Sponsored by edgeful

Happy Sunday, Crew!

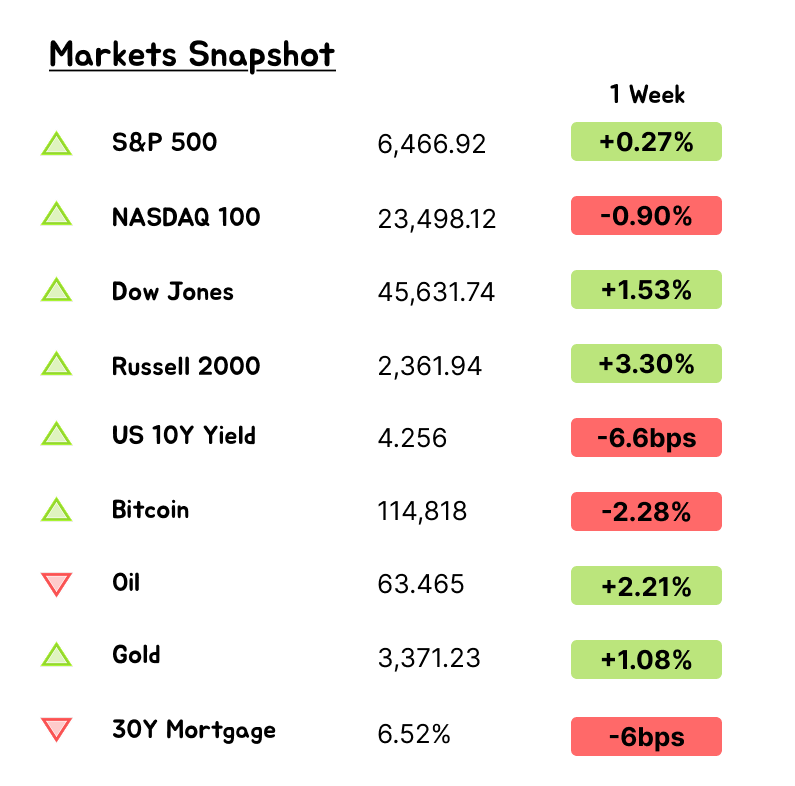

The S&P 500 just notched its new-all-time highs, as Powell gives green light to the bulls. I dropped my full earnings preview on Saturday, so check that out if you haven’t already.

Now, let’s dive into some key stories and get ourselves set for the week ahead. Let’s get into it.

Weekly Performance

Sponsored

Trade with your head, not your gut. If you’ve been making moves based on hunches, it might be time to get a data-driven second opinion. Meet edgeful. I’ve been using it lately, and honestly, it’s become my shortcut to gauge the odds in seconds

edgeful breaks down everything from intraday price patterns to multi-year trends. It gives you price-action probabilities, volume trends, seasonality stats—all the gritty details your gut usually overlooks.

It’s like having a personal quant on call. You can instantly see how any stock or futures contract typically behaves, even down to specific days of the week, and what setups are brewing right now, complete with odds for each trade.

For example, if you trade stocks, edgeful can flag a gap-up stock and show you how often similar gaps have filled or kept running, based on historical data. If you trade futures, you can quickly check how often the S&P 500 breaks out of its morning range on a given day versus fizzling out. In other words, you’ll know the odds before you place a trade.

It covers practically every market—stocks, futures, forex, and crypto.

Here’s something exclusive for my readers: edgeful doesn’t normally offer a public free trial, but I’ve arranged a 7-day free trial just for you. Click below to check it out—and remember, sometimes the best edge is knowing when not to trade.

Palantir vs Citron:

Citron Research dropped another short report on Palantir this week, slapping a $40 price target on the stock. Their argument? If you apply OpenAI's valuation multiple to Palantir's projected revenue, you get $40 per share - and that's being "generous."

Let me break down what they're claiming and where things get messy.

