Happy Sunday! What a rollercoaster of a week it was on Wall Street. In a span of days we saw fear, euphoria, and whiplash-inducing policy pivots. It was arguably one of the most stressful weeks to ever coincide with a big market gain – the S&P 500 rallied hard, but not before investors endured a trade-war soap opera. President Trump finally blinked after a bond market revolt, announcing a 90-day pause on his reciprocal tariffs. However, he left in place a staggering 145% tariff on Chinese goods, and by week’s end China hit back in kind. And just when everyone thought the drama was over, this weekend brought yet another twist: key tech tariffs were suddenly exempted. Buckle up – let’s recap the chaos.

It was a week for the history books on several fronts. Amid the turmoil, multiple market records were shattered:

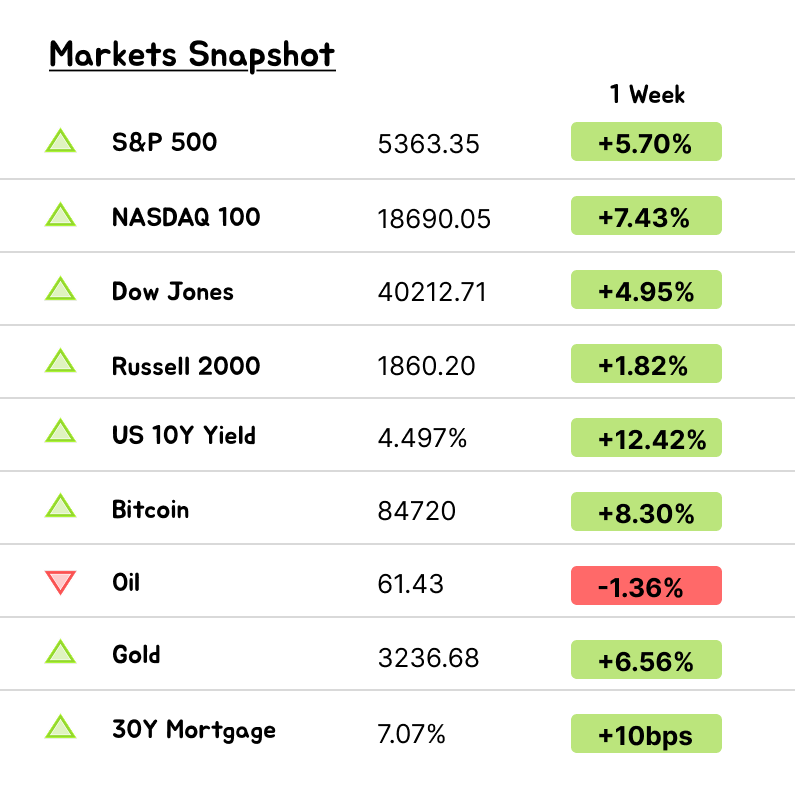

Stocks: The S&P 500 just logged its best week since November 2023

Gold glittered with its strongest week since March 2020

The U.S. Dollar Index had its worst two-week stretch since 2008

The U.S. 10-year Treasury yield notched its biggest one-week jump in about three years, and the 30-year yield saw a similarly historic spike over the same period

