Welcome to this week’s Earnings Preview. I’ll be covering PayPal, Spotify, SoFi, UnitedHealth, Boeing, Visa, Starbucks, Hershey, Etsy, Microsoft, Meta, and Robinhood.

Coming up next: I’ll be diving into QCOM, ARM, Carvana, Roblox, CVS, Amazon, Apple, Coinbase, Reddit, Roku, First Solar, Chevron, and ExxonMobil in the next post—dropping late Monday or early Tuesday. Stay tuned.

Let’s jump in 👇

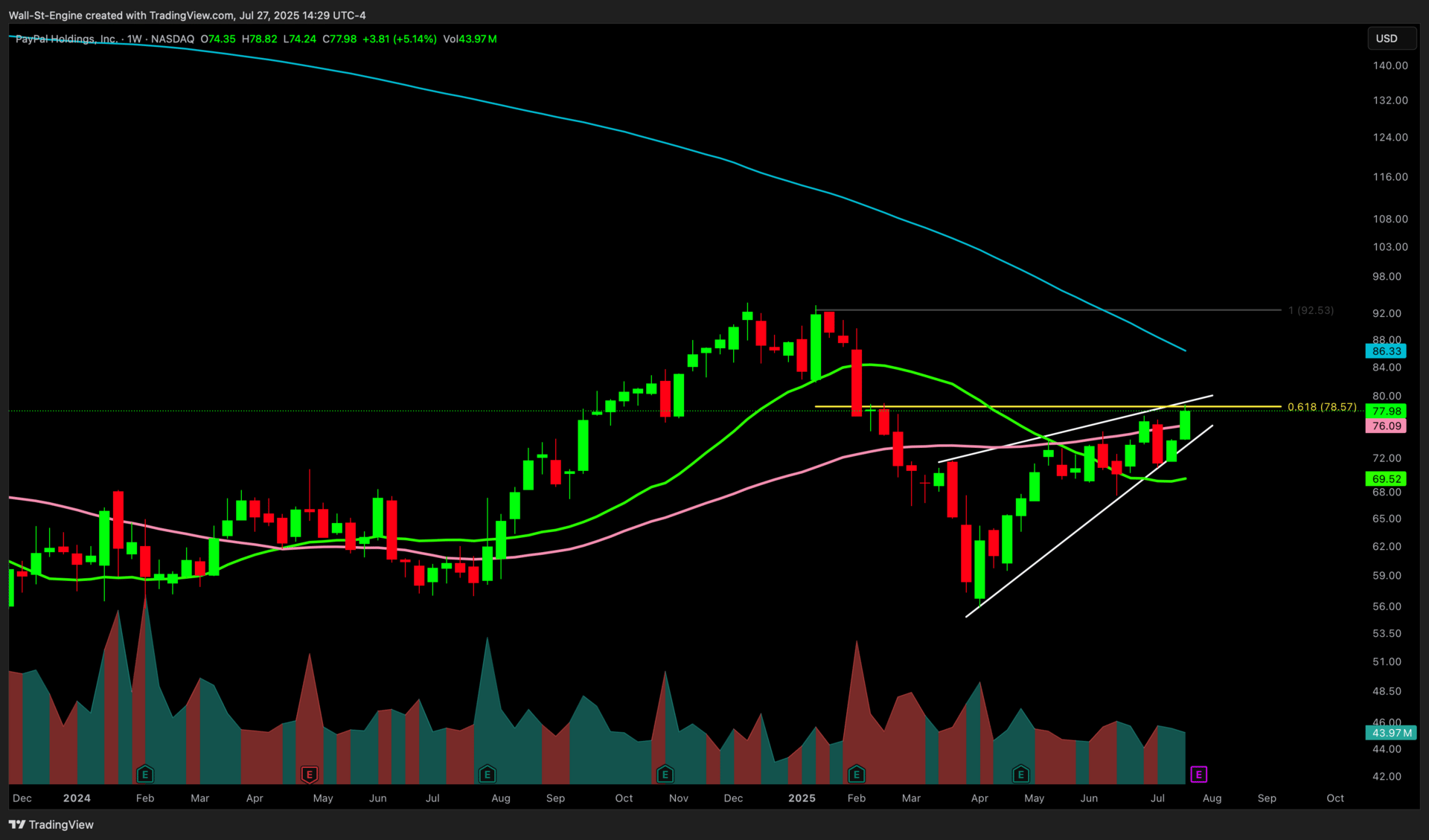

1. PayPal (PYPL) | Q2-25 Preview

Earnings due Tuesday (before the bell) | options imply ± 6.12 % one-day move

It’s not the quarter that changes everything—but it may be the one that confirms it’s all finally changing.

PayPal steps into Q2 earnings next week with something it hasn’t had in a long time: believable momentum. The stock is still down ~75% from its pandemic-era highs, the brand has been written off by most of the Street, and yet—underneath the surface—this might be the most misunderstood setup in fintech right now.

PYPL (Weekly)

Let’s start at the top. Analysts are looking for $8.08B in revenue, but internal models suggest a modest beat—maybe $8.16B on the top line, up ~3.5% FX-neutral. That may look soft at first glance, but this is the final quarter lapping the full -5pt headwind from Braintree’s strategy reset. From here, revenue comps get easier, and the margin mix gets better. Domestically, omnichannel traction is picking up—especially in Germany, where the new checkout is ramping, and we’re starting to see early signals from the Big Ten/Big 12 Venmo rollout.

More important than revenue is what’s happening under the hood. Transaction margin dollars (TM$) are expected to come in north of $3.8B, and margins themselves are quietly inflecting—possibly topping 48.3% this quarter. This is exactly what CEO Alex Chriss has been promising since day one: profitable growth, not topline-at-any-cost. And he’s delivering.