Citron's math is coming straight out of LLM. OpenAI recently raised money at a $500 billion valuation with projected 2026 revenue of $29.6 billion. That's a 16.9x price-to-sales multiple. Apply that same multiple to Palantir's projected $5.6 billion in 2026 revenue, and you get roughly $40 per share.

Their point: if Palantir can't justify the same multiple as the "undisputed leader in AI," then it's overvalued.

Where Citron Gets It Right

Valuation is stretched. Nobody's arguing Palantir is cheap. Trading at over 100x price-to-sales puts it in rarified air. The stock has run hard, and multiples are demanding.

Growth comparison. OpenAI is growing at unprecedented scale - from essentially zero to $30+ billion in revenue in just a few years. That's a different league from Palantir's impressive but more measured growth trajectory.

Where Things Fall Apart

The comparison doesn't work. Comparing these businesses is like comparing a subscription streaming service to a custom software integration company. OpenAI operates a consumer product that scales through subscriptions. Palantir builds integrated platforms that become deeply embedded in how organizations operate.

Stickiness matters. Here's what Citron misses - and it's huge. If ChatGPT Plus costs $20/month and a competitor offers something 90% as good for free, you cancel ChatGPT. If Palantir is running your supply chain optimization and saving you $200 million annually (like they've done for some customers), you don't switch because a competitor offers a 10% discount.

The flywheel argument is backwards. Citron claims Palantir lacks a self-reinforcing flywheel while OpenAI has one. This seems wrong. When Palantir solves a problem for one oil company, they can redeploy that solution across the industry. When customers showcase $200 million in savings at conferences, it drives adoption. That's a flywheel.

The Real Issues Citron Identifies

Government dependency. While Palantir is diversifying into commercial markets (which are now growing faster than government), they still rely heavily on government contracts. That creates some lumpiness.

Competition is coming. As the enterprise AI market matures, Palantir will face more direct competition. Microsoft, Google, and others aren't standing still.

The $40 Problem

Here's where I disagree with Citron: a $40 price target would be destructive rather than reasonable.

The report essentially argues Palantir should trade at the same multiple as a consumer AI service, despite having fundamentally different business mechanics. It's like saying Netflix should trade at the same multiple as Disney because they're both entertainment companies.

More problematic is the cherry-picked comparison. Why OpenAI specifically? Why not compare to other enterprise software companies with similar growth profiles and margins?

What Actually Matters

The real question isn't whether Palantir deserves OpenAI's multiple. It's whether the company can maintain its growth trajectory while expanding margins and diversifying its customer base.

Recent quarters suggest they're doing exactly that. Commercial growth is accelerating, deal sizes are increasing, and customers are expanding their usage - classic signs of a platform gaining traction.

The Bottom Line: Citron is right that Palantir's valuation is aggressive. They're wrong that $40 represents fair value. The comparison to OpenAI makes for attention-grabbing headlines but doesn't hold up to scrutiny.

Palantir trades on future potential, not current fundamentals. Whether that potential justifies today's price is the real debate - and it's a lot more nuanced than Citron's report suggests.

Powell's Jackson Hole Pivot?

Jerome Powell just gave Wall Street exactly what it wanted at Jackson Hole. His speech was supposed to be a non-event - with major jobs and inflation data still coming before September's Fed meeting, the obvious play was staying neutral. Instead, Powell opened the door wide, saying the "shifting balance of risks may warrant adjusting our policy stance."

The market reaction was immediate. Stocks jumped 1.5%, Treasury yields dropped, and futures markets now price in near-certainty of a September rate cut. The S&P 500 closed just shy of record highs after a five-day slide.

Powell's pivot centers on employment concerns, and they're legitimate. Recent job data has been troubling - 461,000 jobs revised downward year-to-date, with 258,000 of those hitting just May and June. The unemployment rate keeps ticking higher, and labor market indicators are flashing warnings. For a Fed with a dual mandate, these trends matter.

But here's the uncomfortable part: Core inflation is running above 3%, not the Fed's 2% target. Producer prices just jumped 0.9% month-over-month - the biggest increase since 2022. We're now 53 straight months above the 2% target. Powell is essentially signaling rate cuts into an inflationary environment. That's not how central banking typically works.

