Sponsored by edgeful

Happy Sunday, Crew!

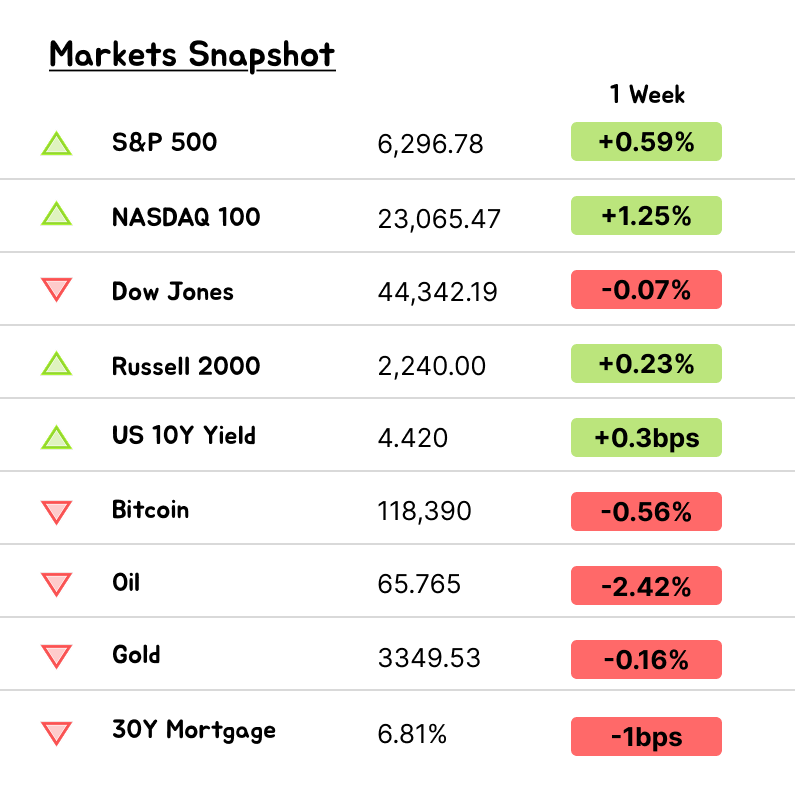

The S&P 500 just notched its ninth record close of the year. But with RSI readings edging into overbought territory and earnings expectations front and center, this week could be a real headline magnet—especially with company commentary under the microscope.

I dropped my full earnings preview on Saturday, so check that out if you haven’t already.

Now, let’s dive into some key stories and get ourselves set for the week ahead. Let’s get into it.

Sponsored

Trade with your head, not your gut. If you’ve been making moves based on hunches, it might be time to get a data-driven second opinion. Meet edgeful. I’ve been using it lately, and honestly, it’s become my shortcut to gauge the odds in seconds

edgeful breaks down everything from intraday price patterns to multi-year trends. It gives you price-action probabilities, volume trends, seasonality stats—all the gritty details your gut usually overlooks.

It’s like having a personal quant on call. You can instantly see how any stock or futures contract typically behaves, even down to specific days of the week, and what setups are brewing right now, complete with odds for each trade.

For example, if you trade stocks, edgeful can flag a gap-up stock and show you how often similar gaps have filled or kept running, based on historical data. If you trade futures, you can quickly check how often the S&P 500 breaks out of its morning range on a given day versus fizzling out. In other words, you’ll know the odds before you place a trade.

It covers practically every market—stocks, futures, forex, and crypto.

Here’s something exclusive for my readers: edgeful doesn’t normally offer a public free trial, but I’ve arranged a 7-day free trial just for you. Click below to check it out—and remember, sometimes the best edge is knowing when not to trade.

Trump Wants Coke to Taste Like It Did in the '70s

Earlier this week, Donald Trump claimed Coca-Cola has agreed to switch its U.S. formula from high-fructose corn syrup to cane sugar. The company didn’t confirm the move but said more product announcements are coming soon.

The news briefly hit HFCS suppliers. ADM and Ingredion saw shares drop 6–7% in premarket trading before recovering slightly. Raw sugar futures jumped over 1%.

Coca-Cola has used HFCS in the U.S. since the 1980s because it's cheaper and more available than cane sugar. Cane-sweetened Coke is already sold in the U.S., mostly in glass bottles imported from Mexico or as seasonal Kosher offerings.

From a health standpoint, experts say switching from HFCS to cane sugar won’t make much of a difference. Both are forms of sugar. Both are linked to weight gain and metabolic issues when consumed in excess. Nutritionists agree: the type matters less than the amount.

There’s also a supply problem. The U.S. only produces about 4 million tons of cane sugar a year—far short of the 12.5 million tons it consumes. Most of the gap is filled by imports or sugar from beets. Meanwhile, over 7 million tons of HFCS are made annually from domestic corn.

