Happy Sunday!

The U.S. has officially struck Iran and entered the war. Late last night around 10 PM ET, Trump addressed the nation, confirming that B-2 bombers hit three nuclear sites in Iran: Fordow, Natanz, and Isfahan. He called the operation a spectacular military success, saying those sites were completely and totally obliterated.

Trump also warned that Iran must now choose peace—or face even greater strikes. He made it clear that if peace doesn't come, the U.S. will go after other targets. The UN nuclear watchdog has reported no increase in off-site radiation levels—for now.

Furthermore, U.S. Secretary of Defense Pete Hegseth is holding a press conference at the Pentagon at 8 AM today. With that, let’s get into the stories that moved Wall Street this week.

Reddit: From AI Casualty to AI Beneficiary?

Just a month ago, Reddit was the poster child for "AI is eating our traffic." Short sellers were leaning in, post-earnings sentiment was grim, and the big narrative was: Google's AI Overviews were going to zero out the value of human-forum content. Now? The script has flipped—hard.

In a LinkedIn post this week, Reddit’s team flagged an encouraging shift: search traffic is up. And not just a little. According to Ahrefs and SensorTower, Reddit’s organic visibility in Google results—while others saw declines—actually ticked higher in early June. That’s the first real inflection since February.

So what changed? In late May, Google began rolling out AI Overviews as a near-default experience. These summaries pull answers from across the web—and guess which site they now cite the most after Wikipedia? Yep, Reddit.

Semrush ranks Reddit as the #2 most-referenced site in AI Overviews. That alone is a massive win for brand visibility. But it gets better: Reddit content is not just being cited more—it's being surfaced more. According to data from OpenAI’s o3 model, Reddit is now up to 10x more likely to show up in AI answers than it was in traditional blue-link search. Across all queries, you're 2–3x more likely to see Reddit in AI results than before.

This is a wild reversal from May’s bear case. And it has real implications. Sell-side shops like Wells Fargo had been pricing in minimal “logged-out” traffic value for Reddit, arguing those users bounce too quickly for ad monetization to matter. But what if that traffic isn’t just passive anymore? What if it feeds a stronger top-of-funnel, especially as Reddit rolls out AI-powered ad tools like Reddit Insights and Conversation Summary Add-ons?

Those tools, built on Reddit’s new “Community Intelligence” engine, pull insights from 22B+ posts and comments to offer marketers real-time feedback loops and social proof. Early test results? +19% click-through rates versus standard image ads. That’s real lift.

And then there’s Meta’s $14.3 billion investment in Scale AI last week. B. Riley analysts see that as a strong read-through for Reddit’s valuation and relevance. If curated data is the new oil for LLMs, Reddit is sitting on one of the deepest wells—1B+ posts, 16B+ comments, and 10M+ daily user interactions. The analysts point out that while Scale AI focuses on labeling, Reddit’s human-generated content offers unique raw training value. Plus, its independence (like blocking Microsoft from scraping) only adds to its future licensing leverage.

All this—improving data, a shifting narrative, high short interest, and a more favorable AI tailwind—sets Reddit up nicely ahead of earnings. It’s no longer about traffic collapse—it’s about relevance, visibility, and unique value in the AI race.

META’s Big WhatsApp Flip: Ads Are Here — For Real This Time

Remember when WhatsApp proudly promised: “No Ads! No Games! No Gimmicks!”? Yeah… about that.

This week, Meta confirmed that ads are now officially live inside the WhatsApp app, tucked into the Updates tab — a move that ends over a decade of ad-free messaging and marks a major shift in the app’s DNA.

For years, Meta danced around the idea of monetizing WhatsApp. Now it’s dancing straight in. You’ll start seeing sponsored “Status” updates — basically ads from businesses appearing alongside the Stories-like feature that disappears after 24 hours. Meta insists your personal chats and calls will remain untouched and encrypted, but this rollout opens the door to something bigger.

Wells Fargo is already forecasting a $6 billion annual revenue opportunity just from these Status ads, comparing them to Instagram's early monetization path. Meta says these new ad products are “built with privacy in mind,” using limited targeting (think location, language, channel follows, etc.) and not pulling data from your messages. Still, critics argue this is a betrayal of WhatsApp’s founding principles, and privacy groups have been vocal about their concerns.