The political backdrop makes this even messier. Trump has been relentlessly attacking Powell, calling him "Too Late" and threatening Fed independence. The pressure is real and unprecedented. Powell seemed eager to signal that politics won't dictate policy, but the timing of this dovish turn raises questions about true independence.

For markets, this is short-term bullish. Lower rates support asset prices, especially growth stocks that have been struggling with valuation concerns. The Russell 2000 surged nearly 4% on rate-sensitive names. But we're entering bubble territory - the S&P 500 now trades at 24x forward earnings, 30% more expensive than its equal-weight counterpart. This valuation gap has historically been a warning sign.

With Powell's dovish turn providing market support, all eyes turn to Nvidia earnings Wednesday. The company's 7.9% S&P 500 weighting means its results could drive major market moves. Options traders are pricing in a 6% move either direction, which could translate to nearly 1% for the broader index.

This approach has risks. Some Fed officials, including Chicago's Goolsbee and Cleveland's Hammack, have expressed more hawkish views recently. There's echoes of 2021 here - when the Fed initially dismissed inflation risks that later became entrenched. If tariffs drive broader price increases, cutting rates now could fuel another inflationary cycle.

This policy shift creates clear winners and losers. Asset owners benefit from lower rates and continued accommodation. Those without assets face wages lagging inflation - the same dynamic that widened wealth gaps post-pandemic.

The next few weeks are crucial. Job numbers, inflation data, and Nvidia earnings will test whether Powell's pivot proves wise or premature. Markets got their green light, but the economic fundamentals haven't changed. We still have elevated inflation, stretched valuations, and mixed economic signals.

Powell traded short-term market calm for potential longer-term policy complications. Wall Street won this round, but the real test comes when policy meets reality in the months ahead.

WASHINGTON BUYS 9.9 OF INTEL:

The U.S. government is taking a 9.9% stake in Intel for $8.9 billion, and the reaction has been mixed. Intel's stock jumped on the news, but this deal raises some uncomfortable questions about where American capitalism is headed.

Here's what actually happened: The government will buy 433 million Intel shares at $20.47 each, funded through remaining CHIPS Act grants and a new "Secure Enclave" program. They're promising to stay passive - no board seats, no governance rights, they'll vote with management. But they do get a five-year warrant to buy another 5% if Intel sells more than half its foundry business.

The timing isn't coincidental. Intel has been struggling badly, trading in the teens just weeks ago. Their foundry business, launched in 2021 to compete with Taiwan's TSMC, hasn't attracted major outside customers. Meanwhile, SoftBank's Masayoshi Son has been circling, taking a $2 billion stake and reportedly discussing buying that same foundry unit. Intel needed a lifeline, and the government provided one.

From a national security perspective, this makes sense. Intel is the only American company doing leading-edge chip design and manufacturing domestically. With tensions rising over Taiwan and China's tech ambitions, having domestic chip production isn't just nice to have - it's essential. The government has already committed to bringing semiconductor manufacturing back through the CHIPS Act, and Intel is the centerpiece of that strategy.

But Walter Isaacson called this "scattershot crony capitalism" on CNBC, and he has a point. The government is picking winners and losers in ways that feel arbitrary. Why Intel and not others? Why equity stakes instead of just grants or loans? It's the kind of state intervention that historically hasn't worked well, whether in Latin America or elsewhere.

The deal also highlights how much the investment landscape has changed. TSMC executives reportedly discussed returning their $6.6 billion in U.S. subsidies rather than accept equity stakes from the Trump administration. They don't want the government as a partner, and you can understand why. Government involvement brings political considerations into business decisions, even with promises of staying passive.

For Intel shareholders, this is bittersweet. They get $10 billion in funding when the company desperately needed it, removing bankruptcy risk and providing runway to complete their massive Arizona fab. But this money was largely coming anyway through CHIPS Act grants - now they're giving up nearly 10% of the company for funds they expected to receive as non-dilutive grants.