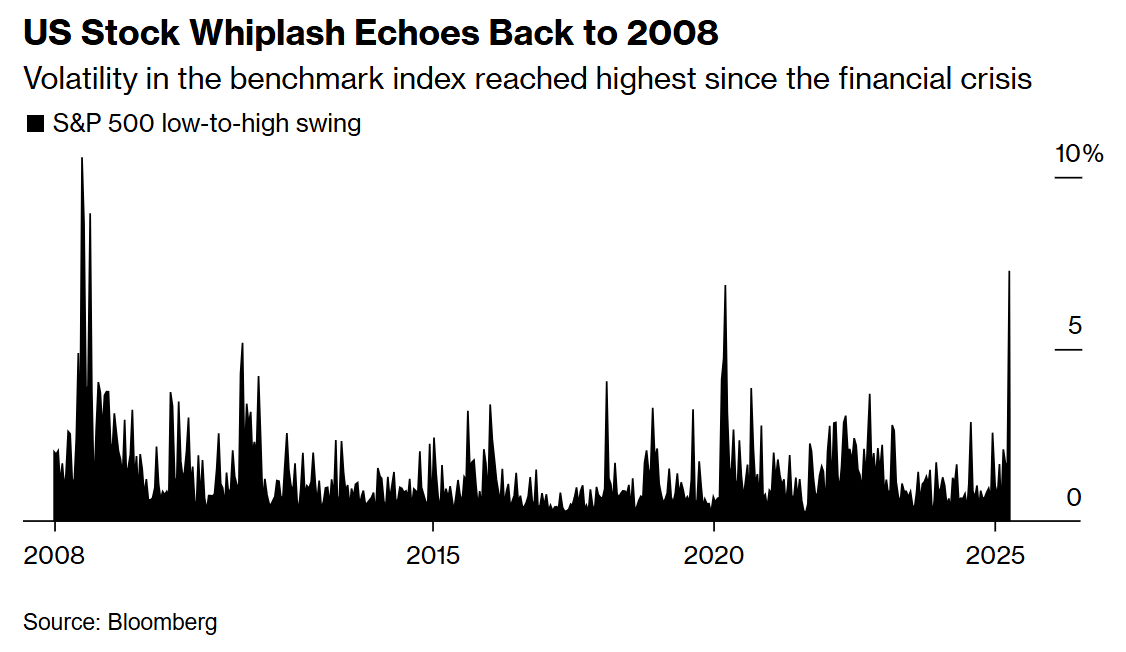

Volatility surged to levels reminiscent of the 2008 financial crisis. In fact, the Cboe Volatility Index (VIX) briefly burst into the 60s – a panic territory rarely seen outside of 2008 or 2020 – before settling down.

Here’s a day-by-day breakdown of how one of the most dramatic weeks since 2008 played out.

The Week That Shook the Street

Tariffs, tantrums, and turnarounds. This week’s narrative felt scripted for a financial thriller. It began with President Trump forging ahead on aggressive new tariffs, only to do a head-spinning about-face under market pressure. When a suite of “Liberation Day” tariffs officially went live Monday at midnight, all hell broke loose in markets: stocks plunged and bond yields skyrocketed in a rare tandem selloff. By mid-week, it was the bond market – not trade negotiators – that effectively forced the President’s hand. Within hours of the tariffs taking effect, Trump suddenly announced a 90-day pause on any new levies for all non-retaliating countries (a move many believe was directly prompted by the bond meltdown). “The blink came sooner than expected, probably forced by the markets,” one strategist quipped of Trump’s rapid U-turn.

Wall Street reacted with utter relief. In fact, Wednesday delivered one of the biggest one-day rallies of the century. The S&P 500 soared 9.5% for its largest daily gain since 2008. The Nasdaq had its best day since 2001, and the Dow exploded nearly 3,000 points higher – its largest single-day point jump ever. It was an eye-popping reversal that vividly illustrated how desperate the market was for good news. As veteran investor Louis Navellier remarked, “This is the biggest rally I’ve ever seen… clearly, Donald Trump likes to watch the stock market”. Traders, smelling blood in the water, piled back in with a vengeance – though some noted the surge was driven in part by short-covering and mechanical flows. Call it a historic relief rally, born from the ashes of panic.

But the celebration was short-lived. By Friday, the trade war pendulum swung back. Beijing showed it wasn’t about to be cowed by a 90-day reprieve. In a defiant rebuttal, China raised its retaliatory tariffs from 84% to 125% on U.S. goods, effective immediately. This tit-for-tat move essentially matched Trump’s own tariff hike and brought China’s total import levies on American products up to roughly 145% as well. Any illusion of a quick truce evaporated. Markets wobbled into the weekend, realizing that despite the week’s wild swings up and down, nothing fundamental had been resolved. The “pause” clock is now ticking, and China clearly isn’t blinking – setting the stage for more chaos if no deal is reached by early July.

Just when traders thought they could catch their breath, the weekend delivered another plot twist. In an apparent effort to sugarcoat the trade war pain (or, depending on your cynicism, to undo self-inflicted damage), the White House announced surprise exemptions on tariffs for key tech products. Late Saturday, President Trump said that semiconductors and electronics (like smartphones and PCs) will be exempt from the higher China tariffs, retroactive to April 5th. Any duties paid on those items over the past week will be reimbursed. In other words, Washington effectively backtracked on tariffing the tech supply chain – a major pivot aimed at protecting U.S. chipmakers and consumers from price spikes.