But here’s why this actually matters — not just to users, but to Meta’s long-term AI + ad strategy.

WhatsApp has 3 billion users globally. That’s more than Instagram. Yet, it’s long been the least monetized asset in Meta’s portfolio. By finally flipping the ad switch, Meta isn’t just looking to plug in more dollars — it’s unlocking an entirely new ad surface on one of the most engaged platforms on earth.

And it doesn’t stop with Status ads. Meta is also introducing:

Promoted Channels – helping brands gain visibility.

Channel Subscriptions – eventually letting users pay for exclusive content, and Meta take a cut.

AI ad tools – that turn product photos into auto-generated video ads, giving small businesses more affordable ways to advertise across Meta’s platforms.

All of this ties back to Meta’s $14.3B investment in Scale AI — a clear bet on the future of training smarter, more efficient AI ad tools. B. Riley analysts say this deal is a bullish signal for the value of unique, structured data — the kind Meta wants from everywhere, including WhatsApp. If the AI arms race is driven by data, WhatsApp’s 3B MAUs, 1.5B daily Update tab users, and deep engagement are a goldmine.

If you’d rather trade on facts than feelings, edgeful is worth a look. It crunches decades of price-action data—volume, intraday stats, the whole lot—and rolls it into one analytical dashboard, pulling in price-action probabilities, volume trends, seasonality and the “What’s In Play” screener so you can see which tickers are setting up right now. No spreadsheets, no code—just solid odds you can act on.

edgeful is clearly built by traders who can’t stand noise—think clean charts, lightning-quick filters, and a live help huddle when you want a second opinion.

Exclusive for our readers: Edgeful doesn’t offer a public free trial, but I’ve arranged a 7-day free trial just for you. Click here to try it out—and remember, the best edge is sometimes knowing when not to trade.

Tesla’s Robotaxi Era Kicks Off in Austin

It’s happening. After years of promises, hype, and memes, Tesla's robotaxi service officially hits the road this Sunday, June 22, in Austin. The service will run daily from 6AM to midnight and be invite-only, at least for now. Early Details say it’ll be operating with geofenced Model Ys—no airport rides just yet.

Per Bloomberg, Tesla’s Full Self-Driving (FSD) software has racked up a staggering 3 billion autonomous miles—a jaw-dropping lead over Waymo’s 22 million. Even more surprising? Tesla’s Q1 crash rate was just 0.15 per million miles, compared to Waymo’s 1.16, and way below the U.S. average of 3.9.

And Tesla’s doing this with fewer sensors. While Waymo’s vehicles are decked out with 40+ sensors including lidar and radar, Tesla relies almost entirely on cameras—and still reports fewer crashes.

But autonomy isn’t just about tech—scale matters too. Tesla builds its own cars. Waymo doesn’t. Tesla is targeting a fleet of 35,000 robotaxis by 2026, while Waymo is aiming for just 2,000. That manufacturing edge could prove key in driving costs down and margins up.

Wedbush’s Dan Ives calls this “the golden age of autonomy.” He sees Tesla’s robotaxi potential unlocking a $1 trillion opportunity.

OpenAI and Microsoft Hit a Wall Over Stake Talks

Tensions are rising between OpenAI and its biggest backer, Microsoft, as negotiations over a potential restructuring stall. According to WSJ, OpenAI execs have considered filing antitrust complaints against Microsoft, citing frustration over the company’s influence and demands for a larger stake in a proposed for-profit spinoff.

OpenAI is looking to raise $20B and restructure, but that requires Microsoft’s approval. Talks have hit a standstill, in part due to Microsoft’s push for more ownership than OpenAI is willing to offer. A key sticking point is IP rights from OpenAI’s $3B Windsurf deal, which OpenAI wants to keep off-limits.

At the same time, OpenAI recently won a $200M AI contract with the U.S. Department of Defense, its first major government deal. That puts it in direct competition with Palantir, which has long dominated the government AI software space.

