Happy Sunday!

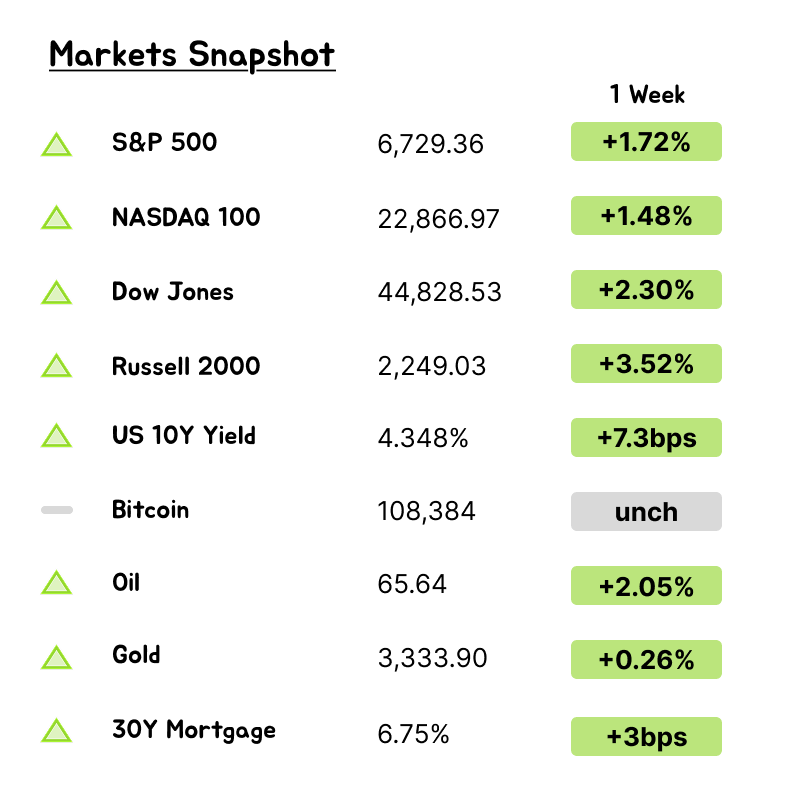

Hope you’re having a great long holiday weekend. It was a shortened week, but we still got some economic data that once again highlighted U.S. resilience. Markets are still pricing in two Fed cuts this year.

On the Trump agenda side, the “Big Beautiful” budget bill was officially signed into law, and we’ll see how bonds react to that in the coming sessions. With the holiday-shortened week, there wasn’t a flood of news, but there are still some key topics and stories I want to touch on today.

So, let’s get into it.

Halftime Scorecard – 2025 in a Nutshell

Time really does fly when you’re busy white-knuckling tariff headlines. Here’s how the first six months shook out:

S&P 500: Up just ~6 % YTD—a far cry from the double-digit sprint we saw by this point last year. Yet that sleepy number hides a roller-coaster: after President Trump’s “Liberation Day” tariff poster board on Apr 2, stocks shed $6 T in two sessions, only to claw back ~24 % from the mid-April trough to notch fresh records by late June.

Ticker | 1H ’25 Return | Why It Popped |

|---|---|---|

PLTR | +≈80 % | Wars may be fought with drones, but the battle plans are written in Palantir’s AI. |

NRG | +≈78 % | Data-center power demand turned this plain-vanilla utility into a hot-rod stock. |

Biggest Laggards

Ticker | 1H ’25 Return | What Went Wrong |

|---|---|---|

DECK | -≈49 % | Ugg boots couldn’t outrun margin pressure and fierce sneaker wars. |

ENPH | -≈42 % | Fears that a GOP tax bill could kneecap solar-panel credits dimmed the outlook. |

🔥 Hey everyone – quick heads up:

We’re running a special Discord SALE right now. Use code “USOFA” to get 30% OFF. This is the lowest price available right now, and prices are set to go up by 50% for new members in September. If you’ve been thinking about joining, this is a great time.

Here’s what you’ll get inside:

✅ Actionable trade setups you can use

✅ Daily live streams

✅ Unusual options flow

✅ Fast & exclusive actionable news, earnings, & market commentary

✅ Portfolio updates so you can follow along or learn positioning

✅ Weekly education sessions

✅ Ideal for catalyst traders, swing traders, day traders, and investors

✅ A super active team of analysts and a community that actually talks trades all day

Almost every single day, we share catalysts that are actionable in real time. Sometimes, we’re the fastest out there – catching moves and themes ahead of the herd. We’ve got a strong track record of spotting emerging market themes early, whether it’s nuclear, eVTOLs and drones, robotics, semiconductors and data centers, defense plays, or countless individual names.