EPS is expected around $1.22, but we wouldn’t be surprised to see a slight beat, maybe $1.31–$1.32. The company is still absorbing increased marketing from Q2’s Will Ferrell campaign, the Germany launch, and developer events, but stronger-than-expected margins and lower share count should help offset. Speaking of which—buybacks have been aggressive. With ~$6–$7B in annual FCF and stock trading under 13x earnings, PayPal can realistically retire 7–8% of its share count annually. That’s not theoretical—it’s happening.

Street expectations

Metric | Cons. | YoY | What matters |

|---|---|---|---|

Revenue | ~$8.1 bn | +3 % | Net‑take‑rate pressure vs. Braintree contract resets |

Adj. EPS | ~$1.22 | +9 % | Opex saves + buy‑backs offset softer top line |

TPV (Fx‑N) | ~8‑9 % | flat vs. Q1 | Debit‑led U.S. volume still healthy |

Guide (FY25) | HSD revenue / low‑teens EPS | reiterated? | Any lift here could force a re‑rating |

Consensus has barely budged over the past month; EPS estimates are down <0.5 %, suggesting expectations are muted.

The market’s been slow to reprice that. But with 436M+ active accounts, growing Venmo monetization (volume +50% YoY), and PayPal World (yes, that’s real) unifying PayPal and Venmo rails globally, it’s getting harder to ignore. Venmo alone is up 10%+ in growth, has doubled monthly actives in offline, and is seeing ARPU expansion of 12%+—and now those users can convert on PayPal-branded buttons. That drives a higher take rate and deeper stickiness.

Then there’s guidance. Last quarter, PayPal held firm on full-year guidance, even though eComm trends outperformed the 3% macro drag they baked in. With FX tailwinds from a weakening dollar and no material impact from recent open banking headlines (like JPM’s API fees), management may finally feel comfortable raising. And if they do? It could be the catalyst this stock’s been waiting for.

Beyond the quarter, the strategic vision is starting to come into view. The Ads business is in early innings but high-margin and potentially a billion-dollar contributor. Agentic commerce partnerships with Microsoft, OpenAI, and Amazon hint at a deeper role in autonomous checkout. And with FastLane, PayPal Everywhere, and new smart checkout flows now reaching 45%+ of U.S. branded volume, conversion rates are improving and trust remains unmatched.

