Happy Sunday!

Grab a coffee — last week’s markets felt like a roller coaster stuck on fast-forward.

We kicked off Monday on edge: Trump’s fresh attacks on Fed Chair Powell, plus escalating tariff threats, sent stocks sliding hard. The Dow dropped sharply, with the S&P and Nasdaq following close behind, while gold and the Swiss franc jumped as the "Sell America" trade caught headlines.

By midweek, though, the mood flipped almost as fast as the news cycle. Treasury Secretary Bessent hinted at a “near future” trade de-escalation, helping spark a rebound. Trump also stepped back from the idea of firing Powell, easing some pressure around Fed independence.

The U.S.-China story only added more chaos. Trump claimed talks with Beijing were progressing, while China publicly denied any negotiations were happening. One side pushing optimism, the other side shutting it down — it was classic diplomatic whiplash.

All in, markets swung from fear to cautious optimism so fast it felt like emotional cardio.

It’s clear we’re stuck in a kind of "tariff purgatory" — headlines bouncing sentiment around without changing the bigger picture. Structurally, risks are still tilted to the downside. But with volatility dropping and softer headlines showing up, bulls have found reasons to stay tactical and chase short-term bounces.

Zweig Signal Sparks Bull FOMO

If your Twitter feed felt like it was screaming about the Zweig Breadth Thrust this week — you’re not alone. It was everywhere. A rare Zweig Breadth Thrust (ZBT) fired off, and let’s just say: bulls lost all chill.

Now, if you’re new to it, a Zweig Breadth Thrust might sound like some impossible yoga pose, but it’s actually a classic technical indicator — one with a jaw-dropping 100% historical success rate when it fires. No joke. It was developed by Marty Zweig decades ago and tracks whether buyers are suddenly overwhelming sellers in a big, dramatic fashion.

Here’s how it works: the 10-day moving average of advancing stocks needs to surge from below 40% to above 61.5%. This week, that exact move happened. In plain English? Breadth — which was ugly and oversold just days ago — snapped back like a rubber band, with buyers flooding in across the board.

That's key: while the S&P 500 itself didn’t quite trigger a ZBT, the S&P 1500 did, meaning it’s not just the Magnificent 7 carrying the water — the rally is broadening out.

As Marty Zweig famously said, “One of the frustrating things for people who miss the first rally in a bull market is that they wait for the big correction...and it never comes.” That quote feels eerily fitting right now. Miss the first leg, and history says you might be watching the market climb a lot higher without you.

The last time we saw a ZBT was November 2023 — and yeah, that kicked off a serious bull move. No guarantees, of course. But when you pair the Zweig trigger with the general FOMO already brewing in markets, it’s hard not to take notice.

Bottom line: when a breadth thrust like this fires, it’s usually a sign that institutional algos have flipped from “panic mode” to “greedy mode.”

Trump Calms Markets: "No Intention of Firing Powell"

Markets breathed a collective sigh of relief Tuesday when President Trump declared he had "no intention of firing" Federal Reserve Chair Jerome Powell. This marked a dramatic reversal from just days earlier when Trump had labeled Powell a "major loser" and said his "termination cannot come fast enough."

The market response was immediate and powerful – following day trading saw huge jump in Indexes. This rally was further supported by Treasury Secretary Scott Bessent's hints that the administration might ease its aggressive trade conflict with China.

For traders, this reinforces what we already know – policy uncertainty creates volatility, and reduced uncertainty tends to support market advances. The Powell situation had become a significant overhang on the market, and Trump's comments helped remove that pressure point.

US–China trade drama: Another “did it or didn’t it?” moment. President Trump told reporters he’s been talking with Xi (and even claimed “ongoing daily negotiations” on trade), yet Beijing flatly denied any such talks. At a press briefing, China’s Commerce Ministry insisted these rumors were “groundless”, saying the US needs to drop tariffs before real negotiations can resume. A noted market commentator put it succinctly: “China says it is NOT having any talks...For the last 3 days, President Trump has said multiple times that there are ongoing daily negotiations with China. Whom to believe?

Who Said No One Wants Our Treasuries?

In case anyone still thinks nobody wants U.S. Treasuries... well, the market just delivered a pretty loud answer.

Bonds ended the week quietly firmer. The 10‑year UST yield slipped to ~4.27% (the lowest close since early April), and the 2‑year sits around 3.76% (down 3bps). That drop – along with a still-strong dollar – reflects both easing rate-cut odds and a rush into safety.

After Thursday’s stress, we saw a tidal wave of cash into government debt: U.S. Treasury funds logged a record $19 billion weekly inflow – trouncing the prior $14B high during the pandemic.