The broader precedent is concerning. As one analyst noted, this doesn't do anything to help Intel catch up technologically to TSMC. It's financial life support, not a cure. And once you start taking equity stakes in struggling companies for national security reasons, where does it end? The government already influences corporate decisions on everything from pricing to environmental policy - direct ownership takes that further.

There are echoes of 2008's TARP program here, when the government took stakes in failing banks and automakers. That worked out reasonably well financially, with most investments recovered. But semiconductors aren't banking - this is about industrial policy and geopolitical competition, not preventing systemic financial collapse.

The real test will be execution. Intel still needs to prove it can manufacture cutting-edge chips competitively. Government backing might help secure customers who want supply chain security, especially if tariffs make foreign chips more expensive. But technology leadership can't be bought with taxpayer dollars - it has to be earned through innovation and flawless execution.

Meanwhile, SoftBank's interest adds another layer. Son has been building an AI empire spanning chips, data centers, and robotics. If he ends up buying Intel's foundry business, it would represent a fascinating convergence of Japanese capital, American technology, and government backing. Not exactly the reshoring story policymakers envisioned.

The market seems cautiously optimistic, pushing Intel's stock up despite the dilution. Investors are betting that government backing reduces execution risk and provides competitive advantages through potential tariff exemptions or preferential treatment. Maybe they're right.

But this deal represents a fundamental shift in how America approaches industrial policy. We're moving from free market capitalism toward something more directed, more interventionist. Whether that's necessary adaptation to global competition or a dangerous precedent depends on your perspective - and probably on how well Intel executes from here.

Want More? Join Me on Discord

If you’re finding value in this newsletter or my updates on X, the Discord is where I go deeper. I share real-time trade setups, earnings breakdowns, morning notes, and market-moving news—plus exclusive insights I don’t post elsewhere. It’s a great space to stay ahead with a strong, active community.

Use code WALL20 for 20% off on any plan.

The AI Reality Check:

This week brought a dose of reality to AI's hype cycle. An MIT study showing 95% of GenAI pilots failing to reach production caught everyone's attention, Sam Altman admitted we're in a bubble, and Meta put the brakes on AI hiring after months of throwing money around. Time to separate what's working from what's just noise.

MIT researchers looked at 300 AI implementations across 52 companies and found something striking: most organizations are stuck in what they call the "GenAI Divide." On one side, 95% of custom enterprise AI tools never make it past the pilot stage. On the other, the 5% that do succeed are generating millions in value.

The problem isn't what you'd expect. It's not model quality, regulation, or even budget constraints. The core issue is that most AI tools don't learn, adapt, or remember. They're static systems trying to solve dynamic business problems.

People love ChatGPT for quick tasks - 80% of organizations have tried it - but when it comes to mission-critical work, 90% still prefer humans. The reason is simple: ChatGPT forgets everything between conversations and can't customize to specific workflows. For high-stakes work, you need systems that accumulate knowledge and improve over time.

Here's where it gets interesting. The study found that 70% of AI budgets go to sales and marketing tools, but the highest ROI comes from back-office automation. Companies are chasing the flashy stuff while ignoring the boring work that actually saves money. It's classic corporate behavior - fund what looks good in board meetings rather than what moves the needle.

The successful 5% share common patterns. They're not building AI tools in-house - they're partnering with vendors who provide deep customization and learning capabilities. External partnerships succeed twice as often as internal builds. The companies crossing the divide treat AI vendors like consulting firms, demanding business outcomes rather than just software features.

Another WSJ headline this week was Meta's hiring freeze, after months of making $100 million offers to poach OpenAI talent and trying to acquire entire startups, however the company calls it "routine organizational planning," Also Alexander wang said they are only investing more and more in AI.

Further, Sam Altman's bubble comments fit the broader pattern. He admitted OpenAI "totally screwed up" the GPT-5 rollout and acknowledged investors are "over excited" about AI. Even the guy building the most valuable AI company thinks we need to pump the brakes on expectations.

