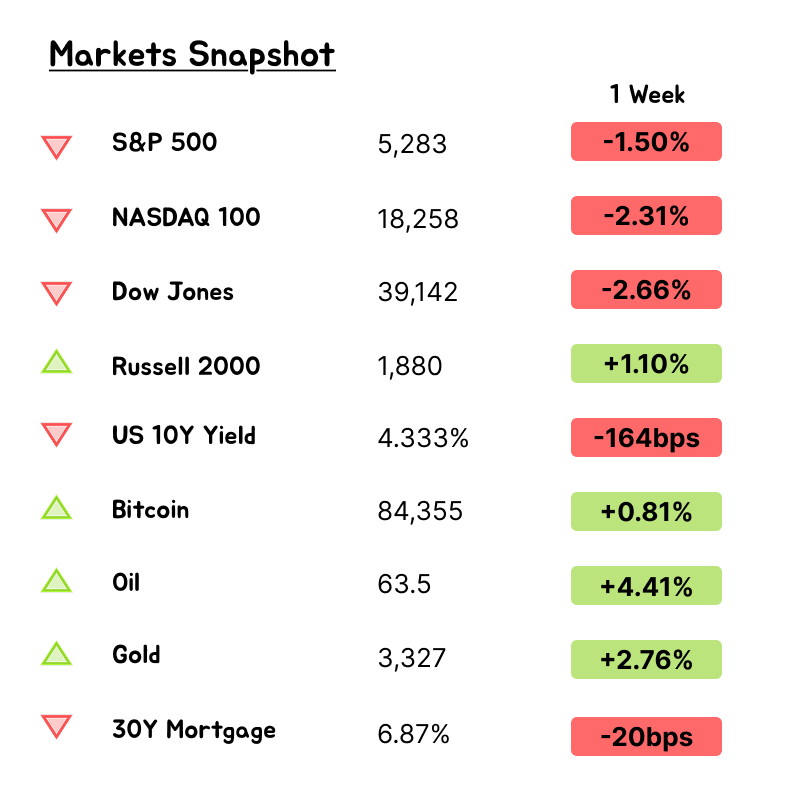

Happy Sunday! Markets hit the snooze bar after last week’s drama, but the tape never felt truly calm. Over the four‑day stretch the S&P 500 slid 1 %, the Nasdaq bled with it, and the Dow limped lower after UnitedHealth’s earnings face‑plant. Small‑caps (Russell 2000) actually rose as money kept crowding into tariff‑insulated fare—streaming, cloud software, U‑S‑only telecom. Cyclicals opened strong, then churned; mega‑cap tech sagged under antitrust chatter and fresh export rules.

Mid‑week Fed Chair Powell warned tariffs are now “a bigger headwind to growth and a tailwind to prices,” but said policy won’t budge until the data scream. Treasuries first rallied—10‑year down 15 bp—then gave a few back; futures still pencil in roughly 88 bp of cuts next year. The dollar bounced off multiyear lows, oil and copper crept higher on talk of trade progress, and gold cooled from record highs. Volatility eased—the VIX finally ducked below 30—but implied ≈2 % daily S&P swings keep everyone on edge.

Adding spice, President Trump spent Thursday openly musing about firing Powell—“If I want him out, he’ll be out real fast, believe me.” That salvo reignited the Wall Street debate over Fed independence and whether a presidential “termination” is even legal. For now it’s political theater, but the mere threat nudged bond desks to re‑price tail‑risk.

So was this quiet week just the eye of the storm? We’ll know soon: Verizon, Tesla, Boeing, Alphabet and more hit the tape, Section 232 probes on chips and pharma grind forward, and Powell’s job security is suddenly a tradable headline. Keep the seatbelt clicked.

Uncertainty Remain Elevated:

Economic policy uncertainty - Record Highs

Trade policy uncertainty - Record Highs

Fiscal policy Uncertainty - Record Highs

US Regulation Uncertainty - Record Highs

Headlines that Drove the Conversation

Tariffs: two steps forward, one step back.