Replacing HFCS at scale would likely mean importing more sugar from Brazil or Mexico—countries currently facing Trump-imposed tariffs starting August 1.

Trump vs. Powell: The Firing That Was Floated, Then Denied

Tensions between President Trump and Federal Reserve Chair Jerome Powell escalated this week—again. According to The New York Times, Trump recently showed Republican lawmakers a draft termination letter for Powell and asked for their feedback. Hours later, a White House official confirmed that Trump was “likely” to fire Powell. But by the next morning, Trump reversed course, calling such a move “highly unlikely.”

It’s not the first time Trump has threatened Powell’s job. But this time, it came with something new: a coordinated messaging effort around alleged mismanagement of the Fed’s $2.5 billion renovation project—suggesting a legal pretext is being floated to justify Powell’s removal.

Why it matters:

The independence of the Federal Reserve is a cornerstone of global financial stability. Markets immediately recognized the risk. Deutsche Bank warned that removing Powell could trigger a collapse in both currency and bond markets. In a report titled “What if?”, the bank’s head of FX research, George Saravelos, said the move would undermine confidence in U.S. institutions and potentially spark a sell-off in the dollar and Treasurys. He called it “one of the largest underpriced event risks” in the market right now.

Can Trump legally fire Powell?

Not over monetary policy. The law allows a Fed chair to be removed only “for cause,” typically interpreted as misconduct or dereliction of duty. Trump’s team appears to be testing the waters by building a case around the renovation’s cost overruns, which they claim Powell misrepresented in congressional testimony.

OMB Director Russ Vought recently sent Powell a letter demanding answers about the renovation project’s scope and cost, specifically whether the Fed misled Congress about luxury elements like a roof garden or beehives. Powell has denied those features were ever part of the plan and asked the Fed’s inspector general to review the matter.

What’s really going on:

This is less about construction and more about pressure. Trump has long pushed Powell to cut interest rates faster and deeper. Powell, for his part, has consistently defended the Fed’s independence and resisted overt political influence. With Powell’s term ending in May 2026, the latest episode may be more about political posturing than imminent action—but that doesn’t mean it’s harmless.

There’s precedent here. In the 1970s, President Nixon exerted similar pressure on then-Fed Chair Arthur Burns, eventually leading to loose policy and the inflation crisis of that decade. The parallels haven’t gone unnoticed.

JPMorgan CEO Jamie Dimon, Senator Elizabeth Warren, and others have spoken out in defense of Powell and the Fed’s independence. Senator Thom Tillis (R-NC) called firing Powell a “huge mistake” on the Senate floor. Betting markets like Polymarket now price a 19% chance Powell will be removed before his term ends. The dollar, already down nearly 10% YTD, would likely fall sharply if the Fed’s independence appears compromised.

NVDA TO RESUME H20 CHIP SALES TO CHINA

NVIDIA is preparing to resume exports of its H20 AI GPUs to China after receiving U.S. government clearance. CEO Jensen Huang confirmed this during a press conference in Beijing on Wednesday, saying the company is “working hard to accelerate supply chain recovery” and expects the ramp to take time.

The H20—NVIDIA’s China-specific AI chip designed to comply with U.S. export restrictions—was temporarily paused amid licensing uncertainty. Huang said he hasn’t yet met with Chinese customers following the latest U.S. decision but emphasized that H20 remains competitive in the current market.

NVIDIA has started filing export applications again and plans to introduce an updated, compliant RTX PRO GPU for China as well. Huang also reiterated support for open-source AI and highlighted the role of U.S. chips in enabling international AI innovation.

While Huang declined to comment on U.S.–China trade negotiations directly, he acknowledged media reports tying NVIDIA’s chips to broader discussions on rare earths and technology.

Analysts estimate NVIDIA has as much as $10 billion in H20 inventory that could now be monetized, with upside to gross margins due to lower write-downs and strong pricing.

The resumption comes as NVIDIA’s market share in China had dropped from 20–25% to around 10–15%. Reopening this pipeline is viewed as critical for maintaining momentum in the global AI arms race, especially as domestic competition in China accelerates.

Huang also appeared at the China International Supply Chain Expo and emphasized the importance of open-source AI, calling it a “fundamental resource” that should be optimized on U.S. tech stacks.

Meanwhile, AMD and others are also regaining export traction. AMD received approval to resume MI308 shipments to China and may add $1–2 billion in 2025–26 revenue from data center GPU sales, according to BofA.

Big Oil, Bigger Battles: Chevron Wins the Hess Deal

The $53 billion Chevron–Hess merger is officially closed. An international arbitration panel ruled against ExxonMobil’s attempt to block the deal, clearing Chevron to move forward with acquiring Hess’s 30% stake in the massive Stabroek oil field off the coast of Guyana.