The real insight from MIT's research is that we're in the "trough of disillusionment" phase of AI adoption. The initial hype created unrealistic expectations, massive investment, and inevitable disappointment when reality set in. This follows the same pattern we saw with smartphones, social media, and every major technology wave.

But here's what's different: the underlying technology works. The issue is implementation. Companies that understand this are quietly building competitive advantages while others chase headlines.

The winners focus on three things: they buy learning-capable systems instead of building static tools, they target specific workflows rather than trying to solve everything, and they measure success by business outcomes rather than technical benchmarks.

Looking ahead, the next 18 months will separate the real AI companies from the pretenders. Organizations are starting to lock in vendor relationships with tools that adapt and learn from their data. Once you've trained a system to understand your specific workflows, switching costs become enormous.

The infrastructure for this shift is already emerging through protocols that let AI agents coordinate with each other. This isn't just about chatbots anymore - it's about building networks of specialized AI systems that can work together across different platforms and vendors.

The AI revolution isn't slowing down. It's just growing up. Companies that recognize the difference between functional AI and marketing AI will build lasting advantages. Those still chasing the hype cycle will find themselves on the wrong side of the divide.

The bubble isn't bursting - it's maturing. And that might be exactly what AI needs to become truly useful.

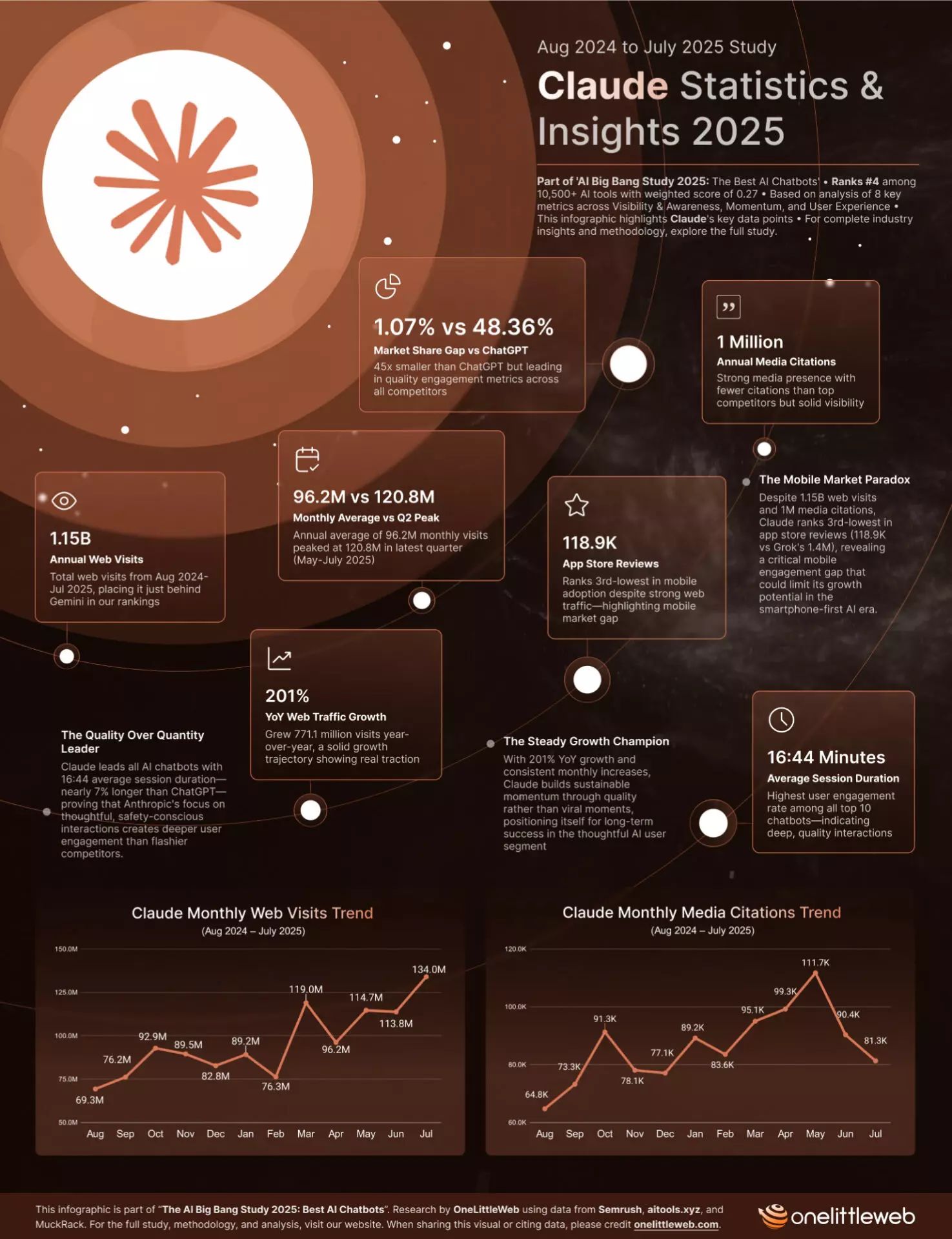

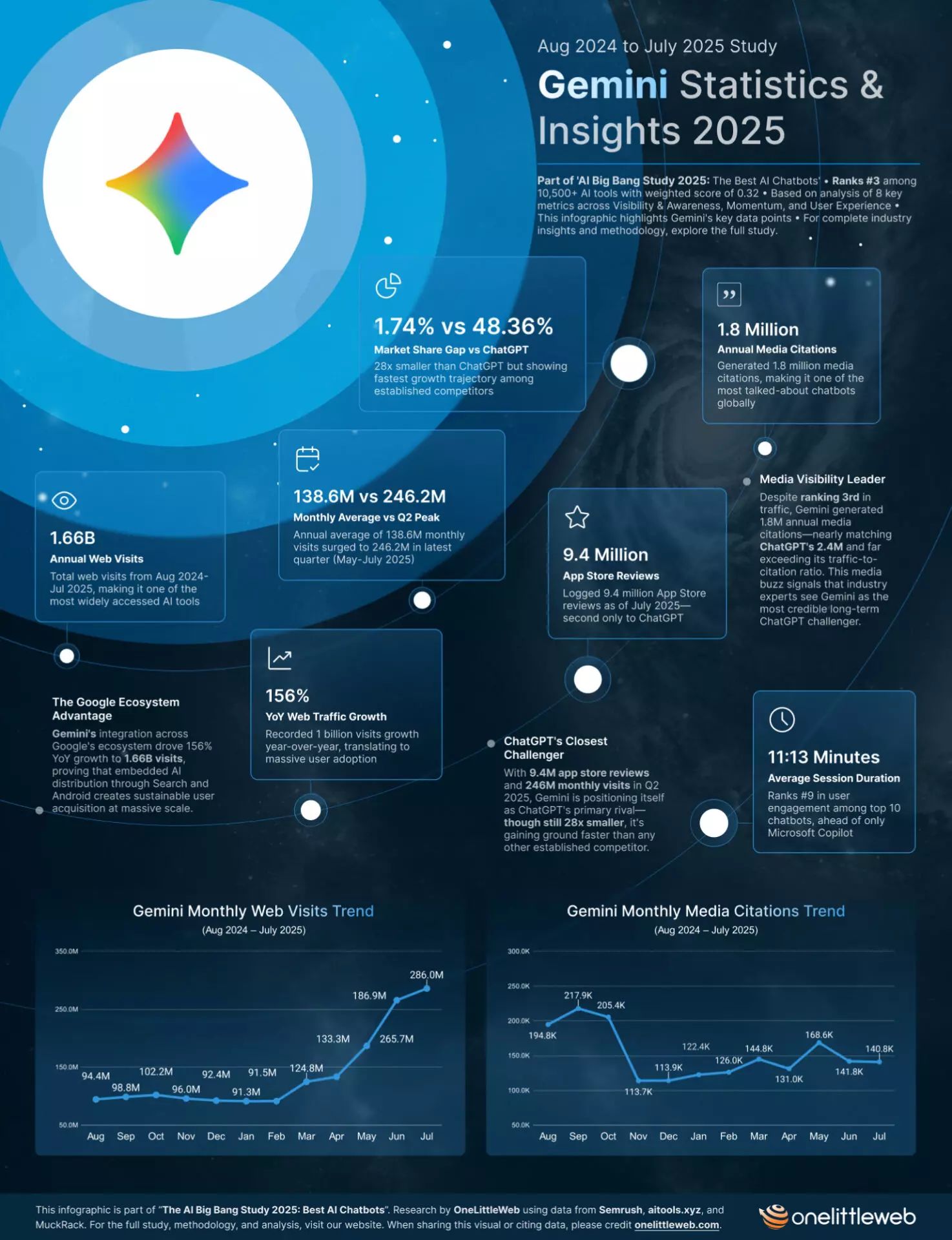

What 56 Billion Visits Tell Us About Real Winners

