1. Verizon (VZ) | Q2-25 Preview

Earnings due Monday (before the bell) | options imply ± 3.2 % one-day move

Verizon is heading into earnings almost flat on the year, stuck in a long, slow chop that’s now testing below its 200-day moving average. It’s the kind of chart that makes you yawn.

VZ (Daily)

Street expectations are muted. Investors are modeling 2–3% annualized adjusted EBITDA growth through 2028, with near-term numbers broadly in line with consensus. ut the new twist this quarter is the tax tailwind: recent legislation restoring bonus depreciation could juice free cash flow by over $1.5B per year through 2027. That’s not a rounding error—it’s meaningful flexibility that could fuel buybacks or accelerate fiber buildout.

The debate now comes down to whether this is just a stable bond proxy with a 6%-plus dividend—or something that could rerate if execution improves. Bulls will point to the potential upside from bonus depreciation, the defensive setup in a high-rate world, and Verizon’s lower promotional intensity relative to peers like T-Mobile. Bears, meanwhile, worry that the Frontier fiber deal could dilute free cash flow once it closes, and that consumer wireless remains sluggish in a hyper-competitive market. The Street's bear case is anchored in stalled subscriber growth and price wars that erode EBITDA.

2. Domino’s Pizza (DPZ) | Q2-25 Preview

Earnings due Monday (before the bell) | options imply ± 6.4 % one-day move

Domino’s Pizza heads into Q2 earnings on Monday morning with a setup that feels steady, not flashy. The stock’s up 12% YTD—respectable, but trailing the S&P—and has mostly churned between $480 and $515 since its May pop on the stuffed crust launch. The broader pizza category hasn’t exactly helped either, with low-single-digit traffic declines across the board. But Domino’s has been quietly taking share, especially in carry-out, and investors are starting to lean back in as comps stabilize and key initiatives like DoorDash integration and the stuffed crust rollout begin to layer in.

DPZ (Weekly)

Street set-up

Consensus | YoY | |

|---|---|---|

U.S. same-store sales | +2.0 % | +70 bp |

Int’l same-store sales | +1.3 % | –40 bp |

Rev. | $1.05 B | +5 % |

Adj. EPS | $3.36 | +8 % |

Franchisee checks actually suggest comps came in closer to +2.5%, helped by carry-out outpacing delivery and some sustained lift from the stuffed crust. That would mark an acceleration from Q1’s two-year stack and likely support management reiterating full-year guidance: ~6% global retail sales growth ex-FX, 3% U.S. SSS, and ~8% operating income growth. Street attention is laser-focused on the trajectory into the back half, especially with DoorDash marketing only recently kicking in and new menu innovations rumored for fall.

That said, there are still some overhangs keeping sentiment in check. Early Q3 comps look to have cooled a bit, back to +2.0%, and the international unit-growth story remains murky following turbulence in markets like Malaysia and Chile. The narrative risk isn’t in the near-term guide—it’s about what happens after the DoorDash and stuffed crust boosts roll off next year. Bears argue that much of the low-hanging fruit is already priced in, and without a fresh 2026 sales lever, Domino’s could struggle to re-rate meaningfully higher.

Still, this quarter has some potential spark. Cheese prices are down ~13% YoY, which could drive upside in supply-chain margins (Street sits at 12.2% but management might clear 13%). If they call out the stuffed crust attach as “sticky” or drop hints on a new loyalty push or LTO for fall, that could reset the comp debate. A reassuring tone on international closures would also help clear a lingering overhang.

Bottom line: this isn’t a “crush and rally” setup, but it’s clean. The market’s already accepted the Q3 comp taper, so the real swing factor is whether management gives investors a new reason to believe in post-2025 growth. If they do, the stock has room to move above that $520 lid. If not, expect it to stay stuck in its current band. Personally, I think there's just enough here to keep bulls engaged—especially if margin tailwinds show up stronger than expected.

