Sponsored by edgeful

Happy Sunday, Crew!

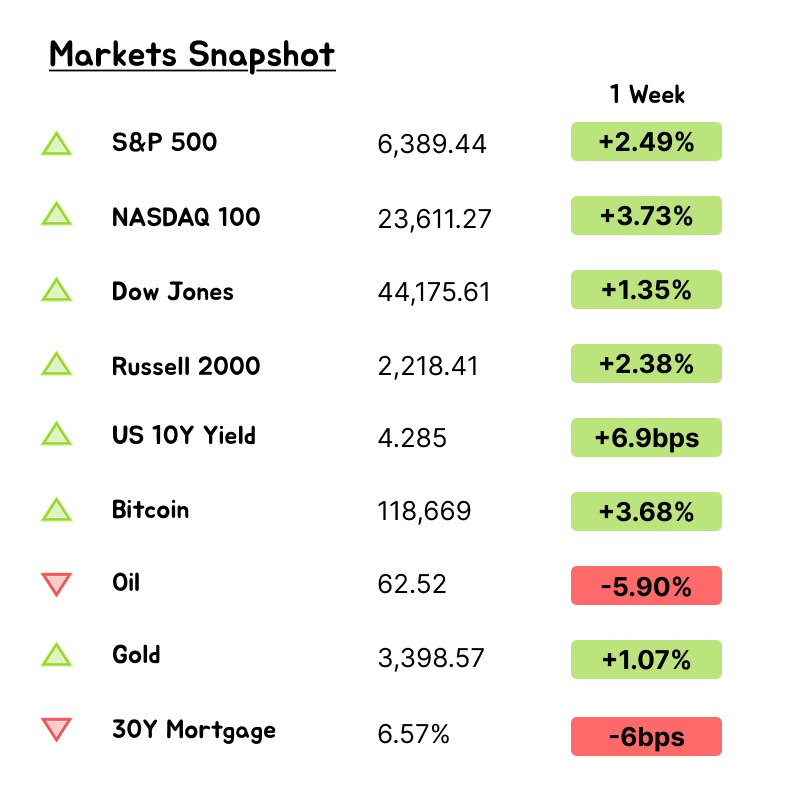

Hope you’re enjoying the weekend. Ethereum just popped above $4.3K for the first time since 2021. I’ll hit the key stories up top, and paid subscribers can catch the earnings previews for ONON, SE, and CSCO at the end. Let’s dive in.

Sponsored

We've all been there—making decisions based on a feeling or a quick glance at the charts, only to second-guess ourselves later. If you're looking to bring more data into the mix without overcomplicating things, edgeful. might be worth a look. I've been testing it out recently, and it's helped me get a clearer picture of market behaviors pretty quickly.

Trade with your head, not your gut. We've all been there—making decisions based on a feeling or a quick glance at the charts, only to second-guess ourselves later. If you're looking to bring more data into the mix without overcomplicating things, edgeful might be worth a look. I've been testing it out recently, and it's helped me get a clearer picture of market behaviors pretty quickly.

What edgeful does is pull together stats on things like price patterns over the day or longer trends, volume shifts, and even how assets perform on certain days of the week. It's not about flashy predictions; it's more like laying out the historical odds so you can weigh them against what you're seeing in real time.

Think of it as a straightforward way to check the backstory on a setup. For stocks, it might show how often a gap-up has closed or continued in similar situations. With futures, you could see the frequency of breakouts from the morning range sticking or fading. Nothing revolutionary, but it puts the numbers right there, helping you decide if a trade aligns with past patterns or if it's better to sit one out.

It works across a range of markets—stocks, futures, forex, and crypto—so if you dip into different areas, it's handy to have one tool that covers them.

One thing for my readers: edgeful usually doesn't do open free trials, but they've set up a 7-day one just for us. If you're curious, give it a try through the link below. No pressure—sometimes the smartest move is knowing when to pass.