Sources also say OpenAI wants to modify revenue-sharing terms, ease exclusivity for model hosting, and limit Microsoft's future profit claims—offering a 33% stake in exchange.

Despite the stalled talks, Microsoft retains access to OpenAI’s models through 2030 under its existing agreement.

Senate Tax Bill Clouds Solar Outlook

This week, the Senate GOP released its version of the sweeping tax bill—and it’s a major blow to residential solar. The proposal phases out investment tax credits (ITCs) for rooftop solar starting in 2026, with full expiration by 2028. That’s a big deal for companies like Sunrun (RUN), Enphase (ENPH), and SolarEdge (SEDG), whose models rely heavily on those credits to keep solar affordable for homeowners.

Sunrun dropped 40% on the news, with peers not far behind, as investors digested what removing these subsidies could mean. A $20,000 system without incentives is now just that—$20,000 out of pocket.

Some clean energy techs were spared: nuclear, biofuels, battery storage, and geothermal received more favorable treatment. Fluence Energy (FLNC), for example, jumped double digits on optimism around storage incentives.

There may still be a lifeline: solar sold under power purchase agreements (PPAs) could still qualify for credits under certain structures. Sunrun uses this approach, so there’s hope depending on how final language shakes out.

Meanwhile, utility-scale players like First Solar (FSLR), Nextracker (NXT), and Array (ARRY) are in much better shape. Their exposure to 45X manufacturing credits, which remain largely intact through 2031, keeps their models more insulated.

That said, some ambiguity remains. Analysts flagged that a provision known as 45X stacking—which allows vertically integrated solar manufacturers like FSLR to claim credits for multiple components—might be rolled back. If so, it could cut potential credits by up to 60%, pressuring margins.

The Fed’s Summer of Wait-and-See

The FOMC parked rates at 4.25 – 4.50 % for the fourth straight meeting and, on paper, still expects two quarter-point cuts before Santa shows up. But the famous dot plot now looks more like abstract art than a roadmap: seven policymakers want zero cuts this year, two want one, eight still want the original two, and a lonely pair are dreaming of three. Translation: conviction is in short supply.

Chair Jay showed up in full “policy purgatory” mode—confident enough to brag that “it’s a pretty good labor market,” but cautious enough to warn that fresh tariffs could goose prices later this summer. His greatest hits:

“The labor market’s not crying out for a rate cut.”

“Uncertainty has come down, but it’s still elevated.”

Policy is “modestly restrictive,” i.e., just tight enough to feel like skinny jeans after Thanksgiving.

Political fireworks: Trump vs. ‘Too Late’ Powell

Back home, Donald Trump has gone full caps-lock on X, calling Powell a “dumb guy,” threatening to “force something,” and even joking he might “appoint myself at the Fed.” He wants rates 2–2½ points lower—yesterday. So far, Powell hasn’t buckled, and history backs that play:

Greenspan hiked a token 100 bps in his final year (2006)

Bernanke kept rates flat in 2014

Yellen raised just 75 bps in 2018

Fed chairs typically dig in late in their tenure to protect their legacy on inflation—no matter who’s tweeting.

Why the stalemate?

Low-Hiring, Low-Firing Economy. Payroll growth has cooled, yet layoffs remain scarce. That odd combo keeps unemployment hovering near 4.2 %—good enough for Powell to chill.

Tariff Wild Card. Higher import duties may shove goods prices higher; nobody knows how far or how fast. The Fed wants data, not guesses.

Split Mandate Tension. Growth is easing, but inflation forecasts just ticked up (3 % core PCE for ’25). If both slow growth and sticky prices show up together, the dual-mandate tug-of-war gets real.

The hawk-dove subplot

Governor Chris Waller—the committee’s plain-spoken economist—basically said “why not cut as soon as July if the data let us?” That plants an early-cut seed, even as Powell keeps his gardening gloves off for now.

The Fed’s just sitting by the window on the data-dependent express—enjoying the ride, no stops till late summer. If tariffs bite and hiring slows, cuts roll in. If inflation won’t cool, buckle up for a longer hold. Until then, the only thing set in stone is… more uncertainty.

