Happy Sunday!

We’re starting the newsletter with a bit of history: the market just logged its ninth straight winning day, the longest streak in 20 years. If this keeps up and stretches to 14, it’ll go down as the longest S&P 500 rally since the index was created. That’s no small milestone—especially with everything else going on. This past week had a bit of everything: If there’s one theme that defined it all, it’s “Tech & Tariffs.” There’s more here than we can cover in one sitting, but I’ve pulled together the biggest moves and sharpest headlines to get you fully up to speed. Let’s dive in.

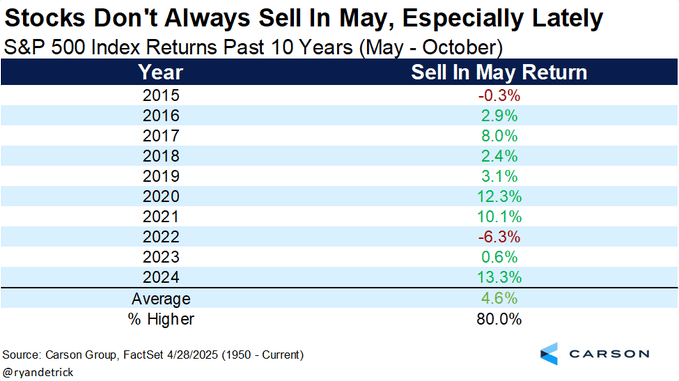

Sell in May? Not So Fast.

Every spring, like clockwork, the old market proverb creeps back in: “Sell in May and go away.” It sounds catchy—and sure, there’s history behind it. Since 1990, the S&P 500 has averaged just a 2% gain from May through October, versus a 7% rally from November to April (per Fidelity). But let’s not pretend this is a playbook to blindly follow—especially not in 2025.

Here’s the kicker: May’s actually been green 9 of the last 10 years. Last year alone, the May–October stretch delivered a +13.3% return. Hardly the stuff of seasonal doom. If anything, you could argue the market’s quietly rewritten the script—maybe we should start calling it “Sell in June, if at all.”

That said, the seasonal lag isn't a myth. According to the Stock Trader’s Almanac, over the last 74 years, the November–April period produced a jaw-dropping +11,657% cumulative return, compared to just +35% for May–October. Bespoke Investment Group backed it up too: the S&P 500 returned +731% during winter stretches since 1993, versus +171% in the summer.

So yeah, the pattern’s real. But context matters.

As Tyler Richey from Sevens Report put it: “The scales are tipped in favor of the ‘May sellers’ this year.” But even he might agree—it’s not about May anymore. As Jay Woods at Freedom Capital bluntly put it: “We’re now in a tariff world. We’re more held hostage to Washington than any seasonal trend.”

In short: it’s less about the calendar, more about catalysts and underlying backdrop. If you’re going to sell, don’t do it just because it’s May. Do it because your thesis changed.

Power Outage in Spain and Portugal: A Grid Wake-Up Call

On April 28, nearly 60 million people across Spain and Portugal were plunged into darkness in one of Europe’s worst blackouts in decades. Flights were grounded, trains froze mid-route, telecoms went silent, and hospitals leaned on backup generators. Initial fears of a cyberattack gave way to reports of a grid malfunction, triggered by a rare “atmospheric vibration” and possibly fire damage to a French high-voltage line.

What Happened – Key Stats

Outage Start: 12:33 p.m. CEST, April 28

Power Lost: 15 GW in Spain (≈60% of demand), 5 GW in Portugal

Duration: 10–12 hours in most areas; longer in rural zones

Fatalities: 8 confirmed (7 in Spain, 1 in Portugal), mostly from generator fumes or fire-related incidents

Evacuations: 30,000+ passengers stranded on trains

Impact Zones: Nearly all of Iberia, with ripple effects into southern France

Telecom & Retail: Mobile/internet collapsed; stores shifted to cash-only, shelves emptied fast

While power was restored within 12 hours for most areas, the event exposed the fragility of an increasingly renewable-heavy grid—Spain and Portugal source ~80% of their power from wind and solar. Experts aren’t blaming renewables, but the infrastructure clearly wasn’t ready for that kind of stress.

April 28 was a dark day—literally—but it lit a fire under European energy policy. As grids go greener and more interconnected, the margin for error keeps shrinking. Expect infrastructure investment to become a front-burner issue, and for traders to start pricing in events like this more often.