While everyone's been debating whether AI is in a bubble, actual users have been voting with their clicks. A massive new study tracking 56 billion visits across the top AI chatbots reveals which platforms are truly winning - and the results might surprise you.

The numbers paint a stark picture of consolidation. Out of over 10,500 AI tools fighting for attention, just 10 chatbots captured nearly 60% of all AI traffic. We're witnessing the great AI shakeout in real time, and it's separating the real platforms from the pretenders.

ChatGPT Is Still King, But the Margin Is Narrowing

ChatGPT remains the undisputed champion with 46.6 billion visits and 48% market share. But here's what's interesting - its growth is actually accelerating, jumping from 22.6 billion to 46.6 billion visits year-over-year. Even as a dominant incumbent, it's still gaining momentum.

The conventional wisdom says market leaders slow down as competition increases. ChatGPT is proving that wrong. Its recent quarterly average hit 5 billion visits per month, up 29% from its annual average. Success is breeding more success.

The Grok Phenomenon: Platform Integration Beats Everything

The real story is Grok's meteoric rise. From virtually zero to 687 million visits in a single year - a staggering 1,343,408% increase. That's not a typo. Grok's growth proves that in AI, distribution trumps technology.

Grok succeeds because it's embedded in X (Twitter), giving it instant access to 500+ million users discussing trending topics. Users don't need to remember to visit another website - the AI is where they already spend time. It's the ultimate platform play.

This validates what we've been saying: the winners aren't necessarily building the smartest AI, they're building the most accessible AI. Integration beats innovation when it comes to user adoption.