The 4‑week moving average is now near $7B, the strongest since early 2023. In other words, traders were parking cash in short-term Treasury trucks just in case the Fed plumbs got gummed up (recall rumors of liquidity “plumbing” angst). The 2s‑10s curve remains inverted, but with the 2‑year ~63bps below the Fed funds midpoint, markets are again whispering “rate cuts are coming,” even as Powell himself got mixed messages from President Trump this week.

Tesla: Turning Doubt Into Hope

Earnings weren’t pretty. Tesla posted one of its worst quarters ever — missing revenue and margin expectations — while also acknowledging brand headwinds tied to Elon Musk’s political ties. Sales were down, profits fell, and the company pulled full-year guidance, citing it was "difficult to measure the impacts of shifting global trade policy on the automotive and energy supply chains, our cost structure, and demand for durable goods and services." They plan to revisit 2025 guidance in the Q2 update.

But despite all that, the market flipped risk-on. Trump’s softer stance on China helped sentiment broadly, and Musk saying his time allocation to D.O.G.E would drop significantly starting in May gave Tesla bulls something to cheer for. Wedbush's Dan Ives called this "a big step in the right direction," noting that "investors wanted to see him recommit to Tesla.”

Here are a few key highlights from Tesla’s Q1 call:

1 million Optimus robot units targeted by 2030 (possibly 2029).

Tesla cars are now 85% USMCA compliant on average.

Tesla is still on track to release more affordable models this year — ramp may be slower, but production start is on schedule.

Musk took a jab at Waymo, calling their autonomous vehicles “way-mo costly” to produce.

Tesla plans to launch an unsupervised Robotaxi service in Austin starting in June with about 10–20 Robotaxis.

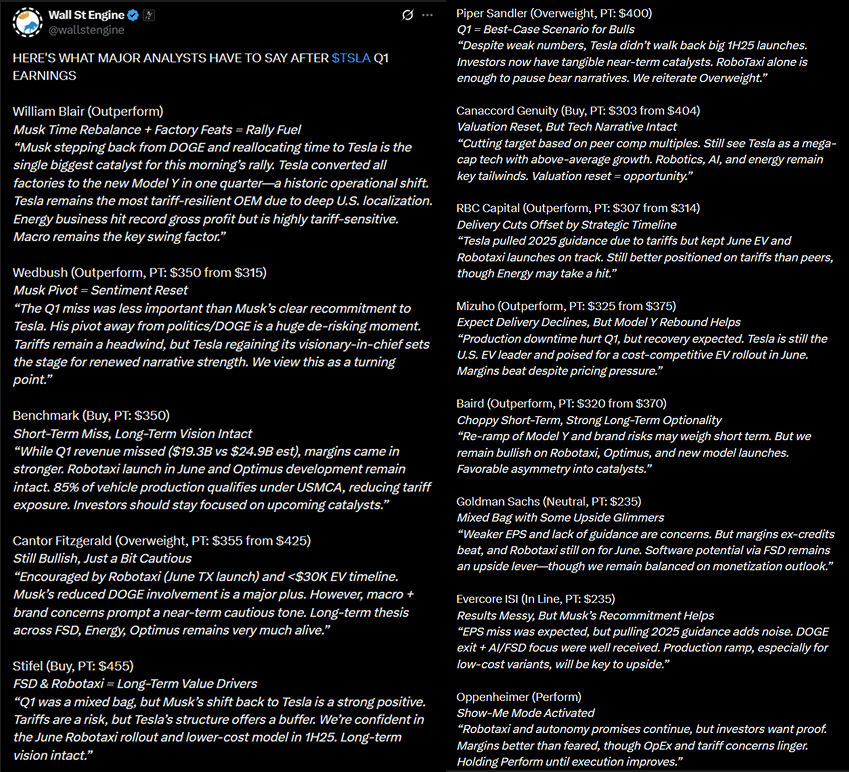

(If you want to dive deeper into the earnings breakdown, I’m attaching what the Street said separately.)

Now, let’s dive into the second big catalyst that hit Friday:

The U.S. Department of Transportation rolled out a new national framework to fast-track AV deployment. U.S.-built self-driving cars can now get exemptions from certain federal safety rules — a break that was previously reserved for foreign-made vehicles. Plus, AV incident reporting requirements will be streamlined too — another clear regulatory tailwind for Tesla’s autonomy ambitions.

Importantly, this shift moves regulation from a slow, state-by-state process to a unified national approach, which could significantly speed up Tesla's rollout plans for Robotaxis across the U.S.

One more thing Tesla investors will like: TSLA closed above its 50-day moving average for the first time since January 30th — a technical win that adds even more momentum to the story.