GTA VI Delayed to 2026:

It’s official: Grand Theft Auto VI won’t be stealing cars (or hearts) in 2025. Rockstar Games just pushed the release to May 26th, 2026, citing polish, pacing, and crunch avoidance.

Take-Two Interactive (TTWO) took an 8% hit on the news, Fans—many of whom have been waiting over a decade since GTA V’s 2013 release—weren’t thrilled.

Investors still expect GTA VI to be a blockbuster on arrival. In the meantime, 2025 opens up space for other studios like Ubisoft and Gearbox to grab attention with titles like Borderlands 4 or Ghost of Yotei.

Microsoft Takes the Crown Back 👑

Satya Nadella deserves some credit—Microsoft just reclaimed the title of the world’s most valuable company. It ended the week with a market cap of $3.235 trillion, edging out Apple, which closed at $3.07 trillion. The reason’s pretty straightforward: Microsoft’s stock has been strong all year, and it got another boost this week after a solid earnings report for the March quarter.

Apple, on the other hand, has had a rougher ride. Its stock’s been underperforming all year and dropped again after its latest earnings update. Investors have been wary for a while now—Apple’s held onto a premium valuation even though sales haven’t really grown much in recent years. That said, the company’s strong cash flow and dominant position in the smartphone market have kept the worst-case scenarios at bay.

But things have shifted, especially with tariffs introduced during the Trump administration. Apple’s more exposed than most other big tech players since it relies heavily on imported hardware. So far this year, Apple’s stock is down 18%, based on Koyfin data—that’s a steeper drop than most of its peers, including Nvidia. Nvidia has its own issues too, with export controls cutting into its China sales.

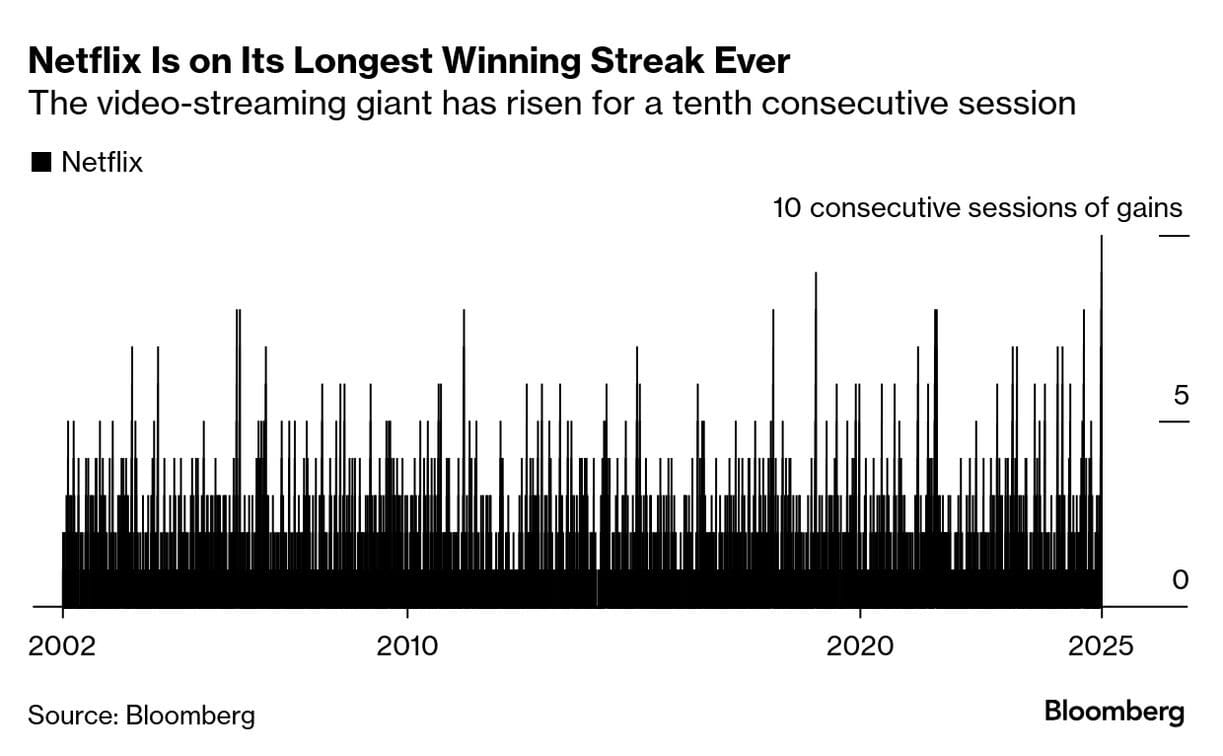

Among the major tech names, only Tesla has fallen more, with a 29% drop. Meanwhile, Microsoft is up 3.27% on the year, making it the best performer among the biggest tech companies. (Netflix is doing even better, up 30%, possibly because it’s seen as a recession-friendly stock.)

