Miss—or simply guide growth back toward the low 30s—and a valuation that’s already in the stratosphere could have plenty of gravity to contend with.

Sponsored

If you're tired of second-guessing your trades based on a hunch, it might be time to lean on some hard data. I've been checking out edgeful lately, and it’s been a solid way to get a clearer picture without overcomplicating things.

edgeful digs into historical patterns—gap fills, breakout odds, volume trends, even seasonal quirks—turning raw market moves into something you can actually work with. Whether it’s a stock gap showing how often it reverses or a futures range hinting at a breakout, it lays out the odds fast.

It covers stocks, futures, forex, crypto—pretty much every market you’d touch.

Good news for my readers: edgeful doesn’t usually offer public trials, but I’ve got you a 7-day free trial. Take a look and see if it fits your style.

2. Hims & Hers (HIMS) | Q2-25 Preview

Earnings due Monday (after the bell) | options imply ± 14.5 % one-day move

Hims & Hers heads into earnings with the chart pressing long-term resistance near $65 and the narrative tug-of-war as loud as it can. Under the hood: internal data shows compounded semaglutide sales jumped about 35 % month-over-month in June, while average order value climbed 11 %. That surge more than covered a ~4 % m/m slide in “core” categories like dermatology, hair, and sexual health, putting weight-loss squarely at the center of the topline story.

HIMS (Weekly)

Consensus sits at $551 M revenue (+75 % YoY), $72 M adj. EBITDA (~13 % margin) and $0.16 EPS (+167 % YoY). A beat-and-raise hinges on two things: proof that GLP-1 momentum can keep lifting ARPU without torching CACs, and reassurance that those legacy franchises aren’t permanently stalling out. Subscriber growth, payback periods, and any hint of mix-shift pressure will be dissected in real time.

The catch is It’s all wrapped in a messy legal overhang. Novo Nordisk has already yanked its co-marketing deal, called Hims’ Wegovy promotions “deceptive,” and is openly weighing litigation to curb compounded GLP-1 sales. Securities class-action suits filed in late June signal the first volley, and while 503A personalization keeps Hims on the right side of compounding law for now, the prospect of a drawn-out fight (and headline risk) will hover until clarity lands, but despite all the doubts, HIMS has managed to climb higher.

What shareholders will be looking forward from Management:

quantify GLP-1 penetration, margin impact, and sourcing safeguards;

lay out a credible defense/contingency path if Novo presses forward;

keep full-year guidance intact or nudge it higher despite core softness; and

update timelines on testosterone, menopause, and the 2026 Canada + Europe expansion, which set up the next leg of growth but won’t help 2025 comps.

Technically, a convincing close through $65 could trigger a fresh momentum chase; a whiff or cautious guide likely knocks the stock back toward the rising 50-week area in the high-40s/low-50s.

3. Caterpillar | Q2-25 Preview

Earnings due Tuesday (before the bell) | options imply ± 4.4 % one-day move

Caterpillar reports before the bell on Tuesday, Aug 5. The Street is looking for about $4.90 of EPS on $16.3 B of revenue, a year-on-year slip as price realization cools and tariffs shave another $250-350 M off the quarter. The bigger debate is 2026-27. Bulls pencil in $22-23 of EPS for 2026 on a tame mining cycle and a construction rebound, while bears sit closer to $17-18. Management’s record $35 B backlog and the surge in datacenter-driven power-gen orders—capacity is booked well into late 2026—give the bull case fresh fuel.