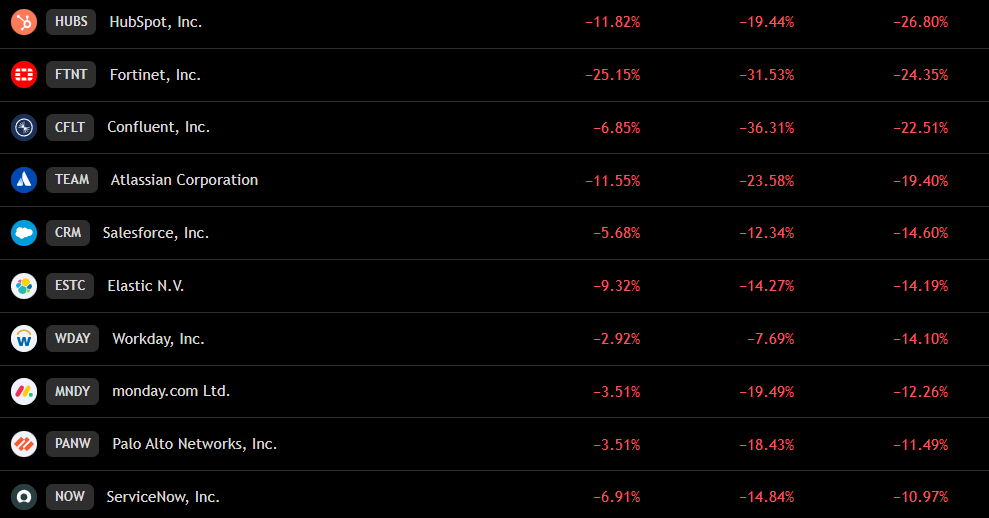

SaaS Is Cracking. AI Is The Reason.

If you have been watching software lately, you know it has not been a fun tape. The price action has been weak for weeks, and every bounce seems to get sold. It is not one headline or one miss. It is a bigger reset in how investors want to value this part of tech. The new AI cycle is pushing people to question the old seat based playbook. If agents can do more of the work and code gets commoditized, then paying a premium for each human seat starts to feel dated. That story alone does not kill a business. It does change how the market looks at the future. When growth feels less certain, the multiple comes down. In a higher rate world, that hits fast.

This does not read like a normal pullback. In a normal pullback, good prints fix things. Lately we see beats fade by the afternoon. Companies guide fine and still get marked lower. That tells you the market is not reacting to last quarter. It is repricing the next few years. Investors are asking a simple question. If AI agents end up doing the clicking, how much of today’s revenue is really tied to people and how much can shift to usage or outcomes. Until there is a clear answer, the default is caution.

HUBS, FTNT, CFLT, TEAM, CRM, ESTC, WDAY, MNDY, PANW, NOW

There is a second layer to this. The strongest platforms in the last cycle trained customers to expect clean APIs, solid open source, and cloud convenience. That helped adoption. It also made it easier for big buyers to say they can run parts of it in house. The tools are better. The talent is more available. The budgets are under a microscope. What used to be a moat can flip into a cost cutting target. None of that says the software is bad. The tech is often great. But when the buyer believes they can get the same outcome for less, pricing power slips. Once the market believes your product can be replicated or routed around, you stop getting paid for the story and start getting judged on the grind.

If you want receipts, the “AI risk” trade is showing up in prices. Bank of America’s basket of names seen as most exposed to AI has lagged the S&P by about twenty-two points since mid-May. You can see it in single names too. Wix and Shutterstock are down a third this year. Adobe is off more than twenty percent as investors test how far generative tools can replace creative work. Staffing names have been hit as people model more automation, with ManpowerGroup and Robert Half sliding hard. Research and marketing aren’t immune either. Gartner fell about thirty percent in five days after a guide down, and big ad agencies are under pressure as brands try AI-built creative.

WIX, ADBE, IT, HUBS

On the other side, the spending drumbeat is still loud. Microsoft, Meta, Alphabet, and Amazon together are on pace to spend roughly three hundred fifty billion dollars on capex this year, up close to fifty percent. That money feeds chips, networks, and storage, which keeps the rotation alive.

Chips and AI infrastructure look like the shovel sellers in a rush. They have clearer demand signals and cleaner narratives. Training needs compute. Inference needs networks. Storage needs to grow. That gives investors something concrete to model. Application software sits in the middle of a bigger question. Who will capture the value that agents create. Will it be the legacy app, a cheaper AI native tool, or the platform that orchestrates the agents. Until more app vendors show they can capture agent-driven work rather than get commoditized into a feature inside a bigger platform, the re-rating bias will stick.

None of this guarantees that AI will wreck SaaS. It does explain why the tape trades like it does. Uncertainty gets punished. Narrative leads price. Price drives more narrative. It is a loop. Old timers have seen this before. Multiples overshoot in both directions. When a category looks structurally challenged, the market does not wait for perfect proof. It marks it down first and looks for reasons to add back later. You can have healthy growth, raise guidance, and still go red because the debate is about durability, not the last 90 days.