Google Earnings: Bulls vs. Bears

Alphabet’s stock popped ~5 % after its Q1 print, and the Street can’t stop arguing about what sticks.

The Bulls:

Top-line muscle: Search revenue +10 % YoY, YouTube ads +10 %, total revenue +12 % to $90.2 B and EPS smashed it at $2.81 vs. $2.01 est., plus a fresh $70 B buyback authorization.

Subscription flywheel: Paid subs have crossed 270 M (YouTube Premium, Google One, etc.), growing double-digits and finally getting investor love.

AI distribution edge: “AI Overviews” already serves 1.5 B monthly users and monetizes at the same rate as classic search, plugging any leakage to ChatGPT-style answers.

Cloud backlog > capacity: Management says demand outpaced data-center supply again in Q1.

CapEx = conviction: Google kept its $75 B 2025 CapEx pledge (Street was at $72 B) — servers, TPUs, and data-center land grabs that cement its AI moat.

Valuation cushion: KeyBanc argues cost cuts + buybacks can drive >$10 EPS in 2026, so 19× 2026 P/E = $195 PT — cheap next to mega-cap peers.

Waymo kicker: 250 K paid robotaxi rides per week (5× YoY) keep the optionality story alive.

The Bears:

Clicks vs. pricing: Paid-click growth crawled at ~2 % — mostly price, not volume — so a consumer wobble could flip Search negative next year.

Cyclical boost question mark: Even bulls admit most upside came from “old-school” ad strength in Search/YouTube and a suddenly hot Subscriptions line, not structural gains.

CapEx hangover: $75 B means depreciation will keep snowballing (already +31 % YoY), dulling margin expansion.

Regulatory overhang: Antitrust cases, a possible Chrome divestiture, and Washington chatter about carving up ad profits cap the multiple.

AI crowding: OpenAI, Perplexity, and every home-grown LLM are nibbling at Google’s core — “the debate has shifted from lawyering facts to reading investor psychology,” quips Bernstein.

Google out-executed a low bar, and the subscription/AI flywheel is finally visible. As long as macro doesn’t gut ad budgets, the risk-reward skews bullish. But with click growth sluggish and regulators circling, there’s no free lunch — keep one hand on the eject button if macro or legal headlines sour the mood.

The $8 Billion Moonshot That Paid Off

Google's parent company reported a whopping $34.5 billion in net income for Q1, up 46% from the same period last year, with earnings of $2.81 per share. While impressive AI-powered growth across search, cloud, and YouTube contributed to these results, one particular investment added some serious rocket fuel to the bottom line.

But there was another quiet driver behind those eye-popping numbers: an $8 billion unrealized gain from Alphabet’s early investment in SpaceX, according to Bloomberg.

Back in 2015, Alphabet and Fidelity invested $1 billion for a combined 10% stake in SpaceX, back when it was still seen as one of Musk’s ambitious bets. Fast forward to today, SpaceX is now valued around $350 billion after a recent tender offer — making it one of the world’s most valuable private companies.

Software Sector Earnings:

Big software names mixed it up this week. ServiceNow (+9%) crushed expectations on cloud bookings: CCRPO (new cloud subscriptions) jumped ~22% YoY vs. 21% forecasts. Management credited booming public-sector business under the U.S. administration – federal ACV rose 30% YoY with 11 >$1m deals (vs. 8 a year ago) – and reiterated full-year guidance. Texas Instruments (+8%) also beat, shrugging off analog-company worries. TI said it saw a broad industrial revival (all sectors up q/q except phones) and guided Q2 revenue ($4.20–4.50B) above consensus. Still, TI warned tariffs will likely cloud the back half of the year; about 50% of TI’s sales touch China, so it’s monitoring those risks closely. Meanwhile IBM lagged. Big Blue’s quarter was so-so, and management admitted “clients delay decision-making, especially in discretionary projects”. In short, NOW and TXN rallied on strength (cloud deals and low-end recovery) while IBM treaded water – classic rotation as investors favor growth spots and shy from any signs of a slowdown.

Consumer Staples Earnings

Staples earnings brought a tale of two balance sheets. PepsiCo slid ~5% after its results disappointed: sales dipped as consumer demand softened, and Pepsi cut its 2025 outlook (core earnings now seen flat versus growing). The tariffs sting plays a part – Pepsi’s sweetener concentrate is made in Ireland, so sugar and aluminum levies bite especially hard. On the other hand, Hasbro had its best day in years (+14.6%). The toy maker soothed investors by highlighting that ~half its U.S. sales are U.S.-based or licensed domestically, insulating it from some tariff pain. Plus, nostalgic products and franchises are booming – e.g. Magic: The Gathering game sales jumped >45% YoY, and a renewed Disney license deal means Marvel/Star Wars toys keep selling. In short: Pepsi got flattened by soft demand and higher costs, while Hasbro capitalized on brand strength (and some luck) to shrug off the tariff storm.