Valuation? PYPL trades at just ~13x 2026 EPS with an 8%+ FCF yield. The market’s still pricing this like a fading legacy payments play, not a 400M+ user platform retooling itself for data-driven monetization. If management can even get close to their 2027 goals—high single-digit TM$ growth and 20%+ EPS growth—there’s a realistic path to $9+ in EPS and 2x the stock.

Bottom line: This might not be the quarter that lights up the tape. But it’s probably the one that lays the final brick in the foundation. The second half of the year has real upside potential—margin expansion, guidance lift, new products scaling—and anyone still sleeping on PayPal may soon wake up to a very different business.

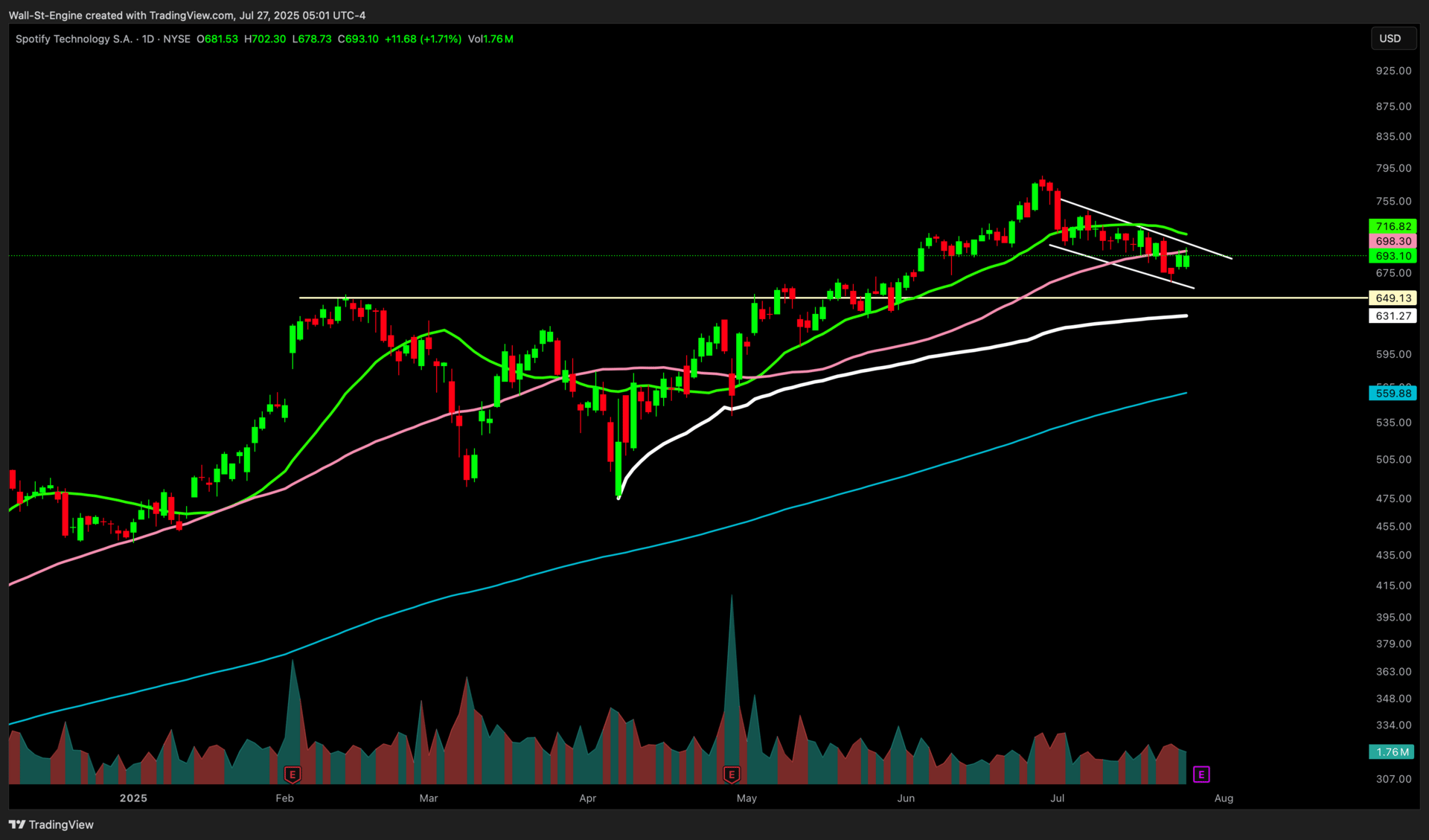

2. Spotify (SPOT) | Q2-25 Preview

Earnings due Tuesday (before the bell) | options imply ± 5.2 % one-day move

Spotify walks into its Q2 print next Tuesday, July 29, before the bell—and the setup feels eerily familiar: a quarter that may look “messy” on the surface, yet one that should keep the long‑range flywheel humming. The stock is still up more than 53% YTD, but after peaking on June 26 it has slipped about 14% and, as of last week, dipped below its 50‑DMA. If the earnings read‑through disappoints and price action stays soggy, we could easily see another round of profit‑taking that drags SPOT toward the 200‑DMA—especially if it can’t find footing above the low‑AVWAP line around €631.

SPOT (Daily)

What the tape might dislike: currency is swinging against Spotify again, and social‑security charges tied to the share‑price rally inflate operating expenses. I’m penciling in €4.2‑4.25 billion of revenue (a two‑point FX haircut to guidance) and operating income nearer €430‑450 million versus the €539 million guide. Gross margin should still hover around 31 percent, but management will likely steer Q3 a touch lower—about 40 bps—because last year’s European regulatory levy returns. None of that screams “broken thesis”; it just means the numbers will be noisy.