If your goal is to actually build your own decision-making skills instead of just copying trades blindly, I think you’re going to love it here.

Use code USOFA for 30% off on any plan.

Tokenized Stocks

Pull up a chair—let’s talk about the word everyone in fintech has started treating like a skeleton key: “tokenization.” In theory, it means porting a slice of a company—stock, credit, real estate, you name it—onto a blockchain so it can trade 24/7 in bite-size pieces. In practice, it’s becoming a clever end-run around a set of rules that have governed U.S. capital markets since the New Deal.

Here’s the short version of how we got here. After the 1929 crash, Washington told companies: “If you want money from the public, open the books.” Audited statements, ongoing disclosures, liability for lying—those were the prices of admission to the big leagues. For decades that bargain held, because retail capital was the deepest pool in town. Fast-forward to the 2020s and a single phone call to a megafund—SoftBank, Sequoia, the Saudi PIF—can raise more cash than an old-school IPO ever could. Private markets are now flooded with trillions, and hot startups like SpaceX, Stripe, or OpenAI can thrive without filing a single 10-K. Great for them; frustrating for the everyday investor stuck outside the velvet rope.

Enter tokenization. Platforms such as Robinhood aren’t waiting for these companies to ring the opening bell; they’re buying (or claiming to buy) private shares, dropping them into a digital wrapper, minting “tokens,” and offering those tokens to retail clients—sometimes abroad, sometimes via giveaways, always under a techno-utopian banner of “democratizing finance.” The pitch: if you can swipe to buy meme coins and zero-day options, why shouldn’t you be able to snag a sliver of SpaceX?

The appeal is obvious: fractional access, round-the-clock liquidity, and a shiny veneer of innovation. But let’s not kid ourselves—this isn’t about blockchains solving settlement friction. It’s about sidestepping a disclosure regime that private companies would rather not touch and that intermediaries find inconvenient. Call it what it is: a proposal to let firms raise money from the public without furnishing the homework that has underpinned U.S. market integrity for nearly a century.

There are real upsides. Retail investors could finally participate in growth that’s been walled off behind venture-capital term sheets. Private companies could reach a broader base without the headaches of quarterly confessionals and activist raids. Liquidity might blossom in corners of the market that have been locked up for years.

But the trade-offs are just as real. Without mandated financials, price discovery leans on rumor and hype. If fraud surfaces, recovering losses gets messy. And the dynamic isn’t exactly grassroots: the big winners, at least initially, are brokerages and exchanges that clip fees on every token flicked across the digital counter.

So where does that leave us? Regulators haven’t slammed the door, yet; Europe is already a testing ground, and the U.S. mood is shifting from reflexive “no” to cautious “maybe.” If policymakers bless tokenized private shares without updating investor protections, we’ll be running the biggest experiment in securities law since 1933—this time led not by Congress but by code.

The bottom line: tokenization could open thrilling new lanes for capital formation and retail access, or it could be crypto’s Wild West pasted onto equities. The technology is the easy part. Deciding how much sunlight a market needs before the public steps in—that’s the real question, and it’s only getting louder.

Zuckerberg’s All-Star AI Draft

When Mark Zuckerberg told Meta employees to “start your timer” on Monday, he wasn’t talking about a product sprint—he was kicking off the most expensive talent draft in Silicon Valley history. The result is Meta Superintelligence Labs, a newly-minted skunkworks that looks less like a research group and more like an NBA All-Star roster in lab-coat form.

Zuckerberg poached heavyweight researchers with résumés that read like a decade-long highlight reel of modern AI breakthroughs: Trapit Bansal (RL chain-of-thought pioneer), Shuchao Bi (voice brains behind GPT-4o), Huiwen Chang (inventor of Google’s MaskGIT and Muse), Jack Rae (DeepMind’s Gopher and Chinchilla), and Shengjia Zhao (ChatGPT and GPT-4 co-creator), to name only a few. These hires arrive alongside Scale AI founder Alexandr Wang, now Meta’s chief AI officer, plus seasoned operators Nat Friedman and—pending paperwork—Daniel Gross. Meta reportedly dangled nine-figure packages to seal many of these deals; WIRED pegs the four-year haul for top recruits at up to $300 million.

Why the open checkbook? Its flagship model, Llama 4, landed with a thud, and follow-ups—code-named Behemoth, Maverick, and Scout—remain stuck in development, leaving the company trailing OpenAI’s ChatGPT, Anthropic’s Claude, and Google’s Gemini. Instead of quietly iterating, Meta chose a blunt-force approach: assemble the brightest minds, give them near-unlimited GPU budgets, and tell them to build something that leapfrogs the field.