Despite its solid performance, Microsoft’s stock is still cheaper than Apple’s or Nvidia’s when you look at enterprise value relative to expected earnings. Microsoft may not be the fastest-growing tech company out there, but in a year like this—full of uncertainty—it’s coming out on top.

Beijing May Be Blinking

China says it’s now “evaluating” trade talks with the U.S.—the first real sign of a thaw since Trump’s tariff hikes last month.

After days of silence and denials, Beijing confirmed the U.S. has “taken the initiative” through back channels to reopen discussions. In response, China says the “door is open”—but warns, “if we fight, we fight to the end.”

There’s talk of a fentanyl export crackdown as an opening gesture, per the WSJ, but so far, neither side has offered to blink on tariffs. The U.S. still holds a 145% rate on all Chinese imports, while China has kept 125% retaliatory duties in place.

Still, even talking about talking feels like a step forward.

Tesla: Insider Buy, Semi Ramp, and FAKE NEWS

Tesla just got its first real insider buy in years. Joseph Gebbia, Airbnb co-founder and Tesla board member, picked up 4,000 shares on the open market—about $1 million worth at $256/share. It’s the first insider purchase since 2020, and it’s a small but notable green light from someone close to the business.

Meanwhile, on the operations side, Tesla’s making a push to ramp up production of its electric Semi. They’ve added over 1,000 workers at the Nevada facility to prep for first deliveries by late 2025, with a long-term goal of hitting a 50,000-unit annual run rate.

Furthermore, A WSJ report on May 1 claimed Tesla’s board had started searching for Elon Musk’s replacement due to shift in Focus. The story triggered a 4% after-hours selloff.

Tesla quickly hit back. Chair Robyn Denholm publicly denied the claim, calling it “absolutely false.” Musk followed up, blasting the report as “deliberately false” and an “EXTREMELY BAD BREACH OF ETHICS”.

Weekly Earnings Recap

META – Another textbook beat: revenue +19 % Y/Y and the best Q1 margin in four years. Management trimmed FY-expense guidance yet lifted cap-ex again to keep the AI flywheel spinning. Advertisers still view the Family-of-Apps as “must-buy,” so the Street is letting Zuck spend.

MSFT – Azure re-accelerated to 33 % Y/Y and is tracking ~34–35 % in the June quarter as fresh capacity lands. Satya signaled FY-26 cap-ex growth will flatten, easing worries about an endless cash burn. Bears calling for an “AI plateau” just lost another inning.

QCOM – The Android down-cycle and tariff friction surfaced in June-quarter guidance, which landed below consensus. Perfect-execution expectations met real-world supply-chain smoke, and the multiple adjusted in a hurry.

Ad & Social

SNAP – Solid Q1 (revenue +14 %) couldn’t offset the chill of “no formal Q2 guide.” Macro ad uncertainty plus heavy brand exposure equals PT cuts up and down the Street.

RDDT – Revenue leapt 61 %, but mgmt. admitted Google search changes are pressuring logged-out traffic; April DAU growth decelerated to the “high-teens %” (vs. Street +24 %). For now, ad budgets are shifting its way and Q2 guidance shows it.

AI Hardware & Infrastructure

SMCI – FY-25 revenue trimmed to $18–19 B as AI-server lead-times lengthen and legacy tariff credits disappear. Even after the cut, the stock still prices in a permanent GPU drought—any hint that shortages ease hurts.

Travel & Leisure

BKNG – Q1 room nights +7 % beat guidance, yet Q2 outlook (+4–6 %) felt light. Management widened full-year ranges to account for “incremental macro uncertainty,” but diversified geography keeps BKNG the sector’s defensive hideout.