And beyond Powell? Nobody knows. Traders are already gaming a 2026 scenario where a Trump-appointed chair could unleash an aggressive cutting cycle.

Amex and JPMorgan Double Down on Luxury Card Perks

The premium credit card rivalry is heating up. JPMorgan just revamped its Sapphire Reserve card, boosting its annual fee from $550 to $795 and adding new perks like $500 in hotel credits and $300 in dining benefits.

In response, American Express teased its biggest-ever refresh to the Platinum Card, set to roll out this fall. Details are scarce, but Amex says new travel, dining, and lifestyle perks are on the way, along with lounge upgrades and expanded hotel access. The company is leaning into younger spending trends—Millennials and Gen Z now drive 35% of U.S. consumer spend.

US Adds 1,000 Millionaires a Day in 2024

Credit: Paramount Pictures

UBS’s 16th Global Wealth Report shows the U.S. now holds 23.8 million millionaires, adding nearly 1,000 new ones daily this year. That’s nearly 40% of global millionaires and an equal share of worldwide wealth. Strong equity markets and a resilient dollar were the main drivers.

Key figures:

Global wealth rose 4.6% in 2024, bouncing back from a 3% dip in 2022.

U.S. added 379,000 new millionaires this year.

Total global millionaires: 60 million.

UBS projects another 5.3 million millionaires by 2029.

UBS also highlighted the “Everyday Millionaire” (those with $1–$5M in assets)—dubbed “EMILLIs.” There are 52 million in this group, and they now hold nearly as much wealth as those worth more than $5M.

Regional trends:

North America and Oceania still lead in average wealth per adult.

China saw rapid growth in the $100K–$1M bracket, showing a rising middle.

Eastern Europe topped regional growth at +12%, supported by equity and currency gains.

Looking ahead: UBS notes a massive $83 trillion wealth transfer expected over the next 25 years, which could significantly shift financial markets and consumer behavior.

Want More? Join Me on Discord

If you’re finding value in this newsletter or my updates on X, the Discord is where I go deeper. I share real-time trade setups, earnings breakdowns, morning notes, and market-moving news—plus exclusive insights I don’t post elsewhere. It’s a great space to stay ahead with a strong, active community.

Use code WALL20 for 20% off on any plan.

Lakers Sold at Record $10B Valuation

The Los Angeles Lakers have been sold at a record ~$10 billion valuation, per ESPN. The Buss family, which has owned the team since buying it for $67.5M in 1979, is selling its 66% majority stake to Mark Walter—CEO of Guggenheim Partners and owner of the Dodgers, Sparks, & more. Jeanie Buss will remain team governor. Walter already owned a minority stake and had first rights since acquiring Philip Anschutz’s 26% in 2021. The deal sets a record NBA franchise valuation. Walter also holds stakes in Chelsea FC, RC Strasbourg, and the PWHL