Why that noise shouldn’t matter: the addressable audience is nowhere near tapped. Even on Oppenheimer’s math, Spotify lands at just 17 percent of the world’s adults by 2030, implying a 75 million net‑add cadence every year between 2026‑2030. The free tier is the big unlock: closing the pricing gap with broadcast radio and podcast CPMs could push ad revenue toward €10 billion before decade‑end; if advertisers drag their feet, a token €1/month starter plan would likely raise an even fatter €12 billion. Layer on App Store rule changes that finally let iOS users upgrade in‑app, a higher‑priced “Superfan” bundle, audiobooks in more markets, and a video‑podcast push, and you start to see why bulls keep nudging price targets north of $800, $850—even $895.

Margin glide‑path still bends up: the model already absorbs near‑term GM pressure from product investments and royalty math, yet Street estimates climb toward the mid‑30s GM range by 2030 on podcast profitability, ad tooling, and disciplined opex. Spotify sits on >€5 billion in cash, so a well‑telegraphed buyback—or the long‑teased Superfan tier—would be a welcome offset if Q3 guidance lands light.

Sponsored

Trade with your head, not your gut. If you’ve been making moves based on hunches, it might be time to get a data-driven second opinion. Meet edgeful. I’ve been using it lately, and honestly, it’s become my shortcut to gauge the odds in seconds

edgeful breaks down everything from intraday price patterns to multi-year trends. It gives you price-action probabilities, volume trends, seasonality stats—all the gritty details your gut usually overlooks.

It’s like having a personal quant on call. You can instantly see how any stock or futures contract typically behaves, even down to specific days of the week, and what setups are brewing right now, complete with odds for each trade.

For example, if you trade stocks, edgeful can flag a gap-up stock and show you how often similar gaps have filled or kept running, based on historical data. If you trade futures, you can quickly check how often the S&P 500 breaks out of its morning range on a given day versus fizzling out. In other words, you’ll know the odds before you place a trade.

It covers practically every market—stocks, futures, forex, and crypto.

Here’s something exclusive for my readers: edgeful doesn’t normally offer a public free trial, but I’ve arranged a 7-day free trial just for you. Click below to check it out—and remember, sometimes the best edge is knowing when not to trade.

