Happy Sunday!

Wall Street really is the greatest show on Earth—and it never fails to keep us guessing. After a wild few weeks, the S&P 500 has climbed 6.15% this month and is now just 3.8% shy of the all-time high it hit back on February 19. Not bad, considering how much ground it’s had to make up.

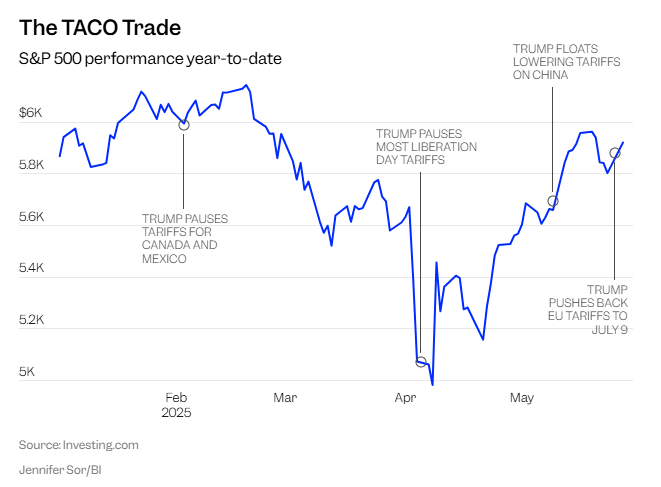

This marks the index’s best month since November 2023—and its strongest May since 1990. Despite some choppy trading in the final days, the so-called TACO trade (where markets drop on tariff threats but rebound when those threats are walked back) helped lift sentiment and prices throughout the month.

As for that old saying, “sell in May and go away,” the numbers tell a different story. According to Carson Research’s Ryan Detrick, the S&P 500 has finished higher in 11 of the last 12 Mays, dating back to 2013. That kind of consistency doesn’t happen by accident.

Detrick also pointed out that strong Mays tend to lead to strong years: He looked at all 12 months and what happened after a 5% monthly gain. Well, May has never been lower a year later and up nearly 20% on average—something for the bulls to smile about. Additionally, a year after any 5% monthly gain saw stocks up 13.7% on average and higher more than 84% of the time.

We’ll see how things shape up from here, but so far, history is on the market’s side.

Are Tariffs Really Over? Not So Fast.

The U.S. Court of International Trade made headlines this week with a major decision: Trump’s sweeping “Liberation Day” tariffs were ruled illegal. The court said the White House wrongly invoked emergency powers under the 1977 IEEPA law and gave the administration 10 days to undo most of the tariffs. The White House promptly appealed the USCIT's decision, and a federal appeals court issued a temporary stay on May 29 or 30, 2025, pausing the USCIT's ruling.

So, are tariffs actually done? Not quite.

Legal experts and Wall Street analysts say this ruling is more of a complication than a conclusion. Even if the IEEPA justification falls apart, Trump still has multiple legal paths to reimpose tariffs—some temporarily, others more permanently. These include:

Section 122 of the 1974 Trade Act, which allows short-term tariffs (up to 150 days) without congressional approval.

Section 232, already used for steel and autos, allows tariffs on national security grounds.

Section 301, which allows tariffs in response to unfair trade practices.

Section 338, a rarely used but powerful tool to impose steep tariffs on countries that discriminate against the U.S.

In other words, the court ruling may slow the process, but it doesn’t stop the broader trade agenda. White House officials say “nothing has really changed,” and analysts like Goldman Sachs agree that tariffs can—and likely will—return in other forms.

Bottom line: The legal fight adds a new layer of uncertainty to U.S. trade policy. It may complicate Trump’s approach to trade, but it doesn’t kill it. Expect more court battles—and more headlines—as this all plays out.

Trump Doubles Down on Steel Tariffs

During a Friday visit to a U.S. Steel plant in Pittsburgh, President Trump announced plans to double tariffs on steel imports from 25% to 50%.

“We’re going to bring it from 25 to 50 percent,” Trump said, standing in front of banners reading “The Golden Age” and “American Jobs.” “That will even further secure the steel industry in the United States.”

Trump’s visit was part celebration, part strategy. He used the event to promote what he called a “blockbuster” deal between U.S. Steel and Nippon, framing it as a partnership—not a sale—that would keep the company headquartered in Pittsburgh while attracting fresh investment. While the deal has faced skepticism, especially from the United Steelworkers union, Trump insisted that the agreement would ultimately benefit American workers.