ABNB – Nights +8 % Y/Y and a healthy EBITDA beat, but Q2 guide signals modest decel and margin drift as marketing ramps. U.S. softness and weaker inbound travel mean growth depends on new verticals (Experiences relaunch May 13) and faster-growing expansion markets such as Brazil. FY EBITDA-margin target (≥34.5 %) stays intact.

Megacaps in the Tariff Crosshairs

AAPL – Revenue/NP/EPS all up ~5 % Y/Y, but Greater China slipped 2 %. Services missed internal “bogeys” and product gross margin fell 70 bps. June-quarter guide: low-to-mid-single-digit growth and a $900 M tariff pinch, with management warning the impact widens over time. A fresh $100 B buyback dulls the sting but doesn’t erase the headline risk.

AMZN – Clean Q1 beat, yet operating-income guide lagged whispers. AWS backlog grew 20 % Y/Y, but capacity constraints mean the real acceleration waits for 2H-25. Logistics spend and Gen-AI cap-ex keep investors debating margins, while China-sourced 3P seller revenue leaves AMZN exposed if tariff rhetoric escalates.

Cloud & Communications

TWLO – Fourth straight rev-accel (+12 %) and the healthiest margin beat since the restructuring. Management hasn’t seen macro drag through April and kept FY-25 guidance conservative, leaving upside if usage holds.

TEAM – Cloud migrations beat expectations, SMB seat growth steady for a fifth quarter, but fewer multi-year Data-Center deals shaved billings. AI assistant Rovo is now bundled in premium—noise today, likely benefit tomorrow.

XYZ (Block/Square) – Lacked momentum. Rare top-line miss, commentary lacked direction, and investors rotated out. FY-guide cut pushed “Rule of 40” hopes to 2026+. Cash App softness and tariff-inflated POS hardware costs drove the reset; analysts moved to the sidelines until a clearer inflection appears.

ROKU – Revenue +16 % beat, but a lighter Q2 gross-profit outlook thanks to promo-season devices and tariffed components. Platform engagement is fine; investors just need proof the march to positive op income by ’26 is still on schedule.

Burger Blues — McDonald’s & Wendy’s Feel the Consumer Squeeze

The Big Mac index just flashed yellow. McDonald’s kicked off the quarter with its steepest U.S. same-store-sales dip since the 2020 shutdowns (-3.6 %), and management finally admitted the middle-income diner is blinking. EPS squeaked past by a penny at $2.67, but revenue missed as check averages couldn’t offset traffic erosion. The Minecraft-movie toy tie-in gave April a sugar rush, yet that promo lasted only a few weeks. Now the chain is leaning on a newly refreshed McValue menu, the coming launch of McCrispy Strips/Snack Wraps, and another ~$3 B cap-ex push (2,200 new stores) to pull share back. Tariffs? Kempczinski called them a drag on sentiment more than supply, but warned that “geopolitical fog” is clouding the view for the rest of ’25.

Across town, square patties aren’t immune. Wendy’s posted flat-line results—EPS $0.20 in line, revenue a hair light—and logged its first U.S. comp decline (-2.8 %) since Covid’s darkest quarter. Management blamed weather early on and a confidence drop-off in March; the Thin Mints Frosty couldn’t keep the grill hot for long. Guidance came down hard: global system sales now seen -2 % to flat (was +2 %–3 %), EPS trimmed to $0.92–$0.98. Franchisees are handing over P&Ls so HQ can prescribe cost fixes, while a “100 Days of Summer” value blitz tries to rekindle traffic. One silver lining: with 95 % of U.S. ingredients sourced domestically, incoming tariffs won’t hit food costs—just the customer’s mood.

While tech stocks have taken a hit over tariff worries, Netflix has been on a roll, climbing to all-time highs. The streaming giant just notched its tenth straight day of gains — its longest winning streak ever — after posting record profits.

The world’s biggest exchange-traded fund just got its strongest vote of confidence yet.

The Vanguard S&P 500 ETF (ticker: VOO), which holds about $608 billion, pulled in nearly $21 billion last month — the biggest monthly inflow in its 15-year history and the fifth largest ever for any fund, according to Bloomberg Intelligence.

Thanks to its ultra-low management fee of just 0.03%, VOO has become especially popular with everyday investors. In fact, its ticker has kind of become a go-to reference among market analysts when they’re talking about retail trading activity.

“The fact that VOO is pulling in record amounts of money even in a choppy market really shows how much retail investors are stepping in,” said Athanasios Psarofagis from Bloomberg Intelligence.