Washington yanked smartphones, laptops, and other consumer tech off the 145 % tariff list late Friday the 11th—instantly cutting the average levy on big‑ticket gadgets from 17 % to about 5 %. Apple and Dell sighed with relief and started rerouting assembly to India and Vietnam during the 90‑day grace period. But the détente was short‑lived: the Commerce Department opened new “national‑security” probes into chips and drug supply chains, and negotiators quietly asked more than 70 trading partners to clamp down on Chinese trans‑shipments. Bottom line: less pain for iPhones today, a fresh cloud over semis tomorrow.

Money keeps crowding into tariff‑light names.

All week the flow was the same: Netflix, Spotify, and other U.S.‑centric platforms found buyers; Meta, Amazon, and Google’s ad empire stayed heavy as agencies flagged a sudden pullback in April ad budgets and Temu/Shein slashed U.S. marketing. Until the trade picture clears, “made‑and‑sold‑here” keeps the bid.

Regulators lit up Big Tech.

A federal judge declared Google an illegal monopoly in ad‑tech, giving DOJ a green light to push for a breakup. Meta spent the week in court defending its Instagram and WhatsApp deals. Next up: a Monday hearing where the government will argue Chrome should be pried away from Google search. Antitrust risk isn’t going away.

Streaming’s bright spot.

Netflix breezed past Q1 estimates, raised Q2 guidance, and said its ad tier should double revenue next year. An internal deck leaked to the Wall Street Journal shows 2030 targets that basically match current Street estimates—comfort food for bulls.

Cloud checks mixed.

Partner data says Azure growth slowed a hair—enough for one broker to slide Microsoft to neutral. Google used Cloud Next to roll out its seventh‑gen TPU and kept the cap‑ex firehose running, but channel partners say tariff drama is delaying big deals. Over in SaaS land, HubSpot and Cloudflare saw solid demand; Atlassian’s user conference was upbeat enough to earn an upgrade.

Chip world: big bills and bigger bookings.

Nvidia booked a $5.5 B charge after Washington froze H20 GPU exports to China. AMD warned of an $800 M hit from the same rule. TSMC, meanwhile, shrugged off the noise—reporting blow‑out Q1 numbers, guiding Q2 higher, and predicting AI‑chip revenue will double next year. ASML missed on orders and blamed tariff uncertainty. Intel cashed in half of Altera to Silver Lake to keep its turnaround funded.

Autos on tariff watch.

Tesla halted Chinese parts shipments for its Cybertruck and Semi while it figures out the new levies; Piper trimmed its target to $400. Lyft scored a fresh “Buy” and Uber opened a Waymo wait‑list in Atlanta, inching the robotaxi race forward.

Fintech shuffle.

Global Payments announced a $24 B buy‑out of the rest of Worldpay and simultaneously sold its issuer unit back to FIS. PayPal caught a downgrade on fears its core checkout growth can’t outrun tariff‑driven consumer sluggishness. Wayfair was clipped for similar worries in home goods.

Aviation and chips in the geopolitical crosshairs.

Beijing told airlines to pause new Boeing jet deliveries, a shot across the bow as trade tensions simmer. South Korea counter‑punched with a $23 B aid package for its semiconductor industry.

AI side hustle.

OpenAI is reportedly test‑driving a ChatGPT‑powered social feed and sniffing around a $3 B Windsurf acquisition—because why stop at search when you can take on Twitter, too?

UnitedHealth Turns the Dow Inside‑Out

What happened?

On Thursday UnitedHealth Group (UNH) lobbed a grenade at the market, cutting its 2025 EPS outlook to $26 – $26.50 vs. roughly $30 penciled in by the Street. Management blamed a spike in medical‑cost “run‑rate,” especially in Medicare Advantage, and lower‑than‑expected government reimbursement.

Price action:

UNH closed the session ‑22 %—its worst one‑day slide since 2000—erasing ≈ $60 B in market cap.

Because UNH is a high‑price component of the price‑weighted Dow, the drop single‑handedly yanked the Dow Jones Industrial Average lower by about 450 points.

Contagion hit peers: Humana (HUM) ‑7 %, Centene (CNC) ‑2 %, CVS Health (CVS) ‑1.8 %. The entire managed‑care cohort closed the week negative.

Why it matters:

Defensive myth busted. Healthcare had been treated as a tariff‑proof safe harbor. UNH’s guide reset shows the group is not immune when utilization accelerates and government rates lag.