But the challenge isn’t talent but taste. Without a decisive technical voice, brilliant researchers can chase half-baked ideas until 100 GPU experiments balloon into 100,000 GPU boondoggles. Meta is probably betting that Wang, Friedman, and Gross can handle it collectively.

Sam Altman is already crowing to OpenAI staff that Meta “had to go quite far down their list.” The next six months will tell whether those barbs sting or motivate.

Meanwhile, Meta’s capex guide could touch $72 billion this year, mostly for AI. If the lab bogs down in ego clashes or another mis-routed “sparse” experiment, investors will start counting how many H100 clusters can be flipped on eBay.

The superintelligence narrative—once called AGI before the acronym lost meaning—now dictates every boardroom budget. “If you believe superintelligence is all that matters, you chase it. Otherwise, you’re a loser.”

NVDA Inches Toward $4 T—And the Runway Still Looks Clear

Nvidia closed Thursday at $159.34, up 18.6 % YTD, putting its market cap at $3.88T—a hair below the combined heft of Alphabet and Meta. The $4 T milestone now sits only a few dollars away.

Competition talk still feels premature. Microsoft’s in-house silicon is running late; Google leans on its TPUs but keeps ordering Nvidia parts for Cloud customers; OpenAI publicly walked back any near-term TPU rollout just two days after a test leak; Apple’s internal silicon, while promising for on-device tasks, isn’t a data-center threat.

On valuation, Nvidia trades cheaper than Broadcom on forward sales and cheaper than Broadcom and AMD on forward earnings—hardly bubble territory given its growth rate. Hit $164 and the $4 T crown is theirs. Next week? Maybe. What matters more is that, for now, no rival looks ready to knock Jensen Huang off the holiday podium.

Tesla: When “Bad” Counts as Good

Tesla just logged its worst delivery quarter ever—382,122 cars in Q2, down 13.5% year-on-year and the second straight sequential drop—yet the shares popped on the day of reporting because the numbers were better than Wall Street expectations, which hovered around 386k. Additionally Ford printed a 14% jump in U.S. sales, GM gained 7%, and Chinese rivals BYD, NIO, and XPeng are sprinting ahead at home. For Tesla’s revenue Autos are ~70% of the top line, so a repeat of Q1’s 20% drop would drag full-year sales well below the current consensus that calls for only a 1.5% slip.

Microsoft: Slimming Down to Bulk Up on AI

Redmond started its new fiscal year by sending 9 000 pink-slips—about 4 % of staff—in its second round of layoffs since April’s 6 000 cut. Management says the aim is simple: offset the tens of billions it’s pouring into data-center build-outs and model training so AI spending doesn’t blow out margins. Teams from sales to Xbox will feel the trim, and remaining employees have been told to lean on Copilot and other in-house tools to raise productivity.

Week Ahead:

It’s a full global calendar coming up:

Sunday: The annual BRICS leaders’ summit kicks off in Rio de Janeiro. OPEC+ also meets, while Vietnam publishes GDP and other economic data.

Monday: Colombia reports inflation; Eurozone May retail sales

Tuesday: CPI data out of Taiwan and Chile. Australia’s central bank decides on rates. French President Emmanuel Macron’s first state visit to the UK. U.S. May consumer credit. Amazon’s Prime Day annual sales event runs through July 11

Wednesday: US “reciprocal” tariffs are set to expire for countries that haven’t cut a deal. The Fed releases its FOMC minutes. Inflation data rolls out from China, Mexico, and Russia. The Reserve Bank of New Zealand is expected to cut rates by 25bps. Meanwhile, Allen & Co.’s high-profile Sun Valley conference begins in Idaho. Samsung is expected to introduce new foldable smartphones and other Galaxy devices at a launch event in New York

Thursday: The Bank of Korea is likely to hold rates steady. Brazil reports inflation. In the US, we get initial jobless claims.

Friday: Canada releases June jobs data. France and Germany publish CPI numbers.

Markets enter the week at record highs as economic bears remain sidelined. Last week’s US jobs report showed 147,000 jobs added in June, unemployment ticking down to 4.1%, and a solid shift from government to private-sector hiring. This marked the 4th straight month of better-than-expected data, forcing skeptics to unwind bearish positions as momentum persists.

Looking ahead, earnings season kicks off in mid-July with banks reporting first. With many stocks sitting at 12-month highs, the risk of “sell the news” reactions will rise. Markets will also stay focused on how trade deals and tariffs play out in the coming future, who the next Fed Chair can be, and what that means for policy direction in the months ahead.

Should be an interesting week. I’ll be tracking it all on X (formerly Twitter): @wallstengine.