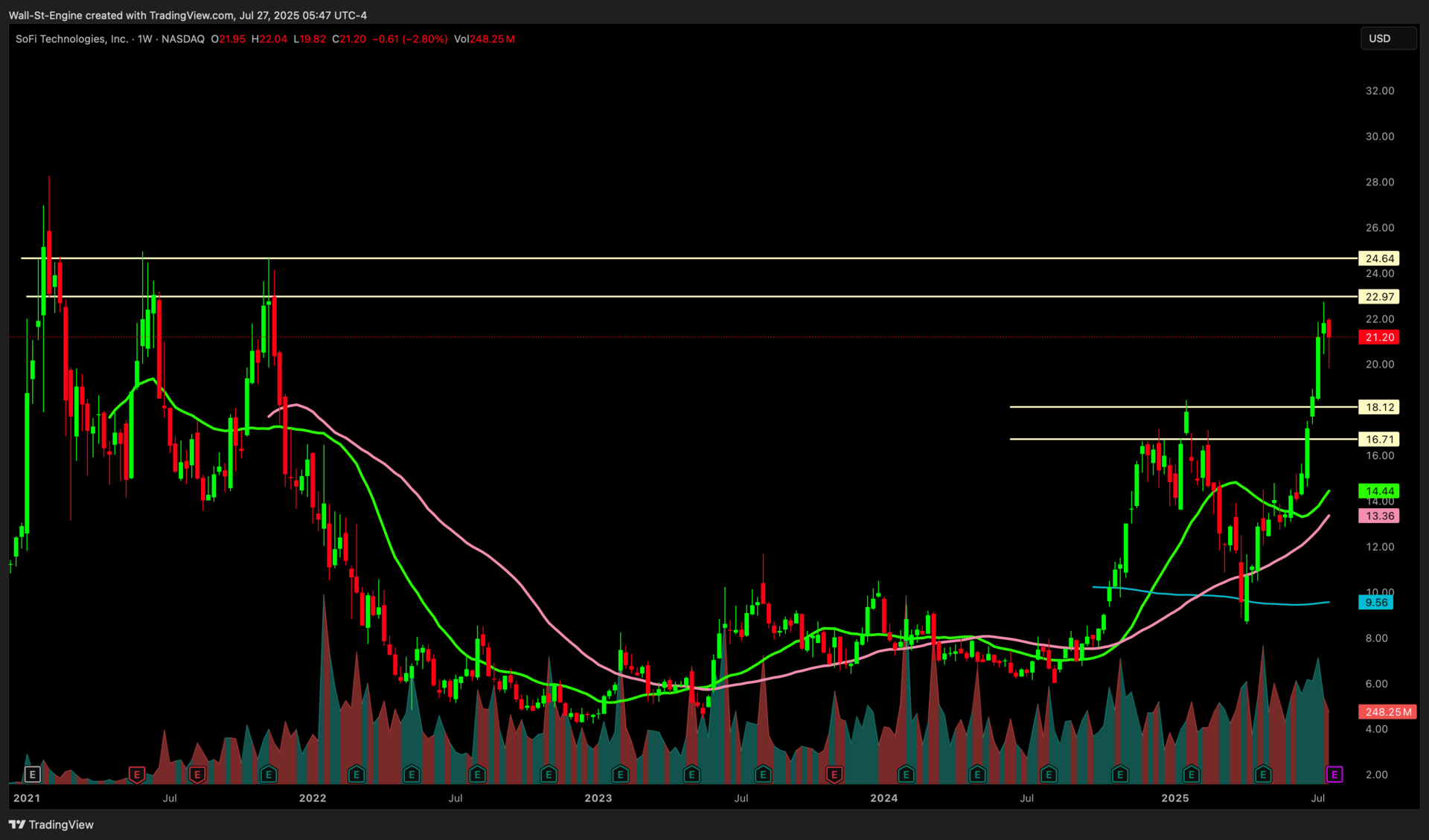

3. SOFI | Q2-25 Preview

Earnings due Tuesday (before the bell) | options imply ± 10 % one-day move

SoFi heads into its July 29 Q2 earnings with some serious momentum—shares are up nearly 38% this year. The stock has doubled since last quarter’s print, helped by optimism around the Trump-era “One Big Beautiful Bill Act” (OBBBA), which could open up a multi-billion-dollar opportunity in private student lending. The market’s finally catching on to SoFi’s evolution into a full-service digital finance platform, but valuation questions are still swirling.