Margin squeeze narrative. Higher inpatient admissions and costlier specialty drugs are eating into MA margins across the space, just as CMS payments flatten. Expect other insurers to face probing questions this earnings season.

Index mechanics. The Dow’s price weighting magnifies single‑stock shocks; UNH’s $110 one‑day drop was the largest absolute point decline for any Dow component on record.

The Week Ahead… and a Closing Thought

Last week reinforced one idea: volatility is a feature, not a bug, of the current market. Tariff headlines, the Fed’s “no‑put” messaging, and renewed questions about the central bank’s independence after President Trump’s Powell remarks kept investors on their toes. Major averages chopped sideways, but individual names swung double‑digits on guidance resets.

Now, Monday – Wednesday stay relatively light (Verizon, GE Vernova, PepsiCo), but Thursday is stacked: Tesla, Alphabet, Intel, Enphase, Boeing, Chipotle, Visa and half‑a‑dozen mid‑caps all report before Friday’s PCE release. Large, liquid names have been reacting 10‑20 % on results, so position size and hedges matter more than usual.

VIX term structure remains backward‑dated into May option expiries, implying another round of 2 %‑plus daily S&P swings is still the base‑case.

Macro checkpoints:

U.S. Q1 GDP (Thu) – consensus sits near 1 ¾ %, but the tariff shock makes the margin of error wide. A miss would likely steepen the cut‑bets curve.

March PCE price index (Fri) – the Fed’s preferred gauge arrives with only one full tariff month in the sample; still, any upside pop will keep inflation anxiety alive.

Fed speakers – Jefferson (Tue), Williams (Wed) and Daly (Fri) will field questions about how much longer they can “look through” tariff‑driven prices after Chair Powell’s caution last week.

Section 232 comment period closes for semiconductors (Fri). Traders will scan filings for early clues on carve‑outs or timing extensions.

Now, lets take a look at some of the earnings expectations

EARNINGS PREVIEW:

Verizon (VZ) – Reports Tuesday (4/22)

What to watch:

Expect stable wireless results, with the spotlight on subscriber trends and 5G rollout progress. Telecom stocks have acted as a defensive play in 2025, and Verizon shares are up ~11% YTD—though they still trail AT&T and T-Mobile.

Street sentiment is warming up. Evercore ISI just upgraded VZ to Outperform, naming it their top wireless pick. They cited improving postpaid phone trends, solid broadband momentum, and an undervalued stock still trading at a discount to peers. Their new price target is $48, based on 2026 estimates (~11.7x FCF).

The upcoming Frontier fiber acquisition is also a key storyline, with ~$400–500M in potential revenue synergies and a much bigger footprint.

Why it matters: Investors will be listening closely for updates on fiber strategy, 5G traction, and how pricing pressures in the wireless space are evolving.

Tesla (TSLA) – Reports Tuesday (4/22) after market

What to watch:

Tesla enters earnings with a tough setup—Q1 deliveries dropped 13% YoY and aggressive price cuts likely pushed gross margins to multi-year lows.

Consensus is sliding fast. BNP Paribas cut 2026 earnings forecasts by 38% and sees Tesla burning cash in 2025–26. They’ve slashed the price target to $137, warning that heavy China exposure (~40% of sales) and macro pressures could weigh on both demand and sentiment.

Tariff risk: Mixed. Most U.S.-sold Teslas are made domestically, but component costs (especially batteries) could rise due to new import tariffs. Musk’s tone on AI, autonomy, and pricing strategy could move the stock just as much as the actual results.

But Tesla trades on vision, not just quarters.

Enphase (ENPH) – Reports Tuesday (4/22) after market

What to watch:

Q1 might be less of a focus than recent policy shifts—namely the 150%+ tariffs on non-EV batteries. Enphase’s solar microinverter business is less exposed, but its storage unit could take a hit as costs rise and demand cools.

Piper Sandler and Citi both warning that storage system adoption could slow if costs get passed on to consumers.

That said, ENPH still trying to build a long-term solar tailwinds and is expanding in Europe, where demand is steadier. Look for management’s strategy on navigating tariffs—whether through sourcing, pricing, or U.S. manufacturing.

Boeing (BA) – Reports Wednesday (4/23) pre-market

What to watch:

Delivery trends are in focus, but China remains the wild card. Bloomberg recently reported Beijing has ordered local airlines to halt new Boeing jet deliveries—a major geopolitical blow.