Telecom Round-Up (Verizon, T-Mobile, AT&T)

Verizon (VZ) delivered a “paper” beat—EPS $1.19 vs $1.15 and revenue $33.5 B vs $33.26 B—but the headline was churn: -289 K post-paid phones versus –185 K expected. With guidance left flat, investors yawned and moved on.

T-Mobile (TMUS) hit the numbers—revenue $20.89 B (est. $20.62 B), EPS $2.58 (est. $2.46), EBITDA +8 % YoY, and even trimmed CapEx. Yet the stock cratered -11 % on the day—the worst drop since 2011—because expectations were sky-high. Full-year guidance came in merely in-line and post-paid phone net adds missed (495 K vs 507 K est., –7 % YoY), reminding everyone TMUS “wasn’t priced for any wobble.”

AT&T (T) seized the spotlight with the sector’s cleanest beat on net-adds and EBITDA, prompting JPMorgan to lift its price target. For once, Ma Bell looked spry while Magenta took a tumble.

Customs Revenue: A Spike That’s Hard to Miss

If the blue wall in the chart didn’t tip you off, April’s tariff take is off the charts—literally. Treasury receipts for customs duties (plus a smattering of excise taxes) hit about $15.6 billion through April 23, already a ~63 % jump over March and the biggest monthly haul on record. For context, that works out to roughly $919 million a day—lofty, but still shy of the “$3 billion a day” number President Trump bandied about last week.

Why the pop? Most of April’s figure reflects the 25 % steel-and-aluminum duties that took effect March 12, finally rolling through the Treasury’s collection cycle. The across-the-board 10 % tariff on nearly all imports only kicked in on April 9, so its punch won’t fully register until May’s statement. Translation: the next data drop could be even punchier.

One caveat: that $15.6 billion pool also sweeps in excise levies on fuel, booze, tobacco, and the like, so pure tariff revenue is a touch smaller. We’ll get the clean split when the full Monthly Treasury Statement lands in mid-May. Even so, the border-tax spigot is wide open—and the inflow is poised to accelerate as the latest round of duties filters through the pipeline.

The Week Ahead: Take the Win... But Stay Grounded

Next week’s shaping up to be pretty wild. We’ve got a loaded earnings calendar, a huge lineup of economic data — including GDP and jobs numbers — and all of it coming while the market feels stuck in a deadlock. Tariff headlines are likely to stay on loop for at least another week or two, so expect the noise to stay high.

Right now, the risk feels tilted to the downside. Earnings are front and center, and with the way sentiment’s been, it’s hard to fully trust any bounce. Having some hedges on still makes sense here.

One thing this week reminded us: Trump — and the folks around him — will react when markets get stressed. If things start to really break, expect softer political headlines to try to calm nerves. And if that happens, the market’s reaction will be critical. We're seeing early signs of tactical bullishness: volatility is cooling, the market’s moved above the 21DMA, and the Zweig Breadth Thrust triggered — all positive signals. It’s not a perfect setup, but even a small positive headline could give us a tradable bounce.

When vol drops, risk appetite tends to pick up — almost mechanically. Targets get adjusted, risk positions get added, and momentum feeds on itself. Plus, let’s be honest, after 15 years of "buy the dip" training, it doesn't take much good news for buyers to show up.

But let’s stay realistic: this isn't a clean recovery. After a week packed with reversals, policy drama, and fast-moving earnings headlines, it's tempting to think the worst is behind us. But the structural issues — tariffs, Fed uncertainty, fiscal risks — haven’t gone away.

Tip: Hope can get you the first 100 points higher. Reality takes over after that.

Markets rarely V-bottom cleanly. They churn. They fake out. They test patience.

And while this bounce has been impressive, it’s been built more on the absence of new bad news than the presence of real solutions.

Big picture, the structural setup for U.S. assets still looks rough. Trillions of dollars are likely prepping to slowly rotate out of the U.S. over the next few years. It won’t happen overnight — but it’s real. And it’s not something you want to sleep on.

Heading into next week, stay tactical. Earnings will drive day-to-day moves, and the bar for positive surprises feels higher now. It's a market where any real disappointment — whether earnings or macro — could quickly flip sentiment back to the downside.

Respect the momentum. But keep one foot near the exit.

It’s still a battlefield out there — and patience, not euphoria, usually wins when the dust settles.

One step at a time.