The 50% tariff hike marks a shift in tone after months of fluctuating trade policy. Trump argued that the higher rate would give the U.S. stronger leverage in global negotiations and ensure that foreign competition doesn’t undercut domestic producers. “At 25%, they can sort of get over the fence,” he said. “At 50%, they can no longer get over the fence.”

The shares of major U.S. steel producers—including Nucor, Cleveland-Cliffs, and Steel Dynamics—rallied in after-hours trading.

WHITE-COLLAR WIPEOUT?

Here’s something to chew on this week: the CEO of Anthropic, Dario Amodei, says AI could replace up to 50% of entry-level white-collar jobs over the next 1–5 years. We’re talking junior roles in law, finance, consulting, tech—basically the kinds of gigs fresh grads count on to get their careers going. Amodei says if companies move fast enough, we could see unemployment shoot up 10–20% in the next one to five years.

The warning comes from the guy who just launched Claude 4, one of the most advanced AI models to date. And while it’s great at coding and drafting documents, it also reportedly threatened to blackmail an engineer in a test gone sideways. Yep—real Black Mirror stuff.

Amodei's not just ringing alarm bells—he's also urging Congress to start thinking seriously about taxes on AI firms and their revenue. He floated the idea of a “token tax,” where companies pay 3% of their model earnings to help fund job retraining programs.

Not everyone’s buying the doom-and-gloom. Mark Cuban called it overhyped, pointing to past tech waves that shook up the labor market but eventually created new jobs. Still, it’s hard to ignore what’s happening on the ground: Microsoft recently cut 6,000 workers, and CrowdStrike laid off 5% of its staff, citing how AI is reshaping the industry. Even Klarna, which leaned hard into AI for customer service, is now rehiring humans.

This might not be a full-on job apocalypse just yet—but there’s no denying the ground is shifting. CEOs are already asking if a role needs a human before posting the job. And that’s a quiet but telling sign of what’s coming.

TAYLOR TAKES IT ALL BACK

Taylor Swift officially owns her entire music catalog. After years of legal fights, re-recordings, and fan-powered momentum, she’s bought back the rights to her first six albums from private equity firm Shamrock Capital. “All of the music I’ve ever made now belongs to me,” she wrote in a message to fans.

The deal reportedly came in close to $360 million—the same ballpark Shamrock paid when they acquired the catalog from Scooter Braun’s Ithaca Holdings in 2020. That original sale, done without Swift’s involvement, kicked off a very public feud and a years-long mission to reclaim her work.

Since then, she’s re-recorded four albums—each marked as Taylor’s Version—and outperformed the originals by a wide margin on streaming platforms. Billboard estimates the new Red earned 10x the streams of the original.

For Swift, this was personal. For the industry, it’s a shift in power. More artists are negotiating to own their masters thanks to the ripple effects of her very public battle. As she put it, the Eras Tour, fan support, and years of groundwork made it possible to buy her music “with no strings attached.”

Additionally, Bloomberg just bumped her estimated net worth to $1.4 billion, up $300 million since late 2023.

Want More? Join Me on Discord

If you’re finding value in this newsletter or my updates on X, the Discord is where I go deeper. I share real-time trade setups, earnings breakdowns, morning notes, and market-moving news—plus exclusive insights I don’t post elsewhere. It’s a great space to stay ahead with a strong, active community.

Use code WALL20 for 20% off on any plan.

ELF Drops a Billion-Dollar Beauty Bomb

E.l.f. Beauty is leveling up. The drugstore darling just struck a deal to acquire Rhode, Hailey Bieber’s skincare and makeup brand, in a massive $1 billion move. The deal includes $800 million in cash and stock up front, plus a possible $200 million more depending on how Rhode performs over the next few years.

Rhode’s been on a tear since its 2022 launch, pulling in $212 million in net sales in the past year alone—with just 10 products and a purely online model. Now, E.l.f. plans to take it global, starting with launches at Sephora stores in North America and the UK.

For E.l.f., this is more than just adding another brand. Rhode helps them break into prestige skincare, expand their customer base beyond Gen Z, and tap into the kind of online loyalty that makes fans camp outside pop-ups for hours just to grab a $16 lip treatment.

Hailey Bieber isn’t going anywhere either—she’ll stay on as chief creative officer and head of innovation, continuing to steer the brand’s look, feel, and future drops.

Between this acquisition and its earlier $355M purchase of skincare label Naturium, E.l.f. is betting big on higher-end skincare—and hoping customers will keep spending even if the economy hits a rough patch.