Trump pivoted, but we’re not going back to where we were before. We’ve learned a few things:

Trump will respond to a certain level of pain in markets.

The Treasury market is perhaps the most important player in markets right now.

There can be exemptions.

As Lisa Abramowicz put it: “There are known unknowns, including how far Trump is willing to go, what his goals are, and how long it’ll take for businesses to resume confidence. But the unknown unknowns are more worrisome – like whether the Treasury market has lost its luster permanently.” Markets may be adapting, but investors are still navigating with foggy radar.

Is this a genuine de-escalation or just a band-aid on a bullet wound? “The tariff clouds parted for the first time today, but it’s too soon to know how sunny the skies will be tomorrow—or 90 days from now,” cautioned Morgan Stanley strategist Daniel Skelly, tempering the optimism. As he noted, “As welcome as the announcement was, investors can’t assume it’s the end of the tariff story, or that the market’s day-to-day volatility will disappear. In other words, don’t ring the “all-clear” bell just yet. This exemption move feels more like a tactical retreat than a peace treaty. Wall Street analysts also pointed out that many tariffs remain in force and the core U.S.-China standoff is far from resolved. The risk is that this sugar high could fade fast – much like prior instances when trade optimism gave way to harsh reality. For now, though, the gesture has provided a glimmer of hope that perhaps the administration is looking for an off-ramp in this escalating conflict.

BOND MARKET MUTINY: AMERICA’S HAVEN BID JUST VANISHED

While stocks grabbed headlines, the real rebellion of the week occurred in the bond market. In a dramatic turn of events, U.S. Treasury yields spiked higher in the midst of an equity selloff – a glaring break from the usual “flight to safety” pattern. It was as if the bond market shouted “No confidence!” in unison. The 10-year Treasury yield shot above 4.5% at one point (marking its fastest three-day climb since 2001), and even after the tariff pause news brought some relief, yields ended the week way above where they started. Typically, when stocks crater, investors buy Treasuries; push yields down and the dollar rally. Not this time. Instead, “the world’s hot new trade is ‘sell America’” as Axios observed, with traders dumping both bonds and dollars. Krishna Guha of Evercore called the phenomenon “rare, ugly, and worrying” – a sign that something is fundamentally cracking in investor confidence. By mid-week, the U.S. dollar index had sunk over 3%, its worst week in years, even as yields were surging. “We are NOT out of the woods,” billionaire Mike Novogratz warned amid the unusual carnage.

So, what triggered this bond market mutiny? There was no single culprit – it was more like a perfect storm of fear factors hitting all at once. Among them:

Hedge Fund “Basis Trade” Unwind: A popular leveraged bond trade blew up as markets moved violently. Funds that borrow heavily to arbitrage tiny differences between Treasury bonds and futures were forced to liquidate positions in a hurry, creating outsized selling pressure in Treasuries. It’s a niche strategy, but when it unravels, it can flood the market with bonds for sale.

Foreign Selling Jitters: With U.S.-China tensions skyrocketing, whispers grew that major foreign holders of U.S. debt – namely China and Japan – might be pulling back. Even the hint that Beijing could retaliate by dumping Treasuries put traders on edge. (China and Japan collectively hold over $2 trillion of U.S. government debt, so this isn’t an idle threat.)

Flight to Liquidity: In times of stress, investors often sell what they can rather than what they want. This week saw a dash for cash – even if it meant selling the safest assets. As one analyst put it, it was a “sell what you can” fire-sale mentality. Treasuries are usually ultra-liquid, so they became an ATM for investors needing to de-risk, which drove prices down and yields up.

Inflation & Growth Angst: The backdrop of sticky inflation and a potential growth slowdown also played a role. Tariffs are essentially a tax, and they threaten to keep price pressures simmering even as the economy softens. With the Fed reluctant to cut rates (more on that in a moment), bond traders saw no cavalry coming to the rescue. In short, the bond market was left to flail on its own, trying to price in a bewildering mix of stagflation fears and a possible credit crunch.