The Quality vs. Quantity Split

Here's where the data gets really interesting. While ChatGPT dominates by volume, Claude wins on engagement depth. Users spend an average of 16 minutes and 44 seconds per Claude session - the longest of any platform. ChatGPT sessions average 15:25, and Microsoft Copilot clocks in at just 9:04.

This tells us the market is splitting into different use cases. Copilot's short sessions aren't a failure - they reflect efficient workplace integration. People pop in, get answers, and get back to work. Meanwhile, Claude's longer sessions suggest deeper, more thoughtful interactions.

The lesson: there's room for specialized excellence alongside general dominance. The AI market isn't winner-take-all - it's winner-take-most with profitable niches for quality players.

The Platform Integration Pattern

Every major success story has the same element: platform integration. ChatGPT thrives through Microsoft Office integration. Gemini grows via Google Search and Android. Grok explodes through X. Meta AI struggles despite having Facebook, Instagram, and WhatsApp - proving that integration alone isn't enough if users don't find value.

This explains why thousands of standalone AI tools are struggling. Without distribution channels, even brilliant AI becomes invisible. The companies winning are those that understand AI as a feature, not a destination.

The DeepSeek Warning

Not every growth story has a happy ending. DeepSeek provides a cautionary tale about viral success without staying power. It peaked at 520 million visits in February 2025, then declined 39.5% over five months to 314.6 million by July.

DeepSeek's rise and fall shows the difference between hype-driven adoption and sustainable product-market fit. Initial buzz can drive massive traffic, but keeping users requires solving real problems consistently.