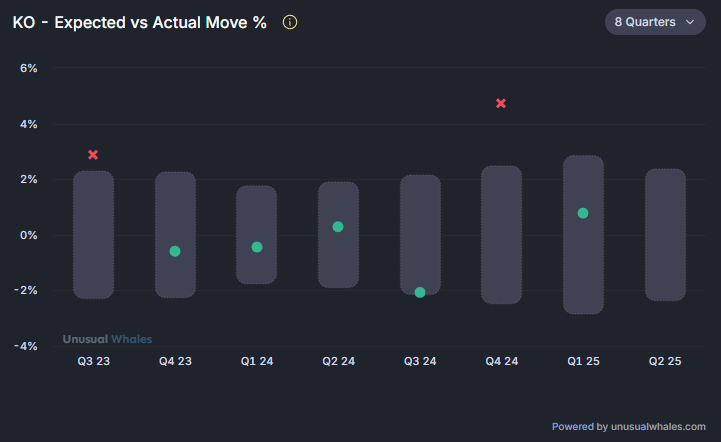

3. Coca-Cola (KO) | Q2-25 Preview

Earnings due Tuesday (before the bell) | options imply ± 2.37 % one-day move

Coca-Cola reports before the bell on Tuesday, and while it’s never the loudest name into earnings season, this setup might deserve more attention than it’s getting. The stock has been consolidating for five months—steadied by a weaker dollar and some cooling input costs—but hasn’t drawn much buzz from traders chasing high-beta themes. Still, the quiet might be masking some decent upside catalysts, especially given KO’s global footprint and emerging market pricing tailwinds.

KO (Daily)

The Street’s looking for Q2 revenue of $12.6B, up about +1.9% YoY, and EPS of $0.83, which would be a slight dip (-1%) from last year as marketing expenses and a $6.1B fairlife payment weigh on the quarter. Segment-wise, North America is expected to come in around $5.06B in sales (+5%), though foot traffic softness in U.S. foodservice (50% of the region’s mix) has some worried about near-term pressure. LatAm is likely to decline (-5%) on Brazil FX drag, while EMEA could show a strong +26% lift on price carry and volume rebound, especially in Africa. Gross margins are guided around 63%—the Street will be watching that number closely if channel mix shifts become more pronounced.

The real investor debate centers on whether North America is losing steam. Management already dialed back U.S. volume expectations earlier this year, and any print above 3% organic growth could flip sentiment quickly. There’s also fair debate around FX—KO had guided to a -3% EPS headwind, but Q2’s dollar weakness likely trims that by ~100bps, potentially lifting FY EPS by ~$0.02. That could be just enough to re-anchor full-year guidance, especially if global trends hold.

Watch for updates on Sprite + Tea—a quirky new SKU born from a viral tea-dipping trend that’s rolling out nationwide. It’s way too early for numbers, but management’s tone could give clues about FY innovation upside. The Street is also looking for commentary on fairlife’s 2026 plant ramp (30% capacity boost), and any clarity on buybacks, given the fairlife payment’s hit to Q2 cash flow. Sugar tax chatter and foodservice exposure still hang in the background as risk flags.

KO isn’t the kind of name that rips on headlines, but it’s one of the few staples with actual EM pricing leverage and less drama on U.S. shelf resets. If they can nudge guidance up on FX and post even modest outperformance in NA volumes, the stock could finally break out of its multi-month drift. I wouldn’t expect fireworks—but the setup’s better than most think.

4. GE Vernova (GEV) | Q2-25 Preview

Earnings due Wednesday (before the bell) | options imply ± 5.8 % one-day move

Since the April ’24 spin-off GEV has ripped +380 % and it hasn’t cooled off: the stock is +75 % YTD, second-best in the S&P, riding the “AI power super-cycle + nuclear renaissance” theme. The daily chart (above) is a master-class in institutional accumulation—half-dozen base-and-breakout patterns, tight respect for the 20- and 50-day SMAs, and only one broad-market shakeout (Feb–Mar) before buyers stepped right back in. Volume surged whenever management raised its multiyear guide, announced the dividend/buyback, or when Washington dangled fresh energy capex—most recently Trump’s $70 B AI-grid package and an executive order to fast-track small-modular reactors.

