Welcome to this week’s Earnings Preview. I’m covering ZS, CRM, GTLB, LULU, and AVGO. Let’s get into it 👇

1. Zscaler (ZS) | Q2-25 Preview

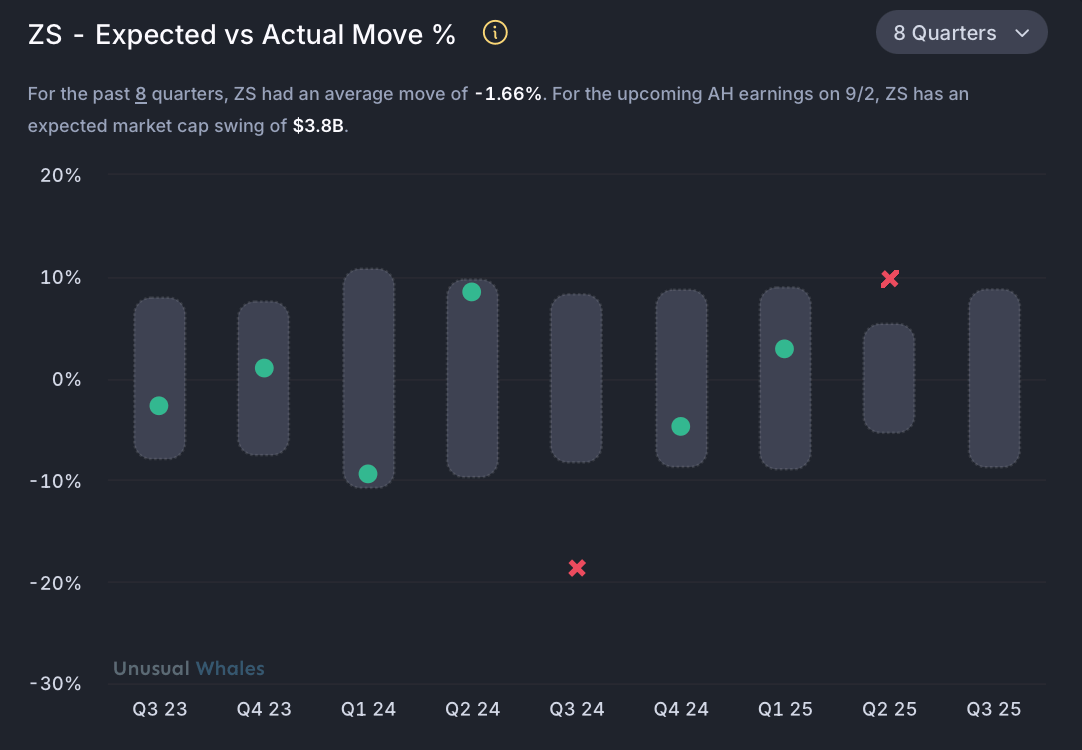

Earnings due Tuesday (after the bell) | options imply ± 8.8% one-day move

Zscaler walks into earnings with a decent hand but some tricky cards to play. The stock sits at $273, up a solid 50% year-to-date and only 13% off its highs – not the beaten-down setup we've seen across other software names. But here's the thing: that resilience might be working against it now.

ZS (Daily)

The story everyone's tracking is Z-Flex, Zscaler's answer to consumption-based models that have worked magic for companies like ServiceNow and CrowdStrike. Three quarters in, they've already booked $65 million in total contract value. That's real money, but it's also just the appetizer.

What matters isn't the early traction – it's whether Zscaler can scale this operationally without breaking their backend. Most companies stumble here because flex programs are nightmares to execute. Every customer wanting to shift between products, adjust volumes, or modify contracts creates a domino effect across accounting, billing, and revenue recognition. Do it manually and you'll never scale. Automate it and you need massive infrastructure investment.

The tell will be any commentary about expanding Z-Flex beyond large enterprises. If they're ready to move down-market, it signals they've cracked the automation code. That would be genuinely bullish.

Here's where it gets interesting. Zscaler trades roughly in-line with cybersecurity peers on earnings multiples when you adjust for growth. That's a far cry from the premium it used to command. Bulls are betting on second-half billings acceleration driven by cloud security adoption, data protection, and AI analytics to justify a return to premium pricing.

If you've been thinking about joining me on Discord, now's the time. Starting September, membership for new members increases from $59/month to $89/month.

Here’s what you’ll get inside:

✅ Actionable trade setups you can use

✅ Daily live streams

✅ Unusual options flow

✅ Fast & exclusive actionable news, earnings, & market commentary

✅ Portfolio updates so you can follow along or learn positioning

✅ Weekly education sessions

✅ Ideal for catalyst traders, swing traders, day traders, and investors

✅ A super active team of analysts and a community that actually talks trades all day

Almost every single day, we share catalysts that are actionable in real time. Sometimes, we’re the fastest out there – catching moves and themes ahead of the herd. We’ve got a strong track record of spotting emerging market themes early, whether it’s nuclear, eVTOLs and drones, robotics, semiconductors and data centers, defense plays, or countless individual names.

If your goal is to actually build your own decision-making skills instead of just copying trades blindly, I think you’re going to love it here.

Use code WALL20 for 20% off on any plan.

2. Salesforce (CRM) | Q2-25 Preview

Earnings due Wednesday (after the bell) | options imply ± 6.8 % one-day move

Salesforce reports Q2 Wednesday after the close, and this setup tells a story. The stock's been a laggard, down 23% year-to-date, but it's held that $230-220 support zone for over a year now. That's either a floor that's about to give way or a launching pad - Wednesday will likely decide which.

Street numbers cluster around $10.1B revenue (up 7.4% year-over-year) and $2.78 EPS, with current remaining performance obligation (cRPO) expected at $19.2B, up 9% in constant currency. Company guidance sits right in line at $10.1-10.2B revenue and $2.76-2.78 EPS. That's not a high bar, but it's also not a setup where beats guarantee upside in this tape.

CRM (Weekly)

Recent partner checks suggest "in line" activity, with the twist being that customers aren't pulling back due to bad fundamentals but rather pausing digital transformation projects to evaluate Agentforce. That's either smart positioning for the AI wave or an excuse for soft demand - the earnings call will tell us which.

The Agentforce story has some substance. About 20% of projects are moving from Phase I pilots to Phase II broader deployments, and management thinks nearly 40% of customers could expand scope over the next 12 months. With 4,000+ paid customers and $100M+ ARR already, this isn't just pilot money. Data Cloud keeps growing at 120%+ with 22+ trillion records processed.

But here's the reality check - Marketing and Commerce Cloud remain weak, Sales Cloud growth is just inline, and Microsoft's bundling pressure isn't going away. The $8 billion Informatica acquisition adds capability but also execution risk.

What actually moves the stock Wednesday is cRPO quality, not just the headline beat. Growth driven by AI product expansions reads bullish. Growth from discounting doesn't. Second, Agentforce metrics need to show real Phase II progression, not just anecdotes. Third, guidance tone heading into Dreamforce - confidence about second-half acceleration matters more than beating by a few pennies.

Salesforce needs to prove Agentforce translates to accelerating revenue, not just good demos.

3. GitLab (GTLB) | Q2-25 Preview

Earnings due Wednesday (after the bell) | options imply ± 12.4 % one-day move

….

Subscribe to access the Earnings Preview

To read the full earnings preview covering GTLB, AVGO, and LULU you’ll need to be a premium subscriber to The Engine Room.

Upgrade