Slowing Down: Recession Signals Stack Up

The debate over whether the U.S. is heading into recession is getting thinner by the day—because the data is starting to speak for itself.

GDP contracted by 0.3% in Q1, a sharp drop from +2.4% in Q4 and well below the +0.4% growth economists expected. That makes it the first quarterly decline since 2022—and one more negative print away from meeting the textbook definition of a recession.

What’s behind the number?

Consumer spending, which makes up about 70% of GDP, still grew, but just barely: +1.8%, the slowest pace since mid-2023. Imports surged over 41% as companies front-loaded purchases ahead of expected tariff hikes, while exports barely budged at +1.8%, dragging on net trade. Meanwhile, cuts to federal spending tied to the administration’s DOGE initiative also weighed on growth.

Inflation, meanwhile, is quietly creeping higher again. The core PCE index rose 3.5% in Q1 (up from 2.6% in Q4), and the broader PCE index accelerated to 3.6%. The monthly March PCE reading came in at +2.3% YoY, just above expectations—but flat MoM. Good news for the Fed on paper, but not enough to shift the mood.

On the jobs side, the April report looked strong at first glance—+177K nonfarm payrolls (vs. +138K est.)—but earlier months were revised sharply lower, and the unemployment rate remains at 4.2%. Wage growth is steady, not strong: +3.8% YoY, a notch below forecast.

Digging deeper, manufacturing lost 1,000 jobs, even as transportation and warehousing added 29,000, likely due to tariff-driven stockpiling. Factory orders ex-transportation actually fell (-0.2%), and ISM’s Manufacturing PMI at 48.7 still signals contraction. On top of that, U.S. factory production just dropped to its lowest level since May 2020.

JOLTS data also slipped, with openings falling to 7.19M—below both consensus and the prior month’s tally. It’s still a healthy labor market, but clearly cooling.

JPMorgan CEO Jamie Dimon recently told investors the “best-case” outcome from here is a mild recession. The data is starting to agree.

UBS summed it up well: they’re “not overly concerned about the negative GDP print,” but warn that the full weight of tariffs is still to come, and the second half of 2025 may bring a deeper slowdown.

Here’s What Else Happened in Tech This Week

A few notable moves across the tech world:

Snowflake set a $100 million revenue target for its AI software business this year, signaling growing ambition in the space.

Amazon is looking to get deeper into the AI coding business, setting itself up to compete more directly with smaller players like Cursor and Windsurf.

Former OpenAI exec Mira Murati is taking lessons from her time at the AI giant to her new startup, Thinking Machines, where she’ll retain key voting control on major decisions.

Nvidia is adapting to fresh export restrictions by working on a new chip designed specifically for the Chinese market.

The Trump administration has closed a duty loophole that previously benefited platforms like Temu and Shein. At the same time, reporting this week spotlighted troubling labor conditions tied to one of Temu’s delivery contractors

Temu has officially shifted away from direct shipping from China. Orders to the U.S. will now be fulfilled by local sellers, as the company adapts to the closure of the “de minimis” duty exemption.

A new export rule kicking in mid-May will limit how many advanced AI chips U.S. cloud companies can operate overseas. Firms like Oracle are already moving to adjust.

Palantir continues to show resilience and remains a favorite with investors. With earnings coming up this week, its shares are trading just below their all-time high.

On the media side, TV and streaming ad spend—especially around entertainment and news—is expected to drop 10% over the coming year as economic uncertainty drags on.

UPS is in talks with Figure AI to deploy humanoid robots in its logistics network.

Mozilla brought in $570 million in revenue last year—85% of it from its search deal with Google, according to recent testimony from its CFO.

Apple is working with Anthropic to bring the Claude Sonnet AI model into Xcode, aimed at helping internal devs code more efficiently.

Apollo Global Management made a major move in April, investing $25 billion in the wake of the new tariff environment, according to CEO Marc Rowan.

$600 is the cost of a new Xbox Series X console. Microsoft raised prices by $100 and is also hiking pricing on games and accessories amid broader uncertainty on how the trade war will impact supply chains.