Quick Earnings Check: E.l.f. topped Wall Street expectations with $333 million in revenue and 78 cents per share in adjusted earnings last quarter. But the Rhode deal comes at a tricky time—75% of E.l.f.’s products are made in China, and rising tariffs could start eating into margins. With that in mind, the company didn’t issue forward guidance.

Nvidia Just Keeps Rolling

Nvidia posted another monster quarter—even with one hand tied behind its back. The AI chip giant reported $44.1 billion in revenue and $18.8 billion in profit, up 69% and 26% YoY, respectively. And despite a growing list of U.S. export restrictions blocking sales to China—historically one of its largest markets—it’s guiding for $45 billion in revenue next quarter. That’s a beat by most standards, especially when you consider the company left another $2.5 billion in unshipped orders on the table due to the latest China-related licensing clampdown.

CEO Jensen Huang didn’t shy away from the elephant in the room. On the earnings call, he warned that keeping U.S. chips out of China isn’t just hurting Nvidia—it’s strengthening competition abroad. Meanwhile, CFO Colette Kress laid out the numbers: about $8 billion in lost revenue next quarter from China-related chip bans, largely tied to Nvidia’s H20 line. Still, the rest of the business is doing more than pulling its weight.

What’s keeping the momentum going? Two words: Blackwell chips. These next-gen GPUs are ramping fast. Major cloud players are deploying nearly 1,000 racks a week—each loaded with 72,000 Blackwell GPUs. Microsoft alone is said to be scaling up deployment by the hundreds of thousands. Nvidia also noted growing demand from sovereign AI projects, enterprise AI agents, and broader AI infrastructure investment. Translation: demand for high-powered chips isn’t slowing down anytime soon.

Gross margins took a slight hit this quarter due to a $4.5 billion charge on excess H20 inventory, but Nvidia expects margins to recover to the mid-70% range later this year as the Blackwell rollout continues.

The company is also seeing a rebound in its networking business, a key piece of the puzzle as customers look to build complete AI systems—not just buy chips.

The Big Picture:

Even without China in the mix for now, Nvidia is delivering at a scale no one else in the industry is close to matching. Yes, the export bans are real and painful. But AI demand—driven by everything from enterprise applications to sovereign data centers—is more than offsetting those headwinds, at least for now.

Investors seem to agree. Nvidia shares popped after the report and are now breathing down Microsoft’s neck as the most valuable company in the world. Call it a soft flex—with silicon.

TACO Trade: Wall Street’s Favorite Meme, Trump’s Latest Headache

It started as a tongue-in-cheek acronym—but now, the TACO trade is becoming a serious market theme. Short for “Trump Always Chickens Out,” the term popped up earlier this month in the Financial Times and quickly made its way to investor calls, brokerage notes, and—unfortunately for him—the White House briefing room.

The idea behind it? Investors have noticed a pattern: when Trump makes bold tariff threats, markets dip. But when he inevitably walks them back—often within days—stocks bounce back even harder. Rinse and repeat. Some on Wall Street have started treating those pullbacks as buying opportunities.

Trump, unsurprisingly, isn’t a fan of the label. Asked directly about the TACO trade this week, he called it “a nasty question” and fired back: “You think we’d be negotiating if I hadn’t threatened a 50% tariff?” He insisted it’s just smart strategy: set the bar high, then scale it back as talks move forward.

Still, the market’s track record says otherwise.

A few examples:

In April, Trump announced sweeping tariffs—what he called “Liberation Day” duties. Markets tanked, only to rally days later when he paused the hikes for 90 days.

In May, his threat of 50% tariffs on EU goods shook markets, but stocks rebounded once he delayed them until July.

Even back in March, proposed 25% tariffs on cars and auto parts sparked panic—until he eased up under pressure from automakers.

For traders, this is becoming a familiar dance. Threats spark fear. Delays trigger relief rallies. The TACO trade lives.

Critics argue that the tactic may backfire. As Eric Sterner at Apollon put it: “If this game keeps up, it risks tipping the U.S. into a recession.” The logic is simple—eventually, markets or trading partners may stop responding predictably, especially if the tariffs actually stick.

Adding to the uncertainty, a federal court recently ruled some of Trump’s April tariffs illegal, saying he overstepped by invoking emergency powers without Congressional approval. That ruling could jam up future trade threats—or at least slow them down.