Stablecoins elbow their way onto Main Street

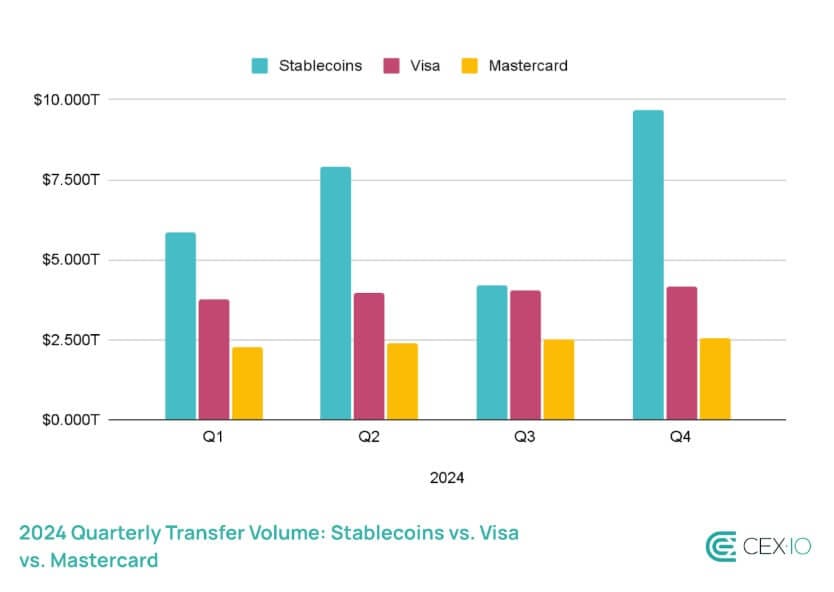

If you blinked this week you probably missed a turning point: the U.S. Senate’s 68-30 nod to the GENIUS Act, the country’s first federal stable-coin rulebook. The bill still needs a House sign-off, but the headline alone lit a fire under every token tied to the dollar—and put the card giants on notice. Stable-coin transfer volume already hit $27.6 trn in 2024, topping Visa + Mastercard by almost 8 %, so Washington’s green light feels less like a science-fair ribbon and more like a starter’s pistol.

Front and center is Circle, whose USDC now commands roughly $60 bn in float. Fresh off its NYSE debut, the Boston firm outlined a real-time Circle Payments Network aimed at cross-border remittances—think “SWIFT without the 48-hour hold.” Investors loved it: CRCL spiked 18 % the morning after the Senate vote, while V and MA slipped.

Coinbase wasted no time, rolling out Coinbase Payments—a USDC checkout stack that’s already live on Shopify and promises 24/7 settlement without merchants ever touching a wallet. The exchange also struck a deal with Nodal Clear to let USDC serve as collateral for regulated futures in 2026, underscoring how fast dollar-backed tokens are bleeding into old-world plumbing.

That backdrop explains why Mastercard has its worst day since 2023 this week and has its worst week in a while and with Visa also following. With Walmart and Amazon reportedly prototyping their own coins and USDC now accepted everywhere from derivatives desks to e-commerce carts, the market is starting to price a future where value hops across blockchains instead of the card networks’ five-tier toll road

None of this means the plastic rails vanish overnight—USDC still needs banks, and Circle still needs compliance chops to match that glossy new rulebook. But the trend line is unmistakable: whenever dollars can move at internet speed for a fraction of a penny, the question shifts from if the incumbents get squeezed to how soon. Keep an eye on the House vote and on retailer pilots; if either breaks Circle’s way, we may look back at this as the week stable-coins stopped knocking and simply walked in.

Here’s What Else Happened This Week

Amazon Ads + Roku inked an exclusive CTV pact giving brands one-stop access to 80 M authenticated U.S. households via Amazon DSP; tests hit +40 % unique reach and –30 % ad-repeat. Nationwide by Q4.

U.S. mulls yanking chip-plant waivers for Samsung, SK Hynix & $TSM in China—next salvo in tech crackdown.

China 🇨🇳 retail sales popped +6.4% YoY in May—best clip since ’23—powered by early “618” promos; home-electronics +53 %, phones +33 %.

Waymo could snag 10% of U.S. rideshare by 2030 (Wells Fargo); that’s 465M rides vs. 18M in ’25—pain for $UBER & $LYFT.

TSMC finished its first Arizona wafer run—20K chips for $AAPL, $AMD, $NVDA (A16, EPYC, Blackwell).

DOJ has opened a $32 B antitrust review of Google’s bid for cloud-security firm Wiz; breakup fee = $3.2 B if it flops.

Bank of Japan is eyeing a 50 % cut to JGB buying, trimming quarterly purchases to ¥200 B starting April ’26; rates still on hold for now.

Amazon will sink A$20 B (~$13 B) into Aussie data-center build-out through 2029—country’s largest tech cap-ex ever—plus three new solar farms.

Masa Son’s “Project Crystal Land”: a proposed $1 T AI-robot mega-hub in Arizona; courting tax breaks and $TSM/Samsung tenants.

Marvell ($MRVL) now targets $18-19 B AI DC sales by CY ’28 on 60 % TAM jump; BofA hikes PT to $90.

Oracle + xAI: Grok models land on OCI; Grok-3 will train on Oracle’s GPU clusters for cheaper scale.