At Friday’s close near $21, shares trade at roughly 5 × tangible book—rich for a bank, defensible for a high‑growth fintech, depending on which constituency you ask. Tuesday’s results will decide which side of that bar room argument gets the last word.

SOFI (Weekly)

Why the stock has already sprinted

Since the April print the shares have doubled, cruising past $20 before settling into the high‑teens. Bulls point to three things:

Diversification math: CEO Anthony Noto keeps hammering home that non‑lending revenue will be “north of 50 %” of the mix this quarter. If that proves out, it de‑banks the bear case that SoFi is just a quirky personal‑loan shop.

LPB tailwind: Private‑credit firms like Blue Owl are hungry for consumer paper, and SoFi’s “originate‑for‑others” rails let it feed that beast without bloating its own balance sheet. The Street still models only a mid‑$300 million contribution from Financial Services; anything above that plants a flag for 40 %+ YoY segment growth.

Policy lottery ticket: July’s “One Big Beautiful Bill Act” effectively privatizes billions in graduate‑school loans starting 2026. Internal desk math says every 10 pts of share could be worth ~$70 million in annual fees, and traders have been front‑running that optionality.

Q2 Expectation:

Consensus is looking for about $804 million of adjusted net revenue and $0.06 in EPS—a 34 percent and 500 percent jump, respectively, versus last year’s subdued base. Management’s own guide implies the high end of that range, and chatter in the SoFi community is even hotter: a cluster of independent models pegs revenue anywhere from the mid‑$830s to the low $870s, underwritten by gross member adds in the 830‑‑840 k zip code and a top‑line growth clip flirting with 40 percent.

Last quarter SoFi printed a record $772 million and kicked guidance to a $795 million midpoint for Q2. Even hitting that midpoint would leave year‑over‑year growth flirting with +35 percent; bulls think the combination of heavy personal‑loan demand, a still‑rising NIM, and an unexpectedly muscular Loan Platform Business could push the topline closer to +40 percent. Behind that is another ~835 thousand net new members and solid traction in checking, credit‑card, and brokerage products—the stuff Noto says now accounts for “more than half” of total revenue. If that split really shows up in the numbers, it answers the Street’s biggest question: can SoFi scale beyond its own balance sheet?

Three levers that can move the tape

Loan‑Platform Business (LPB)

In Q1 the LPB showed it can convert SoFi’s underwriting playbook into fee income for outside pools of capital. Another “whoa, where did that come from?” quarter—especially if it includes student‑loan or mortgage paper, or a wider credit box—would push non‑interest revenue well past the 50 percent mix Anthony Noto keeps promising. The market will key off that mix more than the absolute dollars, because it signals a future that’s less balance‑sheet‑hungry and more tech‑multiple‑worthy.Financial‑Services Flywheel

Debit spend, credit‑card balances and brokerage assets all grew faster than members last quarter; options trading code and crypto custody hooks now hiding in the app suggest more ARPU boosters are coming. If the segment clears $350 million—which bullish models argue is doable—SoFi walks onto CNBC with proof that it can monetise beyond loans.Net‑Interest Income (and the macro sub‑plot)

April’s rate‑cut fatigue prompted management to lean a little harder on fee originations, but May–June volume indications (app‑download data, Google ad spend, Wyndham debit‑card launch) point to a re‑accelerating lending engine. A benign credit‑cost print paired with another 20‑30 million step‑up in NII would soothe bears who still remember 2022’s fintech blow‑ups.