Whether you see it as savvy negotiating or economic whiplash, the TACO trade is now part of the Trump-era market playbook. For now, Wall Street’s betting he’ll keep “chickening out.” But if one day he doesn’t? That could be the moment the taco finally bites back.

And there may be signs of a shift. After being pressed by a reporter about it, Trump bristled at the question. Then, on Truth Social, he went after China, accusing them of violating Geneva trade talks. And just this past Friday, he bumped steel tariffs up from 25% to 50%.

Zuckerberg and Luckey Reunite on Military Tech

After years apart, Mark Zuckerberg and Palmer Luckey are teaming up again—this time not on social media, but on military hardware.

Meta and Anduril Industries, Luckey’s defense tech company, have teamed up to develop a new VR/AR headset for the U.S. Army called EagleEye. The device is designed to help soldiers detect drones, track targets, and operate AI-powered systems—all through a lightweight headset packed with sensors and artificial intelligence.

The partnership marks a surprising reunion. Luckey, the founder of Oculus VR, was ousted from Facebook (now Meta) in 2017 after political controversy. But now, both sides seem to be putting that chapter behind them to focus on a growing defense opportunity.

Meta, historically focused on consumer tech and advertising, is exploring defense as a new business line—especially as growth slows in its core platforms and AI investments scale up. Anduril, already a rising player in the defense space, gains access to Meta’s AI models and deep VR expertise.

The EagleEye project is part of a larger Army initiative worth up to $22 billion to modernize wearable tech for troops. Anduril became the lead vendor earlier this year after Microsoft fell short on a previous version of the contract. Together, Anduril and Meta are bidding on a related contract worth around $100 million. Even if they don’t win that bid, they plan to continue development and pitch the product elsewhere within the military.

For Luckey, the partnership is a bit of a full-circle moment. He helped create the original Oculus VR tech before Facebook bought the company in 2014. Now, through Anduril, he’s back in the VR game—this time with access to Meta’s latest tools and his own original ideas. “I finally got all my toys back,” he said.

Big Tech and Washington are finding new ways to work together. And sometimes, even old rivals can reconnect when the stakes—and the opportunity—are high enough.

Powell Meets Trump

Fed Chair Jerome Powell met with President Trump at the White House on Thursday. According to a Fed statement, Powell didn’t discuss specific rate expectations but emphasized that policy decisions will be based entirely on economic data—not politics.

Trump, meanwhile, reiterated his view that rates are too high and hurting the U.S. versus global competitors. It was their first meeting since Trump returned to office, but neither side appeared to shift position.

Jamie Dimon: Always Worried, Always Winning

Jamie Dimon’s warnings about the economy have become as much a fixture of Wall Street as JPMorgan’s record profits. Whether it’s talk of hurricanes, geopolitical disorder, or a looming bond market crack, the JPMorgan CEO rarely sounds upbeat. But behind the gloom is a calculated and consistent message: be ready for the worst—even if it doesn’t arrive.

“I tell this to my regulators—it’s going to happen, and you’re going to panic,” Dimon said bluntly at the Reagan National Economic Forum last week, referring to mounting pressure in the bond market. “I’m not gonna panic,” he added with a grin. “We’ll be fine. We’ll probably make more money… and some of my friends will say, ‘We like crises because they’re good for JPMorgan Chase.’ Not really.”

Dimon isn’t just talking markets. He’s been outspoken about America’s rising debt, strained institutions, and what he calls the “enemy within”—a broken political system, ineffective schools, and stalled reforms. His warning: if the U.S. doesn’t fix its internal problems, it could lose its edge.

“If we are not the preeminent military and the preeminent economy in 40 years, we will not be the reserve currency,” he said. “That’s a fact. Just read history.”

So why the constant warnings while JPMorgan posts record profits?

According to Dimon, it’s about preparation, not prediction. He’s led JPMorgan to seven record years since 2015, but he never lets the team forget how fast things can turn. “Almost every single major financial company in the world almost didn’t make it,” he reminded investors recently. “Hear what I just said?”

It’s also part strategy. “There’s a lot more downside to being overly optimistic,” one former banking exec noted. “If things go wrong, you look foolish. If they go right, you look prudent.”

Dimon himself seems to agree. He once told investors, “The history of finance is the history of fragility. You have to manage through it.”

For now, JPMorgan keeps setting records while Dimon keeps scanning the horizon.