GEV (Weekly)

What the Street expects

Cons. | y/y | |

|---|---|---|

Revenue | $8.8 B | +7 % |

Adj. EBITDA | $0.70 B | +9 % |

GAAP EPS | $1.64 | +131 % |

Consensus bakes in $11.1B orders (≈5 GW gas turbines). There’s a room for a beat—recent Qatar, Korea and two aero-derivative awards point to ≈6 GW and orders closer to $11.8B.

What to listen for

Power & Nuclear (51 % rev) – Slot-reservation pricing is up ~20 % since January. If management says those higher prices are sticking and books another 5–6 GW, the margin glide path is intact. Watch for commentary on the first SMR site short-list—an upside catalyst Wall Street still treats as optional.

Electrification (Grid, 22 %) – AI data-center demand is pulling forward substation and HVDC orders. Any update on doubling HVDC factory capacity or a big U.S. utility contract could light another leg.

Wind (27 %) – Guidance assumes a slow U.S. PTC cycle; a surprise onshore backlog pop would be gravy.

Implied Move & set-up

Implied move is 5.8%, and historically GEV has traded right inside that band. GEV has become the market’s pure-play on keeping the lights on for AI: gas turbines for immediate peaking capacity, HVDC gear to move bulk power, and a on next-gen nuclear. Yes, valuation’s rich (~23x 2026 EBITDA), and sure, the chart’s extended, and prime for a pullback. But as long as orders keep outrunning expectations and price realization trends up, momentum likely trumps mean reversion—for now.