Media attention follows a similar pattern. DeepSeek dominated headlines during its peak with over 500,000 citations in February, then media mentions dropped 88% as the novelty wore off. Attention without retention leads to inevitable decline.

What This Means for the Industry

The data reveals three clear tiers emerging:

Tier 1: Dominant generalists (ChatGPT) with massive scale and broad utility

Tier 2: Rising challengers (Grok, Gemini, Claude) with specific advantages

Tier 3: Specialized tools (Perplexity, Mistral) serving focused use cases

The thousands of other AI tools are being squeezed out. With 58% of traffic going to just 10 platforms, the long tail is getting longer and thinner. Most AI startups will need to find acquisition buyers or risk irrelevance.

For enterprises, this consolidation is actually good news. Instead of evaluating hundreds of similar tools, they can focus on the handful that have proven staying power with real users.

The European Wild Card

Mistral deserves attention despite ranking #9. It achieved 420% growth while maintaining strong media visibility, particularly in Europe. With privacy concerns growing and regulatory scrutiny increasing, European alternatives to American AI giants could find unexpected opportunities.

Mistral's open-source approach and regional focus might seem niche now, but regulatory shifts could rapidly change market dynamics. Sometimes the also-rans become tomorrow's champions when the playing field shifts.

Looking Ahead

The AI chatbot market is maturing faster than expected. We're moving from an experimental phase where people tried everything to a utilitarian phase where they stick with what works. The platforms winning this transition are those that integrate seamlessly into existing workflows rather than demanding users change their behavior.

The next wave of competition won't be about who has the smartest AI - it'll be about who can make AI disappear into the tools people already use. The future belongs to invisible AI that enhances existing experiences rather than creating new ones.

The shakeout is just beginning. By this time next year, we'll likely see even more consolidation as users gravitate toward platforms that combine capability with convenience. The AI bubble isn't bursting - it's crystallizing around the tools that actually deliver value.

The winners are becoming clear. Now the question is whether the thousands of other players can find their own sustainable niches or if they'll become casualties of the great AI consolidation.

JPMorgan says OpenAI’s revenue is growing fast—$10B ARR in 1H25, up ~82%—but warns it’s still years from profit and valued at 27x 2025E revenue. That’s steep next to AI peers (M7 avg ~9x). With ChatGPT now at 800M users and a $300B valuation, JPM sees a $700B+ TAM by 2030, but notes rising risks around model commoditization, talent, and infrastructure. The report says OpenAI’s moat is shrinking, as newer models outperform GPT-4 (95th in LMSYS Arena) and enterprise adoption remains tough. Agents and monetization outside APIs are key to long-term upside.

Here are some other beautiful visualizations:

Week Ahead:

Monday: South Korean President Lee Jae Myung meets Trump at the White House as geopolitical tensions remain elevated. Germany's IFO business climate and U.S. new home sales data provide economic backdrop. Fed officials Williams and Logan speak at Mexico's central bank centennial.

Tuesday: RBA minutes could signal dovish shift after recent pause. Hungary decides on rates amid regional policy divergence. U.S. durable goods and consumer confidence will test resilience of domestic demand following Fed rally.

Wednesday: The big event - Nvidia earnings after market close will either fuel or halt the AI rally that's driven markets higher. Australia's CPI could influence RBA's next move. Trump's 50% tariff on India imports takes effect, escalating trade tensions.

Thursday: Central bank trifecta as Philippines, South Korea, and Egypt all decide on rates. U.S. final Q2 GDP and ECB minutes provide policy clarity. Fed Governor Waller speaks on monetary policy in Miami.

Friday: U.S. PCE - the Fed's preferred inflation gauge - headlines the data calendar alongside the end of "de minimis" tariff exemptions. Alibaba and BYD earnings cap off a critical week for global growth and AI optimism. Multiple regional GDP and CPI releases round out a data-heavy finish.

Should be an interesting week. I’ll be tracking it all on X (formerly Twitter): @wallstengine.