The result of this cocktail was outright turmoil in the supposedly “safe” part of finance. Yields spiked at a speed reminiscent of crisis times, liquidity got patchy, and there was even chatter about potential funding stress in dollar markets. “Everything that could go wrong, did go wrong,” one analyst lamented of the bond rout.

But the implications go deeper. The historical assumption that U.S. assets will be the world’s anchor in times of stress is suddenly being challenged.

This raises a bigger question: Did we accidentally nuke our own bond market?; Are we witnessing the fading of U.S. exceptionalism? By pushing tariffs to extremes, did policymakers spark a self-inflicted liquidity crisis? Or, alternatively, are foreign players deliberately shunning U.S. debt as a form of retaliation? Either way, the bond market’s message was loud and clear. Uncle Sam’s house is not in order. “It dramatically affected psychology and attitude about the United States’ reliability,” billionaire investor Ray Dalio said of the week’s chaos, noting that many investors have been left with “an element of trauma or shock or fear” after watching U.S. assets tank together.

Indeed, the implications of a broken bond market are serious. The U.S. government’s borrowing costs jumped sharply in just days – a warning shot given the nation’s already bloated deficit. BlackRock CEO Larry Fink warned that if the U.S. tips into recession, the deficit “will go north of 10% [of GDP], and you’ll see a real flood of [Treasury] supply just as others turn their back.” In other words, America could face a funding squeeze at the worst possible time if confidence isn’t restored. Peter Boockvar at Bleakley Advisory Group even joked darkly, “If this fight with China doesn’t end soon, [we should] start betting on how many months before U.S. shelves start emptying out,” – not just from supply chain pain, but from drying up global financing.

By Friday, some calm had returned to bonds – but only barely. Yields came off their highs after the tariff pause, with the 10-year settling around 4.34% (down from the mid-week peak near 4.5%). Still, that’s higher than before all this began. Jamie Dimon, JPMorgan’s CEO, mused that the bond market “probably forced their hand” in Washington. He and others implored leaders to address the root cause. “The volatility coming from tariffs is serious. If you want to calm the markets, then show real progress on trade talks — that’s what’ll do it,” Dimon said bluntly. Absent that, the risk of further bond market upheaval remains. The episode was a stark reminder that the U.S. cannot take its capital markets for granted: if you push investors too far, they push back – and that’s exactly what happened this week in the Treasury pits.

Earnings Season: Guidance? What Guidance?

Amid the macro mayhem, the Q1 earnings season kicked off – and it’s unlike any in recent memory. Typically, investors look to corporate earnings and guidance for clarity about the future. But thanks to the tariff-driven uncertainty, many CEOs basically threw up their hands and said: “Your guess is as good as ours.” This earnings season, guidance has become more like guesswork.

The week saw big names in finance reporting results, providing our first glimpse of how companies navigated the tumultuous quarter. In terms of the numbers, many did better than expected. JPMorgan Chase beat estimates with strong trading revenue, and Morgan Stanley’s profits got a boost as well – its trading arm saw a whopping 45% jump in revenue year-over-year. BlackRock, the world’s largest asset manager, even grew its assets under management to a record $11.6 trillion, as the market’s January-February rally padded portfolios. These solid results lifted bank stocks initially. But on their conference calls and in their outlooks, executives struck a markedly cautious tone.

JPMorgan CEO Jamie Dimon perhaps summed it up best: “The economy is facing considerable turbulence.” Dimon’s team noted that the tariff crosswinds are making it extremely difficult to forecast anything with confidence. In fact, even before this week’s blow-up, Wall Street had been bracing for weaker guidance. More S&P 500 companies issued negative earnings guidance for Q1 than positive, a reversal from the usual optimism, and many had trimmed forecasts going into April.

Now, with the tariff situation evolving by the hour, some companies have decided it’s pointless to even provide an outlook. Consider the airlines: on Monday, Delta slashed its profit forecast in half for the year, and American Airlines doubled its projected Q1 loss. Ouch. Meanwhile, retail giant Walmart said it will stop giving forward guidance entirely for now – essentially saying the terrain is too uncertain to predict. This is almost unprecedented outside of severe recessionary periods. It speaks to just how blindfolded corporate planning departments feel in the current environment. As one market watcher joked, “Everything we thought was true last week has been shattered — and now executives are just as unsure” about what comes next.