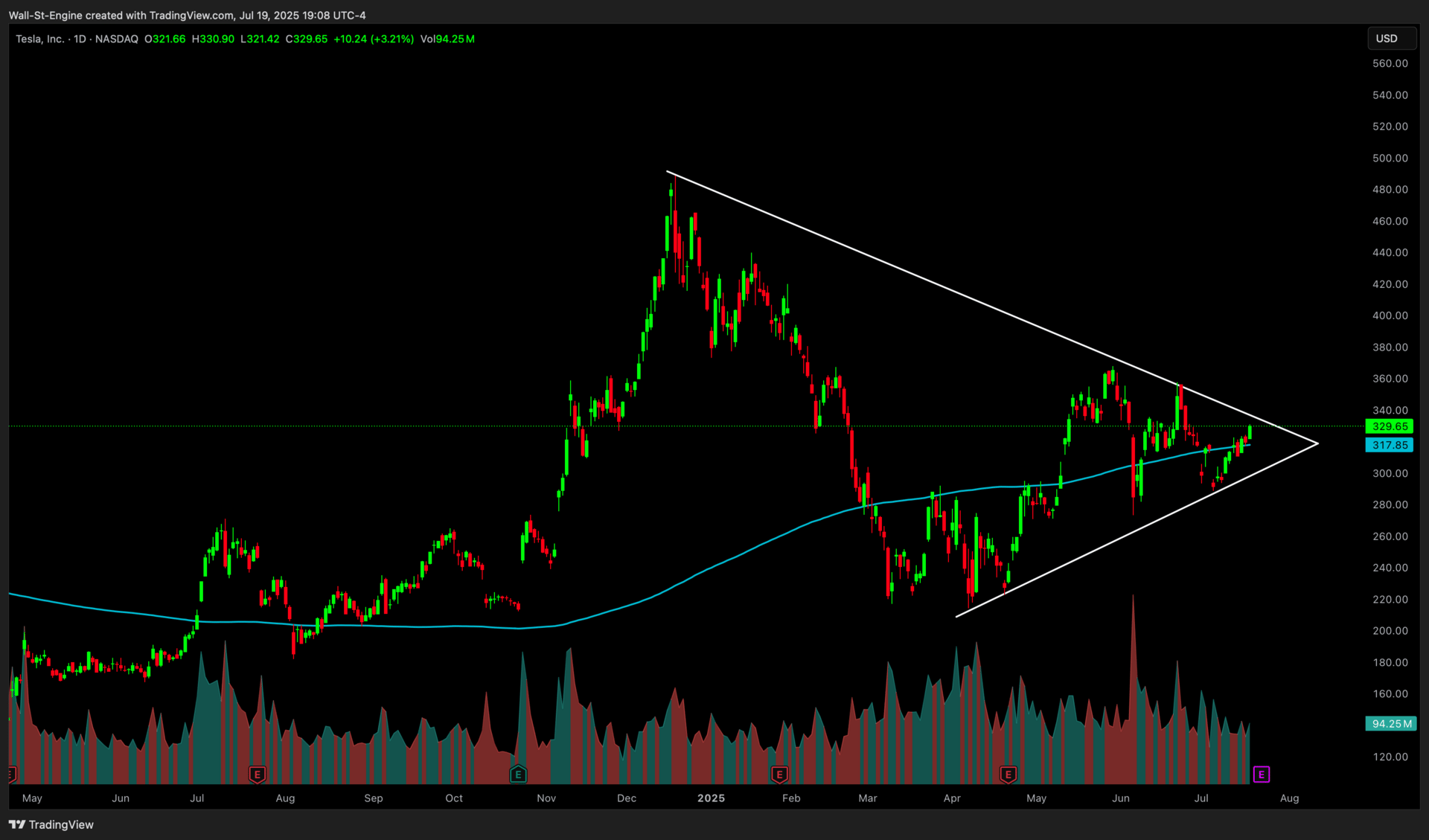

5. Tesla (TSLA) | Q2-25 Preview

Earnings due Wednesday (after the bell) | options imply ± 6.32 % one-day move

Tesla reports Q2 earnings this Wednesday, and let’s be honest—it’s less about the numbers and more about Elon. The stock is still down nearly 20% YTD, worst among the Magnificent 7, and sitting just below major technical resistance (symmetrical triangle) around $335. While deliveries beat low expectations at 384K, revenue is still expected to fall 10% YoY to around $22.9B, with EPS down ~20% to $0.43. But if the past few quarters have taught us anything, it’s that Tesla doesn’t trade on fundamentals alone. The call, the tone, the vision—that’s where this gets decided.

Margins will be scrutinized, especially auto gross margin ex-credits, which are expected to tick up to 13.5–14% from last quarter’s 12.5%. That’ll help EPS, but it’s still far below the ~20% levels investors were used to. Margin math is the swing factor: every 100 bp change in auto GM moves EPS ~6 ¢.

TSLA (Daily)

Meanwhile, regulatory credit revenue could take a hit in coming quarters after California’s CARB waiver rollback. Tesla’s energy business is another wildcard—Q2 deployments came in light at 9.6 GWh (vs. 11.8 GWh est), and tariffs on Chinese LFP batteries could weigh on segment margins, maybe down to the low teens. So yeah, the print may show modest sequential improvement, but nothing game-changing.

The real investor debate is about direction. On one side, you've got brand fatigue, Low-cost Model Q delays, leadership turnover (hello, IT exec running sales), and competitive pressure from BYD and Xiaomi. But the more immediate and unquantifiable headwind is politics. Musk’s increasingly polarizing public stance—especially his alignment with Trump and launch of the “America Party”—has sparked consumer backlash and is clearly impacting demand in key Western markets.

On the other, you've got Elon hyping the robotaxi rollout, an Austin fleet already testing, and a story around Optimus that some bulls think could rival the entire auto business long-term. Toss in the new Model YL in China and Tesla’s pricey India entry, and you’ve got enough material for both camps to dig in. Whisper expectations are low, and sentiment is split.

So what moves the stock? Musk needs to deliver clarity—on robotaxi fleet expansion, Model Q timelines, Optimus factory deployments, and how they plan to hold margin in Q3 as tax credits expire and price cuts loom. If the call is confident and forward-looking, markets will likely forgive a weak quarter (again). If it’s vague, defensive, or if he doubles down on politics, that $331 ceiling could hold hard.

