Sponsored by edgeful

Happy Wednesday, Crew!

Hey, so something massive just happened in the business world that you might’ve missed, but it’s going to impact brands you use every day.

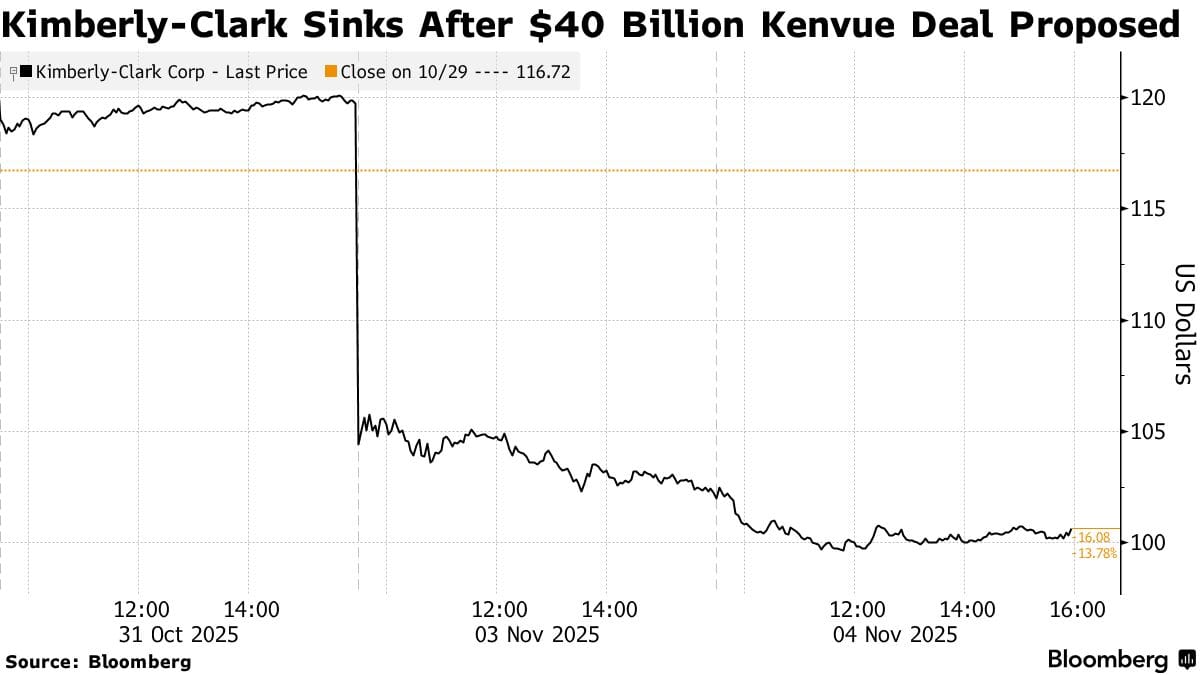

On Monday morning, Mike Hsu, the CEO of Kimberly-Clark, dropped a bombshell. His company, the one that makes Huggies diapers and Kleenex tissues, announced it's buying Kenvue for $40 billion. If you don't know Kenvue, you definitely know their products: Tylenol, Neutrogena, Listerine, Aveeno. By Tuesday afternoon, Kimberly-Clark's stock had crashed 16 percent. Today, as traders are catching their breath, some of the smartest money on Wall Street is quietly betting this disaster might actually be an opportunity. But for now, the stock is still sitting at levels we haven’t seen since 2022.

Let me walk you through what's really going on here.

Kimberly-Clark $KMB ( ▲ 1.28% ) has been stuck for years. Selling toilet paper and tissues isn't exactly a growth business when everyone's cutting back on spending. Mike Hsu has been trying to fix things since he became CEO in 2019, but there's only so much you can do with paper products. Meanwhile, Kenvue owns these health and beauty brands that people actually need, especially as everyone gets older and more focused on wellness.

The timing of this deal is what makes it so interesting. Kenvue $KVUE ( ▲ 1.21% ) has been having an absolutely brutal year. The company was spun out of Johnson & Johnson back in 2023 and has been struggling ever since. Then in September, things got really bad when President Trump claimed that Tylenol's main ingredient could cause autism. Medical groups immediately said this wasn't true, but the damage was done. The stock had fallen over 35 percent before Monday's announcement.

For Mike Hsu, this was the opening he'd been waiting for. Without all the drama around Tylenol, Kenvue would have been way too expensive to buy. Now he could get these powerful brands at a huge discount, though he's also taking on all the problems that come with them.

Here's how the deal works: If you own Kenvue stock, you get $3.50 in cash plus about 0.146 shares of Kimberly-Clark for each share you own. Based on Friday's closing price, that was worth about $21 per share. After the crash on Monday and Tuesday, it's worth more like $18.60. Still, that's a decent premium from Kenvue's $14.37 price before the deal.