Meta swing-and-miss: Zuck courted Safe Superintelligence for $32 B and eyed Perplexity AI, but settled for a $14.3 B, 49 % stake in Scale AI instead.

Meta × Oakley drops “Performance AI Glasses” July 11—3K video, 8-hr battery, Meta AI—starting at $399.

Applied Intuition raised $600 M at $15 B valuation—up 2.5× YoY—to power AV, drone & defense AI; likely last private round pre-IPO.

SoftBank off-loaded 21.5 M $TMUS shares for $4.9 B, trimming stake to 5.6 % in the biggest U.S. block sale since ’23.

Eli Lilly ($LLY) buys Verve for $1.3B, grabbing gene-editing assets for PCSK9 & Lp(a); analysts say “only Lilly could pull this off.”

FDA launched the CNPV voucher, slashing drug-review time to 1–2 mo for nat-sec health priorities.

Instacart × Pinterest: ads now tie recipe or beauty Pins to same-day Instacart checkout using CART first-party purchase data.

Ferrari’s first EV will debut this year (large, not an SUV); second model pushed to ≥2028 on weak super-EV demand.

Netflix House fan hubs (100 K sq ft each) coming to Philly, Dallas (late ’25) and Vegas Strip (’27) with games, VR and themed eats.

OpenAI dangling 10-20 % discounts on ChatGPT Enterprise bundles; eyes $15 B annual rev by 2030.

Amazon warns AI “agents” will trim head-count over the next few years.

Apple foldable iPhone still slated for 2H26 mass-prod; Samsung prepping 7-8 M panel run.

Amazon shelving its Kia Soul same-day courier pilot; routes revert to Flex gig drivers.

Apple faces shareholder suit over Siri AI timelines and is in very early Perplexity AI talks.

A record 16 B passwords leaked across 30 new DBs hitting $AAPL, $META, $GOOGL, GitHub, Telegram, VPNs—biggest breach ever.

Kering shares ripped +8 % as Renault boss Luca de Meo was tapped as CEO to revive Gucci.

Nissan will dump ~5 % of its 15 % Renault stake, raising ¥100 B (~$640 M) to fund new-EV R&D—further loosening the two-decade alliance.

Rheinmetall × Anduril to co-produce Barracuda missiles & Fury drones in Europe, exploring home-grown rocket motors.

Robinhood added simulated options P/L and pro charting to mobile.

Canva planning a secondary sale valuing the design unicorn at $37 B, giving employees liquidity pre-IPO.

Starbucks will tweak the menu toward RFK Jr.’s “MAHA” low-sugar vision, per the candidate.

Nike-Skims collab delayed on production snags—new launch TBD this year.

Trump pushes TikTok divestiture deadline out another 90 days.

Week Ahead:

The week kicks off on Sunday with eyes on Elon Musk, who previously said he “tentatively” expects Tesla to begin its fully driverless ride-hailing service in Austin today.

Monday brings Argentina’s latest GDP numbers, offering a read on the country’s economic recovery trajectory.

On Tuesday, markets will be watching Canada’s CPI release, while the NATO Summit gets underway at The Hague. In the U.S., New York City holds its mayoral primary, and over in Beijing, China’s top legislative body—the Standing Committee of the National People’s Congress—convenes. Fed Chair Jerome Powell also heads to Capitol Hill to testify before Congress

On Wednesday, Powell returns for day two of testimony. Australia reports CPI, Spain posts GDP figures, and the U.S. releases new home sales. The Bank of Thailand is also set to announce its interest rate decision.

Thursday is packed: Mexico’s central bank is widely expected to cut rates by 25 basis points. In Brussels, the EU Leaders Summit begins, while in the U.S., revised Q1 GDP numbers drop alongside earnings from Nike.

The week closes out Friday with the Fed’s annual bank stress test results and PCE inflation data from the U.S.—a key metric for monetary policy. France, Spain, and Japan all report CPI, and Canada rounds things out with its own GDP release.

And with major geopolitical developments over the weekend, expect a busy, headline-driven week. Should be an interesting one. I’ll be tracking it all over on X (Formerly Twitter): @wallstengine.