Add that to Boeing’s existing issues (safety, labor, quality), and you’ve got a low bar. Still, CFO Brian West struck a cautiously optimistic tone, saying Q1 cash flow could improve “by hundreds of millions.”

Tariff watch: Very high. With escalating U.S.–China trade tensions, Boeing’s international footprint is a vulnerability. Management’s guidance around deliveries, backlogs, and geopolitical impact will be critical.

Chipotle (CMG) – Reports Wed (4/23) After Market

Expect slower Q1 comps (~1–2%) due to tough comparisons, soft consumer spending, weak response to the honey chicken LTO, and the Easter shift. Analysts trimmed near-term estimates but remain bullish long term, citing strong brand fundamentals, steady new store growth, and room for margin expansion.

Stock trades at ~33× 2026E EPS, well below its 5-yr avg (~45×), suggesting downside is priced in.

Key watch: Q2 sales tone, cost pressures, and margin commentary.

Tariff risk: Low.

PepsiCo (PEP) – Reports Thu (4/24) Before Market

Expect a steady quarter, with organic growth driven mostly by price. Volume trends are in focus as consumer pushback rises. RBC flagged pressure in snacks and North America.

Key watch: Volume vs. pricing mix, marketing spend, and full-year guidance tone.

Stock trades at ~25× earnings, so expectations are high.

Tariff risk: Moderate (aluminum, sugar, int’l sales).

Intel (INTC) – Reports Thursday (4/24) after market

What to watch:

Expect revenue and earnings to be down YoY, but likely in line with the low guidance Intel issued last quarter. Gross margin guidance is weak (36%), and investors will be watching for signs of stabilization—or more downside ahead.

New CEO Lip-Bu Tan is focused on turning Intel around, cutting costs, and raising cash through moves like selling a 51% stake in Altera.

Tariff angle: Indirect. Intel doesn’t face consumer-facing tariffs, but restrictions on equipment and geopolitical friction could impact both supply chain and sales. PC pull-ahead demand ahead of tariffs may help Q1, but Q2 could feel the hangover.

Alphabet (GOOGL) – Reports Thursday (4/24) after market

What to watch:

Solid Q1 numbers are expected across Search, YouTube, and Cloud, but the focus will be on macro headwinds and how tariffs could weigh on advertiser demand in sectors like autos, pharma, and retail. Valuation is still reasonable (~17–18x forward earnings), but investor sentiment is cautious given fears over all the anti-trust trials, AI competition and macro slowdowns.

CLOSING THOUGHTS: Another week in the books, and—true to 2025 form—it delivered more questions than answers.

Yes, the tape looked calmer. The S&P drifted instead of plunging, Powell avoided new landmines, and traders even squeezed in a modest “buy‑the‑dip” Thursday afternoon. But calm isn’t conviction. We’re still trading inside the same tariff fog, and the president’s public swipe at Chair Powell just reminded everyone that Fed independence—something markets usually take for granted—may be the next shoe to drop.

So where does that leave us? Think of the market as a patient in observation, not yet cleared for discharge. We’ll need hard evidence—earnings that hold up, GDP that doesn’t roll over, and a genuine cooling in trade rhetoric—before the all‑clear sounds. Until those test results come back, the playbook doesn’t change: keep position sizes sensible, respect your stop levels, and treat cash as strategic ammo rather than idle ballast.

Remember, “Hope is not a hedge, and one good day isn’t a trend.” That’s the line to remember heading into a jam‑packed earnings week and the first true look at post‑tariff macro data. Stay curious, stay flexible, and we’ll navigate it one headline—one print—at a time.

A Personal Note

That wraps up this week’s edition of the Wall St Engine Weekly Recap.

Markets were relatively calm, not much changed structurally — and with the holiday week, this one’s a bit shorter than usual. The earnings preview is also on the simpler side, but stick with me — next week, it’ll be sharper, more insightful, and more actionable.

I’m already thinking through a few ways to make this newsletter even better. It’s a work in progress, but we’re building something solid here.

Thanks for riding along — we’ll keep dialing it in, and keep it engaging as ever.

See you all next Sunday. Same time, same storm.