I’m tactically constructive into the print—not because the fundamentals are fixed, but because expectations are buried and the chart is primed for a range break:

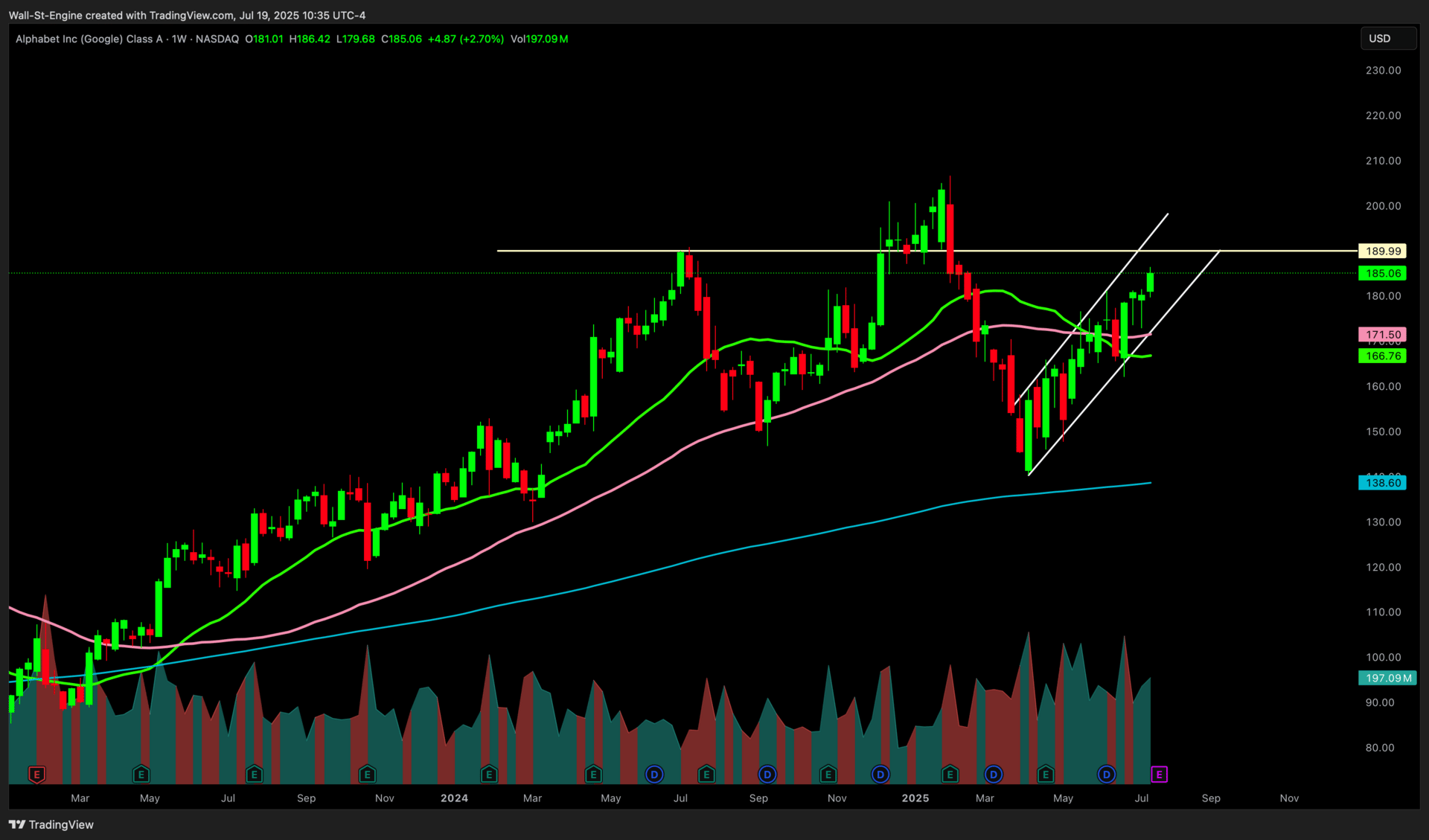

6. Alphabet (GOOGL) | Q2-25 Preview

Earnings due Wednesday (after the bell) | options imply ± 5 % one-day move

Alphabet has been the most debated name in the Mag 7 this year—not because the fundamentals are cracking, but because the narrative around it has been messy. The noise around AI risk, antitrust pressure, and competition from players like ChatGPT and Perplexity has outpaced any actual financial weakness.