What's fascinating is how traders are betting right now. With Kenvue trading around $16 today and the deal worth about $18, the gap suggests the market thinks there's only a 65 to 70 percent chance this actually goes through. Brian Lombardi at FBN Securities thinks everyone's being way too negative. He's telling clients this could be one of those classic situations where fear creates opportunity. If you bet on the deal closing by late next year, you could make high-teens returns on an annualized basis.

But let's be honest about the risks here. The Tylenol situation is scary. A federal judge threw out hundreds of lawsuits in 2023 claiming Tylenol caused autism, but those cases are being appealed. There's actually a hearing scheduled for mid-November. And with the Trump administration's recent comments, more lawsuits could be coming. Kimberly-Clark is basically saying they'll take on all that risk.

There's also the fact that these two companies don't really fit together naturally. Kimberly-Clark knows how to sell to grocery stores and Walmart. Kenvue's products go through different channels, compete against different companies. Hsu will suddenly be competing against focused players like L'Oreal and Colgate that spend way more on marketing and innovation than he's used to.

The backstory on Mike Hsu is pretty compelling though. This guy joined Kimberly-Clark in 2012, and when he took over operations, 22 of their 23 businesses were struggling. He told his team they'd have to "fix the plane while flying it." Since becoming CEO, the stock had only gone up 5 percent before this week, so he needed to do something big.

His logic actually makes sense when you think about it. As people age, they need more health and wellness products. Parents buying Huggies might also grab Johnson's baby shampoo. Older folks buying Depend might need Tylenol too. The combined company would have about $32 billion in annual sales and could save $1.9 billion by cutting overlapping costs.

What's wild is that Kimberly-Clark has essentially locked itself into this deal. The contract says Tylenol problems can't be used as an excuse to back out. If either company walks away, they owe the other side a billion dollars. That's a serious commitment.

The activist investors add another twist. D.E. Shaw was sitting on losses of over $200 million in Kenvue before Monday. Now they'll roughly break even. Starboard Value and Third Point were also pushing for changes at Kenvue. This deal gives them a way out, though some like Toms Capital are sticking around to see what happens.

Wall Street analysts are all over the place on this. Some think Kimberly-Clark is trying to do way too much, especially since they're already in the middle of spinning off some international operations to a Brazilian company. Others point out that the price isn't crazy when you factor in the cost savings, and using mostly stock means they're not loading up on debt.

Both companies' shareholders need to approve this deal, probably sometime next year, with everything closing in the second half of 2026 if it goes through. Between now and then, this gap between where the stocks are trading and what the deal is worth creates this interesting situation for traders.

The market's reaction has been brutal. Monday was bad. Tuesday was worse. Today, people are trying to figure out if everyone's overreacting or if this really is as risky as it seems. The short sellers are having a field day with Kimberly-Clark stock, while some arbitrage funds are quietly building positions betting the deal goes through.

Here's what it comes down to: Either Mike Hsu just made the gutsiest move in consumer products in years and will transform Kimberly-Clark into a health and wellness powerhouse, or he just bet his company on a collection of troubled brands with massive legal problems. The fact that he's willing to take on all the Tylenol risk suggests he really believes in this.

The next few weeks will be crucial. That appeals court hearing on the Tylenol autism cases in mid-November could shift sentiment one way or the other. If Hsu can convince shareholders that putting diapers and pain relievers under one roof makes sense, and if the legal fears turn out to be overblown, this could be remembered as the deal that everyone hated but actually worked.

Right now though, Kimberly-Clark shareholders are not happy. The stock drop has been savage. But sometimes the best trades happen when everyone else is panicking. A bunch of smart traders are starting to think this might be one of those times. Whether they're right or wrong, we'll find out over the next year.

What's certain is that by this time next year, the consumer products industry is going to look very different. And those everyday brands in your medicine cabinet and bathroom are about to have a new owner, assuming Mike Hsu can pull this off.

$1K Could’ve Made $2.5M

In 1999, $1K in Nvidia’s IPO would be worth $2.5M today. Now another early-stage AI tech startup is breaking through—and it’s still early.

RAD Intel’s award-winning AI platform helps Fortune 1000 brands predict ad performance before they spend.

The company’s valuation has surged 4900% in four years* with over $50M raised.

Already trusted by a who’s-who roster of Fortune 1000 brands and leading global agencies. Recurring seven-figure partnerships in place and their Nasdaq ticker is reserved: $RADI.

Now open at $0.81/share, allocations limited – price moves on 11/20.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

Sponsored

Sometimes a setup looks great, but you want to know if the odds are actually on your side. Edgeful helps you check the history behind the move without overcomplicating your process.

You can quickly see how similar price patterns played out in the past, how often breakouts held, or whether volume and trend behavior support the idea. It works across stocks, futures, forex, and crypto.

It is not about guessing the future. It is about using simple stats to decide if a trade makes sense or if patience is better.

Heads up for my readers: Edgeful doesn't usually offer free trials, but they've hooked us up with a 7-day one. If it sounds useful, check it out via the link below—no strings attached, and sometimes passing is the best call.