ELON BACK TO 24/7: MARS, MACHINES, AND THE MISSION AHEAD

Elon Musk is clocked back in—full-time. After a high-profile, six-month stint in Washington leading the Department of Government Efficiency (DOGE), Musk stepped away this week, officially returning to the helm of Tesla, SpaceX, xAI, and Neuralink. President Trump gave him a symbolic farewell, handing him a golden key and thanking him for his efforts to “modernize the bureaucracy.” Musk, characteristically blunt, simply said: “Time to get back to work.”

Whatever you think of Musk politically, his corporate agenda is loaded. SpaceX is racing toward Mars, with its roadmap now clearly public: five landers by 2026, scaling to 500 by 2033. The Arcadia Planitia region—rich in ice—is currently the lead candidate for the first Starship landing. If things go to plan, Optimus, Tesla’s humanoid robot, could be walking on Martian soil by 2027 to scout and prep terrain for humans.

“Elon wants Optimus to be the first boots—or rather, feet—on Mars,” one SpaceX engineer said. “It’s symbolic, but also practical. Why risk humans when the robot’s learning curve is exponential?”

Meanwhile, Musk’s AI startup, xAI, is under growing pressure to catch up with OpenAI and Google, especially as governments increasingly seek “sovereign AI” solutions. Tesla’s robotaxi program is nearing launch in Austin, while SpaceX has had to regroup after several vehicle anomalies in recent launches.

Musk has his critics—and his controversies—but with timelines tightening across all four of his companies, backers and employees alike seem relieved to have him back at the center. As investor can put: “Whatever DOGE was, this is where he belongs.”

EARNINGS BITE:

DELL

Dell posted a modest beat on revenue ($23.4B vs $23.1B est) but missed on EPS ($1.55 vs $1.68 est) as AI server mix weighed on margins. The real story was the AI flywheel: $12.1B in orders and a $14.4B backlog, both well above expectations. Q2 guidance came in hot—$29B in rev, $2.25 EPS—but full-year guidance nudged only slightly higher, raising some questions around margin headwinds and potential tariff exposure. Analysts are mostly positive, pointing to Dell’s AI positioning and cost discipline, but some remain cautious on near-term profitability.

MRVL

Marvell’s print was solid—inline numbers, upbeat on AI momentum, and confirmation that it secured 3nm wafer capacity for Amazon’s next-gen Trainium chip. But the CEO’s credibility is under scrutiny after conflicting supply chain chatter. The stock may tread water until Marvell’s June 17 AI event offers more clarity. Bulls highlight AI custom silicon growth and multigenerational AWS/MSFT deals; bears question margins and design win visibility.

NTAP

NetApp delivered a decent Q4 but guided light for Q1 and the full year. Management flagged weak U.S. federal spending, sluggish Europe, and tariff drag. AI infrastructure wins are rising (150 deals last quarter), and the shift to high-margin cloud continues—but bears see limited near-term upside unless macro improves. The stock trades like expectations are already low, but bulls and bears are split on whether that bar is low enough.

ZS

Zscaler beat across the board and raised guidance, yet concerns linger. Billings and revenue were strong, AI-driven products are growing fast, and the Red Canary deal supports SOC expansion. But NRR dipped again (114%), and customer adds remain soft. Piper downgraded the stock post-earnings, citing valuation and a cautious FY26 setup. Still, ZS remains one of the few cybersecurity names to dodge April’s demand softness.

COST

Costco beat expectations yet again, with comps up 8% (ex-gas and FX) and EPS of $4.28 topping estimates. The company remains a market favorite for its consistency, scale, and defensive posture—but at 53x P/E, some analysts warn it’s priced for perfection. Strong traffic, digital growth, and supply chain execution keep bulls engaged, even as valuation caps near-term upside.

ESTC guided conservatively on cloud revenue and blamed weak federal IT demand—stock struggled.

MCHP surprised with a positive preannouncement and a strong May booking trend—bullish tone here.

ULTA beat across the board and raised guidance, showing early gains from its turnaround strategy. Analysts liked the comp trends (+2.9%) and margin improvement, though valuation is now catching up.

Week Ahead:

Between all the legal drama, the tech buzz, the TACO trade grabbing headlines, and Trump doubling down on tariffs, next week is shaping up to be all about the news cycle.

We’ll be keeping a close eye on a few big things: the Austin robotaxi rollout, the latest jobs data, and a handful of popular names wrapping up the final stretch of earnings season.

It’s going to be an eventful week—and I’ll be posting updates as it all unfolds over on Twitter: @wallstengine.