We’ve seen a pattern this earnings season: even solid beats have turned into sell-the-news events across the board, as a lot of stocks have already run up ahead of results. SOFI Shares are already up over 15% this month on the OBBBA catalyst, so to keep climbing, SoFi probably needs more than just a clean beat—think raised guidance or a new LPB deal. On the flip side, if revenue growth comes in below +38% YoY, it wouldn’t be a shock to see a quick drop back to the 50-day (~$17). Options are pricing in about a 10% move either way.

4. UnitedHealth (UNH) | Q2-25 Preview

Earnings due Tuesday (before the bell) | options imply ± 7 % one-day move

UnitedHealth limps into Tuesday’s print looking every bit the market’s fallen giant—down nearly 60 % year‑to‑date, trading at a forward P/E south of 12‑times, and carrying the bruises of a news cycle that hasn’t given it a day off since March. The DOJ’s criminal and civil probes into Medicare billing, a wholesale guidance withdrawal, and Steven Hemsley’s surprise return to the C‑suite have turned what was once a bulletproof compounder into this year’s poster child for “show‑me” stories. Management knows it, too: they’ve tacked an extra 45 minutes onto the earnings call so analysts can throw every last kitchen‑sink question at them. That small gesture tells you they understand credibility—not the quarter—has to be won back first.

UNH (Monthly)

The consensus script is simple: re‑issue 2025 EPS at roughly $18–$19, sketch a high‑level glide path to something in the low‑$20s for 2026, and frame 2027 as the year margins finally chase down the old 6 % Optum‑led target. Land that plane and most investors will call the quarter a win, because expectations have faded hard over the past month. Anything materially below the $18 handle, though, risks reigniting fears that Medicare Advantage is permanently a 1 % margin business and that OptumCare’s capitated revenue can’t carry the weight. The stakes are that binary.

MA is ~40 % of revenue and under DOJ scrutiny; statutory PAYGO could whack Medicare funding in 2026; Medicaid roll‑offs and PBM reform chatter lurk in the wings; and higher‑acuity aging demographics threaten utilization spikes. Layer a trillion‑dollar Medicaid haircut from the latest House budget bill and you can torture the model into single‑digit earnings power. Yet even the skeptics concede that Washington rarely kneecaps the nation’s largest Medicare insurer, PAYGO cuts have been waived every year since 2010, and CMS cap‑rate resets plus premium tweaks can blunt much of the cost inflation. Optum still throws off mid‑teens margins, and management has read the room—SG&A is headed higher to shore up compliance and revamp risk‑scoring, even if that dents 2025 optics.

For all the noise, the tape is flashing classic distress‑valuation signals. At ~$285 the stock yields a full 3 %, trades nearly 40 % below the cheapest buy‑side target, and bakes in a 3 % annual decline in free cash flow on our reverse‑DCF math—roughly the same bargain table where big‑name insiders spent $32 million on open‑market buys in May and June. Congressional filings show lawmakers nibbling, too, which may or may not be your preferred sentiment gauge, but certainly beats the alternative.

So the setup boils down to this: if Hemsley can plant a credible $18 floor, talk convincingly about MA repricing, and hint that Optum’s risk‑bearing model stays intact, UNH graduates from “broken stock” to “classic turn‑around value trade.” Miss that mark, or dodge the hard questions Tuesday afternoon, and the market will assume the knife still has room to fall toward that 200 Monthly moving average. Either way, volatility is the only guarantee—options are pricing a 7% move into ER. My bias is cautiously constructive: the business isn’t half as impaired as the chart implies, and a clean reset could let investors underwrite a multi‑year margin rebuild at a multiple last seen during the 2011 debt‑ceiling scare. In a market that’s happy to pay 30‑times for AI fairy dust, 11‑times a beaten‑up healthcare oligopoly feels more than reasonable—provided management can finally close the uncertainty gap on July 29.

Subscribe to read the rest.

To read the full earnings previews on Boeing, Visa, Starbucks, Hershey, Etsy, Microsoft, Meta, and Robinhood, you’ll need to be a premium subscriber to The Engine Room.

Upgrade