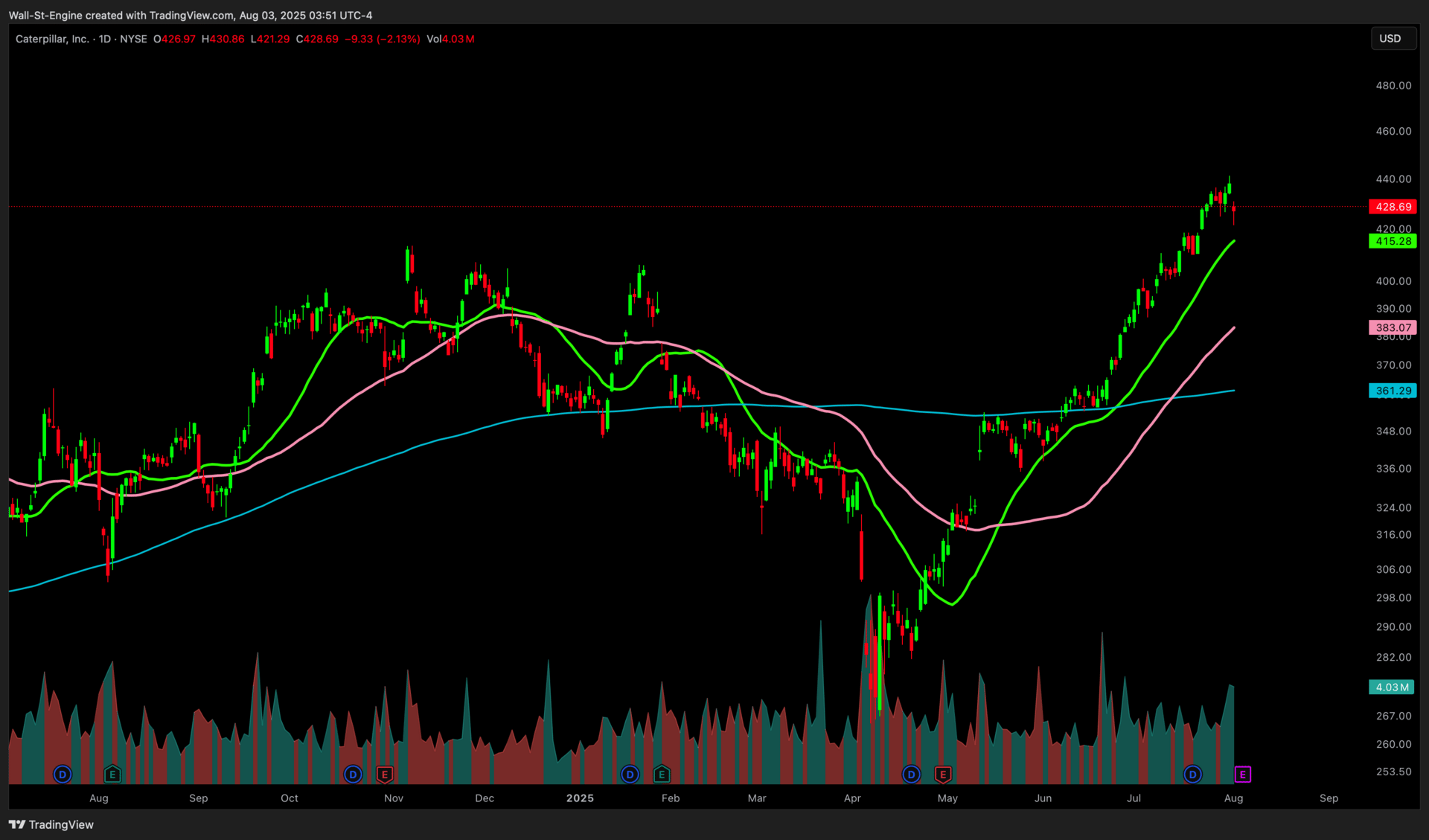

CAT (Daily)

One major broker just returned CAT to Buy, lifting its 2027 numbers to the top of the pack after recalibrating for that AI-era baseload power opportunity. On roughly 14× FY-25 EPS the stock trades at half the 25-30× multiple investors grant GE Vernova’s forward earnings; apply 17× to the new 2027 EPS and you get about 30 % upside.

Near-term focus stays on price/mix, dealer inventory swings, and how much of that backlog converts to cash in the back half. Construction (≈40 % of ME&T sales) is the swing factor; mining looks steady and oil & gas has likely found a floor. Listen for color on grid constraints and datacenter deliveries—those matter more than the headline print.

History says tread lightly: in 68 % of the past five years’ earnings days CAT has closed lower, with a median one-day drop of -3.2 %. If management can keep full-year EPS tracking the Street’s $18.80 view and show progress on the power-gen story, any dip could be a buying window

Subscribe to access the Earnings Preview

To read the full earnings previews on MELI, ALAB, TOST, SNAP, SMCI, AMD, UBER, SHOP, DIS, MCD, U, OSCR, APP, you’ll need to be a premium subscriber to The Engine Room.

Upgrade