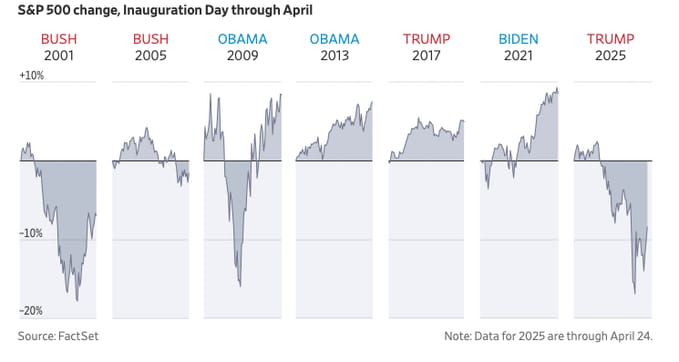

100 DAYS IN: POWER, POLITICS, AND THE MARKET’S COLD SHOULDER

President Trump’s first 100 days back in office have been anything but quiet—and the stock market has taken notice.

In just over three months, Trump has signed a record 143 executive orders, along with 42 proclamations and 42 memorandums—easily outpacing any of his predecessors in the modern era. The orders cover everything from sweeping immigration crackdowns and federal spending cuts to aggressive tariff escalations and government restructuring through the Musk-led DOGE (Department of Government Efficiency). The volume and scope of these orders have drawn both praise and legal scrutiny, with several already facing court challenges.

From a policy standpoint, Trump has moved fast to deliver on core campaign promises. His agenda has targeted mass deportation, slashing the federal workforce, asserting executive control over independent agencies, and reshaping America’s global trade strategy. With full GOP control in Congress, he's enjoyed minimal resistance—at least inside Washington.

But markets haven’t celebrated.

Despite the legislative and executive flurry, Trump’s return has marked the weakest 100-day start for equities in decades. The Dow is down 6.8%, its worst opening act since Nixon’s second term. The S&P 500 has dropped 7.3%, the Nasdaq is off 11%, and the Russell 2000 has cratered 13.2%—with many investors pricing in trade uncertainty, inflation risks, and rising geopolitical friction.

The contrast is sharp. During Trump’s first term in 2017, markets rallied on expectations of corporate tax cuts and deregulation. This time, Wall Street sees more risk than reward in Trump’s protectionist pivot. A new round of tariffs (as high as 145% on some Chinese imports) has already triggered bond market stress and dampened business confidence.

Still, Trump frames the turbulence as part of a necessary reset. He’s argued the U.S. is “reclaiming its store” from foreign exploiters, and insists deals are coming. “Tariffs are great,” he told TIME, despite internal administration concerns over recession risks and market dysfunction.

What stands out most in this early stretch isn’t just the volume of Trump’s actions—but the intensity.

The Week Ahead: A Big Test Just Ahead

We’re coming off a strong stretch — tech’s been ripping, the QQQs are up over 20% from the lows, and earnings have mostly come in solid. But next week sets the stage for a big test: we’re hovering just under the 200-day moving average on the NASDAQ, and that level matters. If bulls want to keep this momentum going, we’ll need to see some real strength show up right here.

This is the first time we've bumped up against the 200DMA since the recent run began — and it’s happening into a loaded earnings calendar and an FOMC meeting. It's a high-stakes moment, plain and simple.

Some folks are brushing off the chart analogs — and yeah, we get it. Comparing now to 2022 can feel like a stretch. But the setups are strikingly similar, and sometimes it's worth paying attention to echoes from the past. If you've ever watched Trader — that early Paul Tudor Jones documentary — you know how much those historical patterns shaped his framework. It’s not about being cute with charts. It’s about recognizing when crowd behavior starts to rhyme.

And right now, this market feels like it's at one of those inflection points. If we can clear that 200DMA cleanly, it could spark another round of positioning — CTAs, funds, and underinvested bulls getting pulled back in. But if we fail right here, that could also be a signal that this bounce was more about oversold relief than a durable trend shift.

The FOMC on Wednesday will carry weight, even if the Fed stays put. Tone, language, and how they talk about growth and inflation will matter — especially with recent data holding up and oil drifting lower. Earnings will keep driving day-to-day action, and it’s a stacked lineup: AMD, SMCI, DIS, COIN, SHOP, and a whole wave of internet and software names in focus.

Breadth is improving, sentiment’s thawed, and a clean break above key technicals could unleash another wave of momentum. This move’s been mostly about positioning/liquidity/momentum, not fundamentals — and we’re now at a spot where reality needs to step in.

This market’s earned a little optimism — just not complacency.