There is a fair counter to the most bearish takes. Deep domain software is not an overnight clone. Years of workflow entanglement are hard to copy. In some parts of the back office, agents will take over faster. In others, the path is slower. And if a vendor supplies the agent that removes labor, pricing can shift to value and even go up per task. That is the optimistic path. The problem for the sector is that investors want to see it, not hear it. They want clear usage based or outcome based revenue tied to agent activity. They want proof that customers are not building their own version. They want to know that churn will not spike if a department trims seats.

So where does that leave us. Think of this as a recession in software valuations rather than a collapse in software demand. Plenty of companies will keep selling. They will just do it at lower multiples until the model lines up with how work gets done in an AI first world. A few will show clean pivots to agent centric workflows and value capture. They will earn the benefit of the doubt. Many others will have to prove it quarter by quarter. The market will keep asking for evidence that revenue is shifting from headcount to usage, that gross margin holds as AI costs flow through, and that the product does not get commoditized into a feature inside a bigger platform.

Lilly’s Pill Stumbles, Novo Scores

Eli Lilly’s latest quarter looked great on paper — revenue topped $15.6 billion, earnings beat forecasts, and the company raised its 2025 outlook. But the spotlight quickly shifted to trial data for its experimental weight-loss pill, orforglipron, and the market didn’t like what it saw.

In a large Phase 3 study, the pill helped patients lose about 11% of their body weight at the highest dose, short of Wall Street’s hopes for something closer to Novo Nordisk’s Wegovy, which averages around 15%. Nearly a quarter of high-dose patients dropped out due to side effects like nausea and vomiting, raising questions about how much more accessible the pill really is compared to injections. Analysts now doubt it can reach Lilly’s $12 billion annual sales target by 2030.

The news wiped $100 billion off Lilly’s market cap in its biggest single-day drop in 25 years, while Novo shares surged. Rival drugmakers, from AstraZeneca to Pfizer, are also chasing the still-huge obesity pill market, expected to hit $95 billion by 2030. For now, though, this round goes to Novo — and Lilly has to prove its pill can win over both doctors and patients when it hits the market, potentially next year.

Tim Cook Plays Diplomat — and Wins

Apple just logged its best week since July 2020, climbing 13% after pulling off a political and strategic two-for-one: a $100B U.S. investment pledge that helps secure tariff relief while keeping its global supply chain largely intact.

The headline number includes a $2.5B boost to Corning’s Harrodsburg, KY facility, which will now produce all iPhone and Apple Watch cover glass domestically — the first time that’s ever happened. It will be the world’s largest smartphone glass production line, increasing Corning’s local workforce by 50%. The broader plan calls for 20,000 new Apple hires in the U.S. and is part of a $600B four-year commitment to American operations.

Reading between the lines, this is less about a manufacturing overhaul and more about political optics. Trump gets to tout U.S. jobs, while Cook gets tariff protection — savings estimated at $4B to $10B a year — without disrupting Apple’s core overseas assembly model in China and India. Margins should stay stable, and the removal of tariff uncertainty could support multiple expansion.

Apple is not getting much credit for what it is building, largely because it is not in the foundation-model business and it has moved slowly. That caution has been helped by the absence of a breakout AI device from competitors. Apple’s advantage remains the tight loop of hardware, software, and services at scale. A more capable Siri, likely revealed next spring, is the next proof point. If GPT-5 and successors keep lifting engagement and Apple stitches those capabilities cleanly into the device experience, the narrative gap can close fast. In the meantime, investors can breathe easier knowing supply chain costs won’t spike and tariff risk is off the table for the next few years.

ESPN Gets NFL Muscle

Disney just struck one of the boldest sports-media deals yet, handing the NFL a 10% stake in ESPN—valued at about $2.5 to $3 billion—in exchange for NFL Network, RedZone distribution rights, and NFL Fantasy. For ESPN, it’s a direct shot in the arm ahead of its $29.99-a-month streaming launch on August 21, which will roll in NFL games alongside NBA, MLB, UFC, and more.

The move strengthens ESPN’s content library and folds two massive fantasy platforms into one, but it’s also raising eyebrows. The NFL now owns part of its biggest broadcast partner, and some wonder how that might color coverage or tilt future rights deals. Disney and league execs insist nothing changes on the editorial side.

It comes at a busy time for ESPN—just days after sealing a $1.6 billion, five-year deal to bring WWE’s biggest events exclusively to its platforms starting in 2026. Disney’s betting that live sports will anchor streaming growth as traditional TV declines. The strategy’s clear: pack ESPN’s new app with enough high-profile rights to make it a must-have for sports fans before rivals like Fox’s new FOX One and Amazon grab more turf.