Exxon, which operates the Guyana project and holds a 45% stake, argued it had the right of first refusal to buy Hess’s share. The arbitration panel disagreed, stating that the right didn’t apply to a full corporate acquisition like Chevron’s.

With the deal closed, Chevron now joins the Guyana oil consortium, alongside Exxon and China’s CNOOC, which holds 25%. The field is expected to produce 1.2 million barrels per day by 2027. For Chevron—down nearly 7.4% over the past year—this is a critical win. Its oil reserves hit a 10-year low in 2023, and the company is restructuring and cutting 8,000 jobs by the end of 2026.

Chevron CEO Mike Wirth confirmed that John Hess, CEO of Hess Corp., will join Chevron’s board. The FTC had lifted restrictions on the move just a day prior.

Exxon, while disagreeing with the ruling, said it would continue operating in Guyana and welcomed Chevron to the consortium.

JPMORGAN ON OPENAI: VALUATION HIGH AND MOAT SHRINKING

JPMorgan says OpenAI’s revenue is growing fast—$10B ARR in 1H25, up ~82%—but warns it’s still years from profit and valued at 27x 2025E revenue. That’s steep next to AI peers (M7 avg ~9x). With ChatGPT now at 800M users and a $300B valuation, JPM sees a $700B+ TAM by 2030, but notes rising risks around model commoditization, talent, and infrastructure. The report says OpenAI’s moat is shrinking, as newer models outperform GPT-4 (95th in LMSYS Arena) and enterprise adoption remains tough. Agents and monetization outside APIs are key to long-term upside.

Want More? Join Me on Discord

If you’re finding value in this newsletter or my updates on X, the Discord is where I go deeper. I share real-time trade setups, earnings breakdowns, morning notes, and market-moving news—plus exclusive insights I don’t post elsewhere. It’s a great space to stay ahead with a strong, active community.

Use code WALL20 for 20% off on any plan.

Week Ahead:

Macro + Central Bank Watch

This week’s macro calendar is central bank-heavy. The ECB, Turkey’s CBRT, and Russia’s CBRF all hold rate meetings—none are expected to shock, but given recent inflation stickiness in Europe and lira volatility in Turkey, guidance will matter. Meanwhile, China’s loan prime rate is expected to stay unchanged Monday, but any surprise cut would ripple fast.

In Japan, markets are closed Monday for Marine Day, but the weekend’s upper house election results could stir political chatter—voters are weighing in on PM Ishiba’s 10-month tenure amid rising inflation and trade friction with the U.S.

Friday’s Tokyo CPI and Germany’s IFO will give an early peek into Q3 sentiment. Eurozone consumer confidence (Wed) and the ECB’s inflation survey (Fri) will round out a week that’s loaded with forward-looking signals.

AI, Trade, and a Side of Politics

Trump’s back on stage midweek (July 23) to outline his AI policy at the “Winning the AI Race” event—expect full of headlines out of it.

China hosts its World Artificial Intelligence Conference on Friday in Shanghai, just a day after the EU-China Summit in Beijing. Between that and the looming August 1 tariff deadline, we’re watching for any last-minute fireworks on trade.

Oh, and Trump is expected to drop by Scotland for some private tee time and a probable handshake with UK PM Keir Starmer. Classic.

Flash PMIs Drop Thursday

If there's one number traders will dissect this week, it’s the Flash July PMIs. Services have been holding up—but manufacturing's been in a funk globally. New orders, hiring, and pricing power metrics will be closely watched for clues on economic re-acceleration (or not).

U.S. Data Highlights

Monday: June Leading Index

Wednesday: June Existing Home Sales

Thursday: Weekly Jobless Claims, June New Home Sales, Flash PMIs

Friday: June Durable Goods

Earnings Tsunami Incoming

Over 600 companies report this week—112 of them are S&P 500 names. This is the real kickoff to earnings season, and we’ll get updates from key names across tech, industrials, financials, and consumer.

Must-Watch Reports

Mon: $DPZ, $VZ, $NXPI

Tues: $KO, $GM, $LMT, $TXN, $SAP, $CB

Wed: $TSLA, $GOOGL, $IBM, $NOW, $URI, $T

Thu: $INTC, $UNP, $AAL, $HON, $DLR

Fri: $HCA, $PSX, $CHTR

The Fed? On Mute (for Now)

With the July 29-30 FOMC meeting coming up, we’ve entered the Fed’s blackout window. Powell speaks Tuesday at a bank regulation event, but don’t expect anything new. As of now, the market sees a 93.5% chance of no cut this month and just under 60% for a September move.

Should be an interesting week. I’ll be tracking it all on X (formerly Twitter): @wallstengine.