The banks echoed this uncertainty. While their Q1 numbers were good, they all acknowledged the outlook is murky. Morgan Stanley’s CFO remarked that the tariff turmoil makes it hard to forecast client activity. And JPMorgan’s Dimon warned that analyst earnings estimates might still be too high. “Analysts have generally reduced their S&P estimates by 5% in recent days,” he said on Friday, “I think you’ll see that come down some more.” In other words, expect a flurry of downward revisions as companies fess up to the trade war impact.

One striking theme is how many firms are withdrawing guidance. By week’s end, a slew of companies across industries – from Delta Air Lines to Walmart to several tech hardware firms – had either lowered or outright pulled their financial guidance due to the tariff fog. This is likely to become commonplace this earnings season. Rather than sticking their necks out with bold predictions, CEOs are hunkering down and admitting they don’t have a clear crystal ball right now. As the Delta CEO put it, it’s a “stark sign of the turmoil” that even huge corporations can’t handicap the next few quarters.

So what does this mean for investors? Earnings reports will have to be taken with a grain of salt. Backward-looking results might be fine, but it’s the lack of forward guidance that’s the real story. The stock reactions may be less about last quarter’s beat or miss, and more about how much uncertainty management expresses. Companies that can provide even a modicum of clarity (or those relatively insulated from tariffs) could be rewarded. But many will simply say “no comment” on the future, leaving investors flying blind.

The silver lining: some market pros think this sets us up for lower expectations that could be more easily surpassed if trade tensions ease. But that’s a big “if.” For now, caution is the watchword. As an earnings analyst wryly noted, “We’re likely to have more questions than answers this earnings season, leaving investors to try and find a signal in all the tariff noise.” In other words, keep your seatbelts fastened – the earnings call Q&A sessions might be more about geopolitics than P&L this quarter.

Week in Economics: Hope Meets Hesitation

This week’s economic calendar brought both relief and anxiety:

Consumer Price Index (CPI): Headline inflation declined 0.1% MoM – the first outright drop since 2020. YoY CPI eased to 2.4%, and core CPI rose only 0.1%, both softer than expected.

Producer Price Index (PPI): Final demand PPI fell 0.4% – the weakest reading since April 2020.

U.S. Budget Deficit at $160.5B; Est. -$145B

University of Michigan Consumer Sentiment: Confidence took a hit, falling more than expected to 76.5 (from 79.4), with the biggest drop in consumer expectations. Inflation expectations rose to 3.1% (1-year outlook) – the highest in months.

The takeaway? Consumers may be reacting to the volatility and trade threats with renewed caution. “Consumers are spooked by policy whiplash,” one strategist remarked. “They’re seeing price spikes and hearing about tariffs and wondering if they should delay big purchases.” Expect spending to soften if confidence doesn’t rebound soon.

The Week Ahead… and a Closing Thought

Somehow, every week since late January has felt like a hurricane in disguise. Maybe—just maybe—we’ll get a breather this time. The calendar thins out a bit, and with Good Friday closing U.S. markets, next week might bring a little less chaos... at least on paper.

CLOSING THOUGHTS: After such a dizzying week, it’s only natural to ask: What comes next?

In the short term, markets have latched onto a cautiously optimistic narrative — The traders’ ability to buy the dip show there’s still a reservoir of hope that cooler heads will prevail. But let’s be clear: this isn’t a clean break from the storm. As Nationwide’s Mark Hackett put it: “In the fog of war, extreme rallies are no healthier than extreme declines. Markets rarely have a V-shaped bottom — it takes some churning and clarity to have a sustained recovery.”

That quote might be the most important thing to carry forward this week.

From here, we need to see more than headlines. We need follow-through: real negotiations, real de-escalation, and real earnings clarity. Until then, staying nimble, hedged, and level-headed may be the best strategy. So let’s take it one step at a time

A Personal Note

This wraps up the first-ever issue of the Wall St Engine Weekly Recap.

Still finding the rhythm. Still building the format.

But if you stuck around till the end — thank you.

This will only get sharper, more insightful, and yes — more exciting.

We’re in it for the long haul.

See you next Sunday. Same time. Same storm.