Earnings-wise, Disney beat profit expectations last quarter but fell short on revenue. Legacy TV remains in decline, while parks and resorts posted record third-quarter revenue. With NFL and WWE content in its pocket and Hulu set to merge into Disney+ by 2026, the company’s building for the long game—though in streaming, that game’s just getting underway.

Uber’s Robotaxi Tightrope

Uber posted a clean quarter, with revenue up 18% to $12.7 billion and free cash flow up 44% to $2.475 billion. Rides and delivery both grew at a healthy clip. The part everyone wanted to hear about, though, was autonomy. Uber says it will spend to stay in the race, but not flip its business model to do it.

The Lucid pact is the headline shift. Uber and fleet partners pledged to bring at least 20,000 Lucid self-driving EVs onto the platform over the next few years. That raised eyebrows because Uber has run an asset-light playbook since selling its in-house AV unit in 2020. Management’s message was simple. Shareholders come first. At least half of future cash flow is going to buybacks, with a new program sized at 20 billion dollars. AV spending will be modest and funded mostly by recycling stakes in other companies like Didi, Grab, and Aurora, not by draining operating cash.

Strategy wise, Dara Khosrowshahi framed the bottleneck as hardware, not regulation. If manufacturers can build and retrofit at scale and at the right price, the rest follows. Uber wants some skin in the game to prove the economics, then lean on banks or private equity to finance fleets that end up off Uber’s balance sheet. The company is testing models like revenue sharing and software licensing, and is blunt that AVs are not profitable today.

Not everyone is satisfied. Some analysts argue Uber should lean in harder, given Tesla’s robotaxi push and Waymo’s decision to partner elsewhere in Dallas even as Waymo rides run on Uber in Austin and Atlanta. Investors also want real numbers on AV margins and market performance. Meanwhile, Lyft put up a mixed quarter but is trying to close the gap with a Baidu tie-up in Europe and the FreeNow deal.

Big picture, the gig names reminded the market they print cash. Uber, DoorDash, Lyft, and Airbnb generated 4.2 billion dollars in free cash flow this quarter. Uber is the standout on growth, DoorDash still leads in delivery, and autonomy sits over the whole group like a weather system. For now, Uber is trying to buy time, prove unit economics in small bites, and keep returning cash while it learns.

Other Key Stories:

GPT-5: OpenAI rolled out its new model, GPT-5. Nick Turley, who runs the ChatGPT team, says it finds better answers, responds faster, and hallucinates less than prior versions. The catch is the product setup: unless you pay for model switching and explicitly select GPT-5 Thinking or Pro, you can get different models in the same chat, which has confused users and reviewers. Net-net, early feedback is mixed to slightly disappointed.

Trump vs. Intel: President Donald Trump posted on Truth Social that Intel CEO Lip-Bu Tan is “highly CONFLICTED” and should resign, without providing evidence. Tan told employees he has the board’s full backing, loves the U.S., and is committed to advancing national and economic security. He was hired to lead Intel’s turnaround and is five months into the role.

Tesla Dojo no more: Tesla is disbanding its Dojo supercomputer team and will lean more on partners like Nvidia, AMD, and Samsung. Elon Musk said splitting resources across two very different chip designs no longer makes sense, and that Tesla’s AI5 and AI6 chips will handle inference and be “at least pretty good” for training. He added that clusters packed with AI5/AI6 could be seen as “Dojo 3,” and claimed AI5 shows a much larger real-world performance jump over AI4 than typical version steps.

Week Ahead:

Tuesday: July CPI is the main event. Consensus looks like +0.2% m/m headline and +0.3% core, with y/y edging to 2.8% and 3.0%. Watch shelter, core services, and any tariff pass-through. The U.S.–China tariff truce deadline also hits; an extension would keep risk premia in check. OPEC’s monthly report lands around the same time and can swing energy.

Wednesday: Light on U.S. data. Focus turns to how CPI reshapes September cut odds and to any mid-week Fed remarks. Positioning usually drifts ahead of PPI.

Thursday: July PPI and weekly jobless claims give a second read on pipeline prices and the labor trend. A tame PPI would reinforce the disinflation message from CPI. A claims pop would keep the growth scare alive.

Friday: July Retail Sales is the consumer gut check. Headline is seen around +0.5% with softer ex-autos. The control group will drive Q3 GDP tracking. University of Michigan sentiment gives an early look at inflation expectations and spending intent heading into late summer.

Should be an interesting week. I’ll be tracking it all on X (formerly Twitter): @wallstengine.

EARNINGS PREVIEW:

Subscribe to access the Earnings Preview

To read the full earnings previews on ONON, SE, CSCO, CAVA you’ll need to be a premium subscriber to The Engine Room.

Upgrade