GOOGL (Weekly)

The truth is: GOOGL has underperformed. Not dramatically, but noticeably. While peers like Meta and Microsoft have surged on cleaner AI stories, Google’s outlook has been riddled with “ifs” and “wait-and-sees.” And because markets discount the future, the stock has absorbed a lot of hypothetical damage that hasn’t shown up in the P&L—at least not yet.

Still, the core engines keep firing. Search traffic is up. Gemini daily users just crossed 30 million. And Google Cloud has become the silent winner for Google. GCP isn’t AWS or Azure, but it's quietly picking up real wins. Even OpenAI now uses Google Cloud for infrastructure. If margins continue improving here, that story alone could shift sentiment.

More recently, a third-party data firm flagged that Search ad revenue has picked up—from 8–9% YoY growth in late June to about 13% now. That’s not something a company in retreat puts up.

And the broader picture shows more signs of long-term retooling than short-term scrambling. Waymo just hit 100 million autonomous miles and is expanding into Austin. YouTube is going hard on Shorts and AI-generated content. Android is prepping deeper Gemini integration. And in a major energy move, Google signed a deal to lock in 3GW of U.S. hydropower for its AI-focused data centers—a foundational play, not a flashy headline.

But the Street’s still cautious.

Yes, GOOGL stock has been climbing steadily. But it’s still lagging its Mag 7 peers YTD. That’s partly because the narrative hasn’t cleared: antitrust overhangs, a murky AI monetization roadmap, and a sharp CapEx ramp (up ~45% YoY) have created real hesitation. And with a DOJ ruling expected in August, many investors are watching for a "clearing event" that could finally lift the legal cloud hovering over the stock.

Street Estimates

Metric (Q2 ’25e) | Consensus | YoY Δ |

|---|---|---|

EPS (GAAP) | $2.14 | +13 % |

Revenue (total) | $93.8 B | +10.7 % |

Search & Other Ads | $52.8 B | +9 % |

YouTube Ads | $9.5 B | +10 % |

Google Cloud | $13.1 B | +26 % |

Subscriptions & Other | $9.2 B | +13 % |

Capex | ~$16 B | +45 % (AI data-center build-out; stylized) |

This isn't just another quarter. GOOGL needs to give investors a reason to stay focused. Everyone knows they’re late to AI monetization, but that’s not fatal—as long as it changes soon.

The bull-bear debate is simple. Bears think AI-mode answers will shave high-value clicks off search just as the DOJ case heats up. Bulls argue Search RPMs are already ticking higher, Gemini is gaining real traction in Workspace, and Cloud is quietly becoming a margin story. Add in Waymo’s milestone and that massive clean-energy deal, and you start to see a company that’s way more diversified than the tired “one-trick search pony” narrative.

Alphabet still generates more cash than Apple or Microsoft, yet trades at around 18× forward earnings. That kind of discount only exists because the market’s still pricing in downside that hasn’t happened. If Sundar Pichai can make the case that AI is enhancing—not eroding—the core franchise, the catch-up trade becomes obvious.

Personally, the setup feels ripe for a sentiment reset—one clean quarter could be the catalyst that finally breaks the stock through its $190 ceiling. Just my take.

Subscribe to read the rest.

Thanks for checking out the first post in our earnings preview series. To unlock the full breakdowns — including setups on ServiceNow, Chipotle, Intel, and Deckers — become a paid subscriber to The Engine Room. Starting with the next newsletter, 70% of our Earnings Preview content will move behind the paywall, exclusive to premium members.

Upgrade